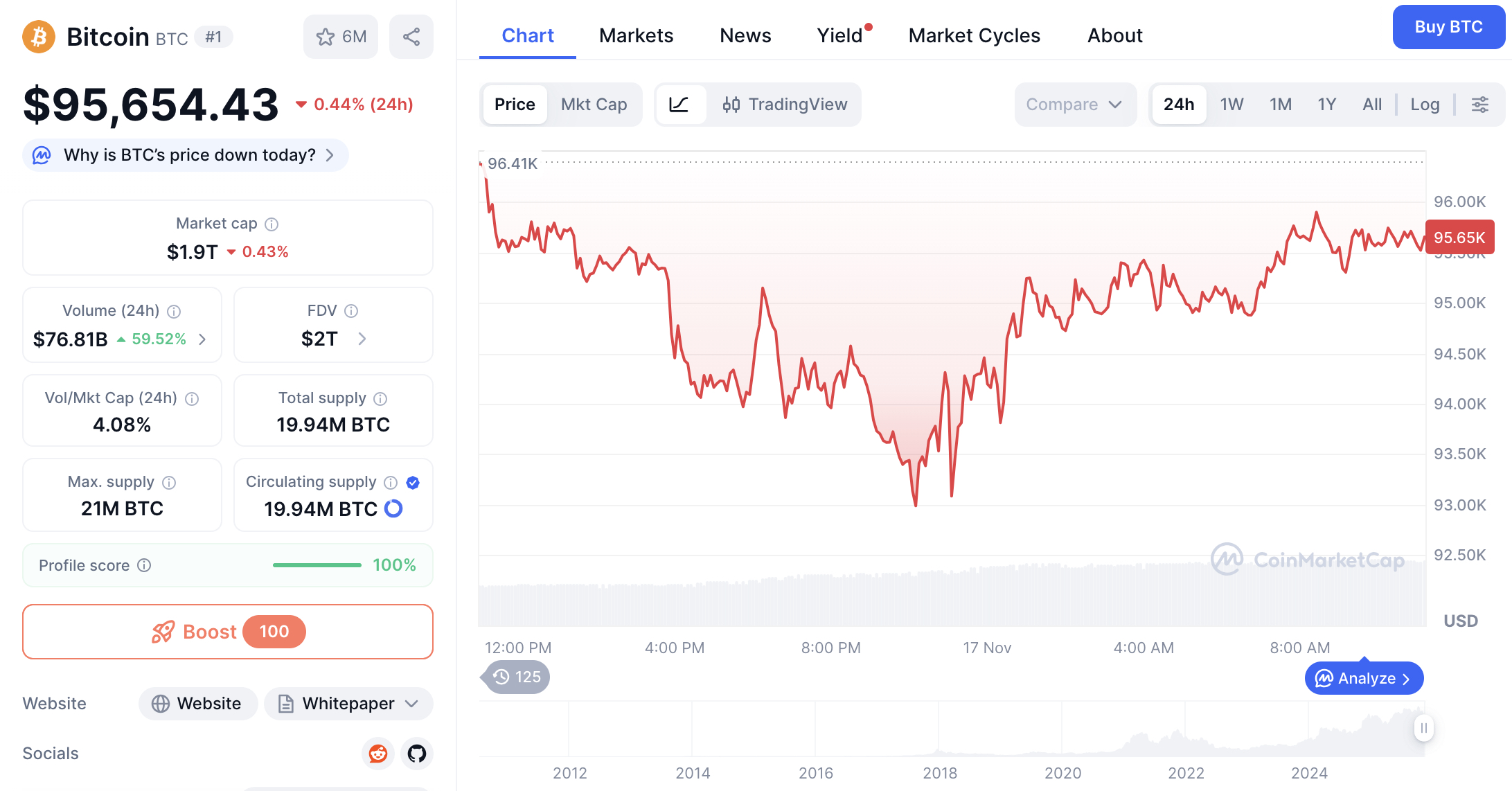

Bitcoin's recent price action served as a stark reminder of the market's inherent volatility. Over the weekend, the cryptocurrency's value dipped below its New Year opening price of $93,507, briefly touching the $93,000 mark. This decline erased its year-to-date gains within a few hours.

The current pullback places Bitcoin approximately 25% below its all-time high reached in October. This occurred despite a year characterized by positive macroeconomic signals, a supportive stance from Washington towards cryptocurrencies, a quiet increase in Bitcoin holdings by corporations, and consistent institutional investment through spot Bitcoin ETFs.

Market Dynamics Driving the Selloff

Beneath the surface of the price decline, several factors appear to be contributing to the selloff. These include outflows from spot ETFs, profit-taking by long-term holders, and selling pressure from miners. This behavior is often observed during consolidation phases at high valuations.

Recent market data indicates that hundreds of millions of dollars have exited through spot ETF channels. Concurrently, long-term holders' wallets have reportedly distributed over 800,000 BTC in the past month. Collectively, the broader digital asset market has seen a reduction in value of nearly half a trillion dollars since early October.

