A powerful wave of short-term altcoin momentum swept across the market over the past day, with Pieverse, Piggycell, and Starknet leading a fast-building rotation into high-beta tokens.

Fresh listing activity, real-world adoption milestones, and accelerating Bitcoin-focused DeFi flows created a perfect setup for breakouts, pushing traders back toward risk assets despite macro uncertainty. Interest in early-stage ecosystems has also intensified following this week’s uptick in BTC network fees and the rise in ETH L2 activity, giving smaller tokens room to outperform.

Pieverse Soars Triple Digits After Dual Binance Listings

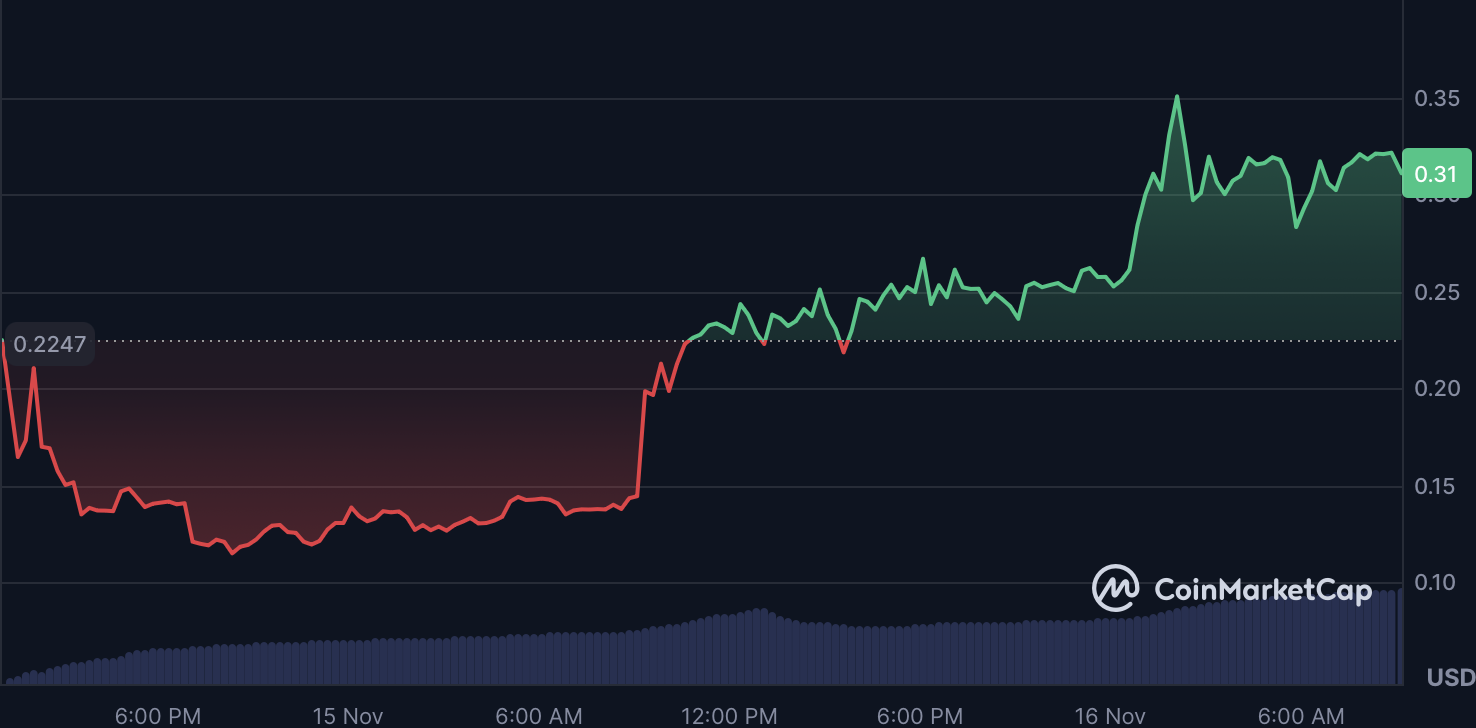

Pieverse delivered one of the sharpest moves of the week, exploding 130% in 24 hours following its simultaneous listings on Binance Alpha and Binance Futures on November 14. Perpetual contracts with 40x leverage ignited aggressive speculation, while liquidity programs amplified attention.

Trading volume surged 76% to $120.7 million, boosted by Binance’s Booster Program, which distributed 30 million PIEVERSE tokens, equivalent to 3% of total supply. The project’s ongoing integrations with Kite AI and RaveDAO suggest the team is pushing toward broader adoption for agentic payments and AI-driven micro-transactions.

Fresh data from the last 48 hours shows that Pieverse has now broken into Binance’s top 10 most-traded new listings, reinforcing the intensity of retail demand. Analysts warn, however, that the token’s $55 million market cap leaves it highly vulnerable to sudden volatility, especially if early holders capitalize on post-listing strength. Sustained daily volume above $80 million would indicate stronger organic demand rather than short-term speculative churn.

Piggycell Rallies on Korea Expansion and NFT Reward Momentum

Piggycell posted a 44% gain in the last 24 hours after confirming its dominant position in South Korea’s power-bank rental industry, where it commands a 95% market share, serving over 4 million users across 14,000 charging stations.

The announcement was followed by an 87% jump in trading volume to $100.7 million, supported by a positive verification from CertiK, where Piggycell secured an A-grade rating with a Skynet score of 85.13. This strengthened confidence in PIGGY’s Web3 expansion plans, which revolve around lifetime NFT perks and loyalty-driven onboarding.

New updates from November 15 indicate that Piggycell is preparing an additional batch of NFT utility upgrades aimed at mobile-first Korean users, an audience already demonstrating high daily engagement. Investors see the project as a rare crossover case where real-world traction and blockchain rewards intersect meaningfully. User expansion ahead of the next Web3 rewards update and NFT redemption rate trends will determine ongoing demand.

Starknet Extends Its Climb as BTCFi Demand Accelerates

Starknet continued its upward trajectory with a 32% daily rise, following a week where the token gained more than 68% amid surging interest in Bitcoin-centric DeFi.

The network’s total value locked has tripled to $164 million, and staked STRK has climbed to 900 million tokens, representing 20% of total supply. This is a key factor offsetting concerns around the recent 127 million token unlock.

Momentum intensified as Starknet’s BTCFi initiative attracted $72 million in new Bitcoin deposits, supported by a fresh 100 million STRK incentive program. The rollout of the S-two prover, a major technical upgrade, has also strengthened the project’s pitch to institutional and high-volume DeFi users.

Within the last 48 hours, cross-chain dashboards show a steady pickup in STRK/BTC trading pair activity, suggesting traders are increasingly positioning around Starknet’s Bitcoin integration.