Key Developments in Brief

- •21Shares has submitted an S-1 registration statement to the SEC for the 21Shares Hyperliquid ETF, aiming to integrate DeFi with U.S. regulatory frameworks.

- •Hyperliquid is leading decentralized exchanges (DEXs) with a 160% Annual Percentage Rate (APR) for liquidity providers and a 10.9% weekly growth in Total Value Locked (TVL).

- •The crypto ETF landscape is experiencing a significant increase in filings, with new spot ETFs for Litecoin (LTC) and Hedera (HBAR) launching this week.

21Shares Introduces Hyperliquid ETF

On October 29, 2025, 21Shares filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) to introduce the 21Shares Hyperliquid ETF. This filing, made under the Securities Act of 1933, represents 21Shares' latest effort to channel on-chain liquidity and digital asset exposure into traditional, regulated investment channels.

The proposed ETF is designed to offer investors structured exposure to Hyperliquid ($HYPE), a decentralized exchange distinguished by its high-speed trading infrastructure, low-latency performance, and a rapidly expanding derivatives market share.

This filing by 21Shares occurs during a period of intense activity in the crypto ETF sector. In early October, REX Shares and Osprey Funds collectively submitted over 20 crypto-related ETF filings, targeting diverse digital asset baskets and sector-specific investment strategies. Furthermore, Canary Capital announced on October 28, 2025, that the first U.S. spot ETFs tracking Litecoin (LTC) and Hedera (HBAR) officially commenced trading. This development signifies the SEC's increasing receptiveness to a wider array of diversified crypto investment products.

Hyperliquid Drives Growth in DeFi Market

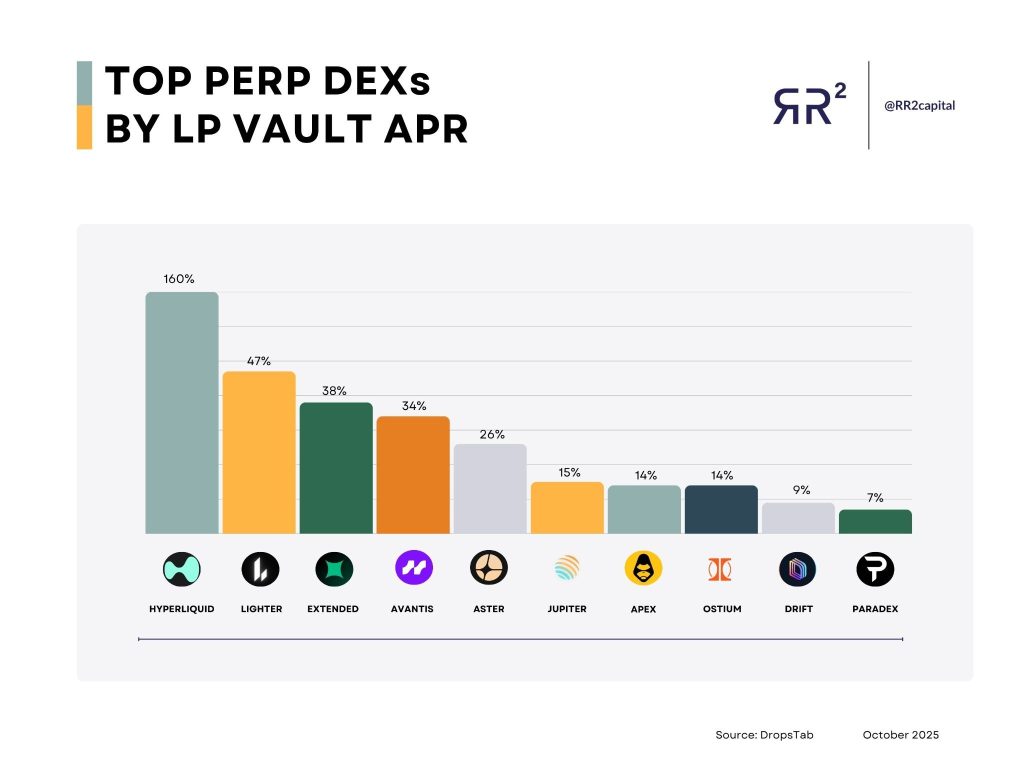

Recent data from RR2 Capital and DropsTab indicates that Hyperliquid is outperforming other perpetual DEXs, offering an industry-leading 160% APR for its liquidity provider vaults. This figure significantly surpasses competitors such as Lighter (47%), Extended (38%), and Avantis (34%). The platform continues to lead in trading volume and liquidity provision within the decentralized derivatives market.

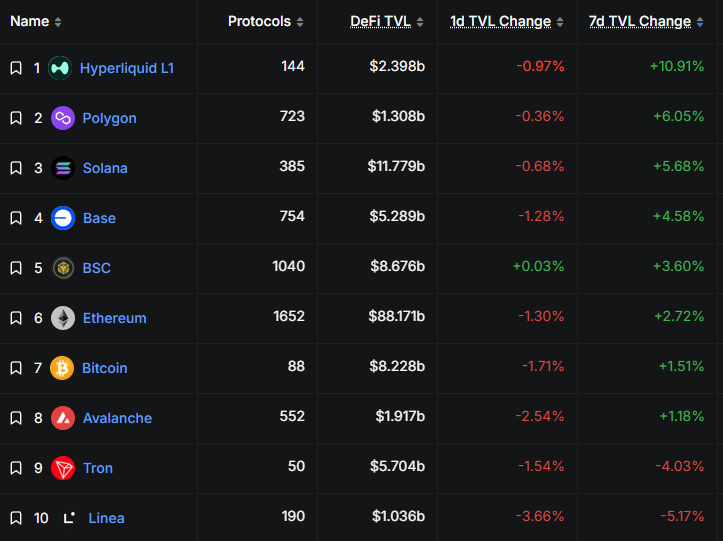

The broader DeFi market is showing signs of sustained recovery. According to market data, 13 blockchains have now surpassed $1 billion in total value locked (TVL), with nine of them experiencing growth over the past week.

Hyperliquid is at the forefront of this growth, recording a +10.9% increase in TVL over a 7-day period. Polygon follows with a +6.0% increase, reflecting strengthening capital inflows and growing confidence in the DeFi ecosystem.

Following the announcement of the ETF filing, market sentiment surrounding Hyperliquid ($HYPE) has seen a notable improvement. As of the latest data, the token is trading at $49.12, showing a 1.78% increase in the past 24 hours and a 35% rise over the past week.