Coinbase has formally urged the US Treasury Department to adhere strictly to Congress's original vision for the GENIUS Act. The cryptocurrency exchange expressed concerns that succumbing to pressure from traditional financial institutions could inadvertently stifle innovation within the stablecoin sector.

In its official response to the Treasury's request for public comments, Coinbase emphasized that regulators must avoid imposing any requirements that extend beyond the explicit mandates of the statute. The exchange argued that Congress meticulously drafted the GENIUS Act with the express purpose of fostering responsible growth in stablecoins, reinforcing the United States' leadership in the cryptocurrency space, and modernizing the nation's payments infrastructure.

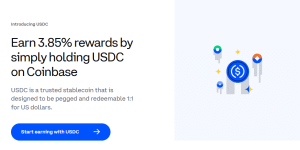

This stance comes as banking groups have actively called on regulators to address what they perceive as a "yield loophole." This loophole, according to these groups, allows firms such as Coinbase to offer returns on holdings of Circle's USDC stablecoin through intermediary third parties.

Coinbase contends that any expansion of the ban on stablecoin yields would essentially constitute a "rewrite of Congress’s carefully-drawn lines." Such an action, the exchange warned, would negatively impact consumers and curb innovation by eliminating crucial market incentives that contribute to lower costs and drive wider adoption of stablecoin technology.

Furthermore, Coinbase advised the Treasury to engage in close coordination with other regulatory bodies to prevent the creation of overlapping and potentially conflicting rules that could lead to market fragmentation. The exchange highlighted that the GENIUS Act represents one of several federal initiatives aimed at providing much-needed clarity in digital asset markets. Therefore, Coinbase stressed the importance of the Treasury being mindful not to create conflicts with ongoing efforts by Congress or other federal regulators.

We submitted @coinbase's response to @USTreasury's request for comments on the implementation of the GENIUS Act. Our message is simple: GENIUS is landmark legislation designed to make the US the undisputed global leader in crypto and stablecoins. To make that happen, the… pic.twitter.com/XLyq15u0Ov

— Faryar Shirzad 🛡️ (@faryarshirzad) November 5, 2025

Banking Lobby Groups Express Discontent Over Stablecoin Firms Circumventing Yield Ban

The GENIUS Act has been instrumental in providing the digital asset market with a degree of regulatory clarity that has been long anticipated. It establishes a foundational regulatory framework specifically for stablecoin firms intending to issue their tokens within the United States. The act primarily focuses on the classification of "payment stablecoins," outlining how they may be regulated and identifying the entities authorized to issue them.

A core requirement stipulated within the GENIUS Act is that permitted issuers must maintain a 100% reserve backing for all outstanding stablecoins. These reserves must consist of highly liquid assets, such as US dollars or short-term US Treasuries. Additionally, these firms are obligated to provide monthly disclosures detailing the composition of their reserves and submit annual audited financial statements.

The legislation also includes a prohibition on stablecoin firms directly offering yield to their token holders. However, this prohibition has not been extended to cover third parties or affiliated entities, a point of contention for banking lobby groups.

According to these banking lobby groups, this omission creates a pathway for stablecoin firms to effectively bypass the intended ban. This situation has become evident with platforms like Coinbase offering yield on USDC holdings, which they argue circumvents the spirit of the regulation.

International Regulators Actively Developing Stablecoin Regulation

While the US Treasury Department focuses on the implementation of the GENIUS Act, regulatory bodies in other parts of the world have also indicated that they are actively developing their own comprehensive regulatory frameworks for stablecoins.

Canada, for instance, recently unveiled its plans for a stablecoin regulatory framework as part of its 2025 federal budget. Mirroring the approach of the GENIUS Act, Canada's proposed framework mandates that stablecoin firms must maintain adequate reserves to back their issued tokens.

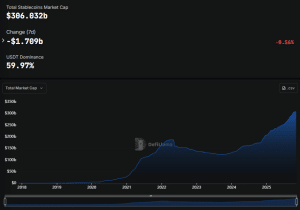

In parallel, Sarah Breeden, Deputy Governor of the Bank of England, has expressed her expectation that the United Kingdom will align its regulatory efforts with those of the United States concerning the regulation of the rapidly expanding stablecoin market, which is currently valued at $306 billion.

Breeden also underscored the critical importance of synchronization between the US and the UK in their regulatory approaches to this fast-growing sector. Reports indicate that the Bank of England is anticipated to release its stablecoin consultation paper on November 10, following discussions with US authorities and agencies.