The throughput race has significantly intensified. Recent statistics indicate that Ethereum's broader ecosystem briefly achieved a record of 24,192 transactions per second, driven by a surge in Layer 2 (L2) activity.

These recent Ethereum blockchain figures are attributed to scaling solutions and high-speed execution. This new record highlights the potential when rollups handle the bulk of the processing. It also accentuates a long-standing contrast. While Bitcoin remains secure and has proven its resilience, its base layer still supports only modest throughput. This disparity is a crucial factor in shaping the current market narrative.

Transaction fees and latency directly influence user behavior and market expectations. When blockspace is limited, users naturally gravitate towards the most affordable and fastest transaction channels, and liquidity follows suit.

This has been Ethereum's strategy since its inception, and the trend continues into 2025, with rollups absorbing demand and setting new transaction per second (TPS) highs. For traders observing market rotations, this trend serves as a clear signal. Utility is progressively gaining importance, and speed is the primary gateway to accessing that utility.

This context brings Bitcoin into sharper focus. The original blockchain boasts unparalleled brand recognition and security. However, everyday payments and high-frequency applications still often require users to seek alternative solutions. This discrepancy presents a commercial opportunity that is currently masked by technical limitations. Developers are now actively working to integrate scalable execution capabilities with Bitcoin without compromising its fundamental settlement layer.

The 24K TPS milestone validates a two-layer architecture approach. This model involves offloading execution to scalable environments while utilizing the base layer for settlement. Such a system reduces fees and increases capacity for decentralized applications (dApps), NFTs, and payment processing, fostering compounding network effects over time.

For market participants, this signifies that near-instant user experience is now an expected standard. Ethereum is already achieving this through its rollups. Bitcoin's response needs to offer a similar feel while maintaining its core trust assumptions.

This is precisely where Bitcoin Hyper ($HYPER) emerges. It is a Bitcoin-anchored L2 project that leverages modern execution capabilities to achieve high throughput. In a week where Ethereum's ecosystem has demonstrated its scaling prowess, the demand for a Bitcoin-centric high-speed network appears particularly timely.

Why Bitcoin Hyper’s L2 Model Fits This Moment

Bitcoin's inherent throughput limitations create a specific market niche. This is partly due to Bitcoin's conservative design, which prioritizes security and decentralization, making it the preferred base for collateral. The trade-off for these features is lower transaction speed.

Consequently, capital tends to flow towards scaled environments when network activity increases. A credible Bitcoin L2 solution that inherits Bitcoin's settlement security but processes transactions at modern speeds could redirect some of this capital back into the Bitcoin ecosystem. The narrative is straightforward: if the user experience improves, liquidity will follow.

The design objective is clear: maintain Bitcoin's role for security and settlement while offloading transaction volume to a faster execution layer. For end-users, this translates to near-instant transfers, reduced fees, and a more seamless experience for consumer-focused use cases such as micro-transactions, blockchain gaming, DeFi lending protocols, and other Web3 applications.

This aligns with existing demand patterns observed on other blockchain networks. The key differentiator is the core asset involved. On the Hyper network, wrapped $BTC serves as the primary asset, rather than a distinct side token.

The process involves bridging user funds from Bitcoin's Layer 1 to the Bitcoin Hyper environment. Within this layer, transactions are cleared rapidly before periodic settlement proofs synchronize the state back to the Bitcoin blockchain.

This approach aims to minimize trust requirements while providing applications with the necessary operational flexibility. The project elaborates further on its sequencing and zero-knowledge verification mechanisms in its whitepaper. The core promise is to deliver speed without departing from Bitcoin's established ecosystem.

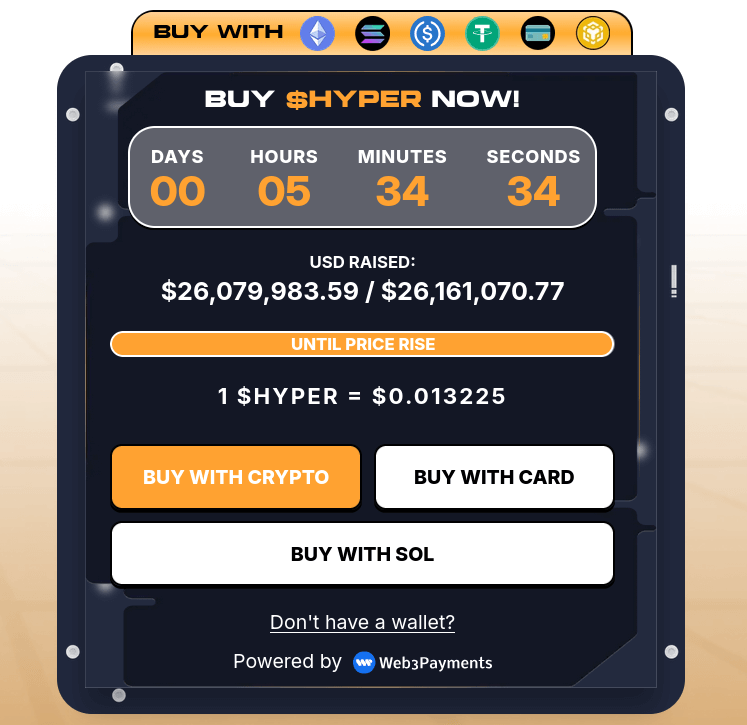

$HYPER’s $26M+ Presale Signals Momentum and Market Potential

$Bitcoin Hyper ($HYPER)’s presale is supported by concrete figures, reflecting a vote of confidence in a market where presales are critically dependent on traction and transparency.

To date, the presale has successfully raised over $26 million, with the token currently priced at $0.013225 during this stage. Recent activity includes significant whale purchases, such as a $68.4K acquisition and a substantial $140.3K transaction recorded on November 5.

This level of momentum suggests considerable market interest in a Bitcoin-centric scaling solution, particularly as Ethereum's ecosystem achieves new throughput records and redefines user expectations.

Additionally, the dynamic staking pool currently offers an Annual Percentage Yield (APY) of 45%. This indicates an early-stage incentive structure designed to foster ecosystem expansion, with community benefits playing a central role. According to the project's whitepaper, token holders will also be eligible for governance voting rights, reduced network fees, priority access to dApps, and grants for developers looking to contribute to the project.

The project does not necessarily need to outperform Ethereum to be successful. Its primary objective is to capture $BTC-native transaction flows that currently migrate to other ecosystems during periods of high network activity.