Market sentiment has shifted significantly, with the Crypto Fear & Greed Index falling into the "extreme fear" range. Traders are closely watching key psychological support levels around $92,000. Despite these fluctuations, many long-cycle valuation models still categorize the current move as a mid-trend correction rather than a structural breakdown, underscoring the non-linear progression of adoption curves.

Shift Towards Utility-Driven Projects

For many retail and institutional participants, this level of volatility reinforces a fundamental investment principle: participation in the crypto market does not have to depend solely on timing Bitcoin's next upward surge. An increasing number of investors are choosing to gain exposure through utility-driven projects rather than focusing exclusively on price-tracking investments.

This is the strategic positioning of Best Wallet Token ($BEST). The project offers infrastructure-layer utility, aiming to provide value beyond a directional bet on Bitcoin. Its presale has garnered over $17.1 million, with tokens trading at $0.025955. With approximately 11 days remaining, the project continues to promote a "wallet-first" adoption narrative and a long-term ecosystem roadmap.

Bitcoin Jitters Boost Interest In Wallet-Led Ecosystems

In times of market instability, infrastructure layers and user-facing products tend to demonstrate resilience. This includes secure, user-friendly, multi-chain wallets that offer a streamlined experience while enabling swaps, bridges, presales, and asset management within a single platform.

Best Wallet is targeting this specific market gap. According to the project's whitepaper, its objective is to capture up to 40% of the crypto wallet market by the end of 2026. This goal is to be achieved through a mobile-first, non-custodial, multi-chain application.

Security is a cornerstone of the Best Wallet offering. Instead of relying on traditional recovery seeds, the wallet utilizes Fireblocks' MPC-CMP architecture. This approach distributes key material, ensuring that no single device or individual holds complete control over the private keys.

The wallet also integrates Best DEX, an in-app DEX aggregator designed to optimize order routing. It connects with over 200 decentralized exchanges and 20+ cross-chain bridges to enhance pricing and execution efficiency.

Beyond asset storage, the project's roadmap includes tools focused on practical usage and risk management. These features comprise:

- •Best Card: A crypto debit card that will support Bitcoin, Ethereum, and other major assets, with planned cashback rewards.

- •Smart investing tools: Features such as limit/stop orders, dollar-cost averaging (DCA), anti-MEV protection, and portfolio analytics.

- •Staking aggregator: A tool designed to simplify yield-generating strategies across various blockchain networks.

Central to this ecosystem is the $BEST token. Holding this token grants users access to reduced transaction fees, enhanced staking rewards, governance rights for new integrations, and early access to vetted presales through the platform's Upcoming Tokens launchpad.

With estimates suggesting that 25% of online adults in the Asia-Pacific region may already own cryptocurrency, and many still encountering fragmented onboarding processes and an overwhelming array of tools, the wallet-plus-launchpad model aligns with how the next wave of users is likely to engage with digital assets. This approach favors trusted interfaces over speculative hype cycles.

For individuals looking to diversify their crypto exposure beyond Bitcoin following the recent pullback, the core message is straightforward:

Best Wallet Token Presale Combines Utility, Yield & Optional Upside

Momentum is building around the $BEST token. The presale has successfully surpassed $17.1 million, with tokens currently priced at $0.025955 at the time of this report.

As detailed in the tokenomics model, 8% of the total token supply has been allocated to the staking rewards pool. Participants have the opportunity to stake their tokens immediately during the presale period. This means early adopters can begin earning rewards from day one, prior to the token's official listing.

This structure is particularly relevant in the current post-correction Bitcoin market environment. The $BEST token offers holders the potential to extract value through two primary avenues, moving beyond reliance solely on price appreciation:

- Reduced fees and in-app perks within the Best Wallet ecosystem.

- Staking rewards generated from the dedicated pool integrated into the smart-contract framework.

This dual-benefit model is designed to incentivize both token holders and active users of the wallet, aligning their interests with the long-term growth of the platform rather than short-term speculative trading.

While third-party market analyses have begun to project potential future valuations for $BEST, it is crucial to recognize these as independent forecasts, not guarantees, and they should be considered as opinions rather than financial advice.

Investors are encouraged to evaluate fundamental factors such as product adoption rates, the execution of the project's roadmap, exchange liquidity, user growth metrics, and the uptake of post-launch utilities when assessing the long-term value proposition.

As with any presale asset, inherent risks are present, including execution risk, liquidity risk, market volatility, and smart contract vulnerabilities. The Best Wallet whitepaper explicitly states that it does not constitute a regulated securities prospectus.

A significant advantage is that Best Wallet is already a functional product and is under continuous development. The capital raised through the presale will be directed towards scaling an existing, operational product rather than funding a theoretical development phase.

With only 11 days remaining, the $BEST presale presents a combination of live utility, access to yield opportunities, and long-term ecosystem alignment. This offering may appeal to investors seeking alternatives to strategies focused solely on price movement. Interested parties can find further details on the presale and staking options directly through the official platform.