The cryptocurrency market is anticipating a rebound, bolstered by Bitcoin's return to the $108,000 region. Investors are optimistic that potential interest rate cuts before the end of the year could stimulate a significant inflow of capital into prominent altcoins.

This market sentiment has intensified the search for the best cryptocurrencies to hold. Among those frequently mentioned are Floki and Aster. Concurrently, PayDax, a new player in crypto lending, is gaining attention for its innovative peer-to-peer utility-based value generation model.

PayDax's ongoing presale has already surpassed $1.3 million in funding. Investors are highlighting PayDax Protocol (PDP) as a potentially strong contender among the best cryptocurrencies to hold.

FLOKI's Community Strength Amidst Volatility

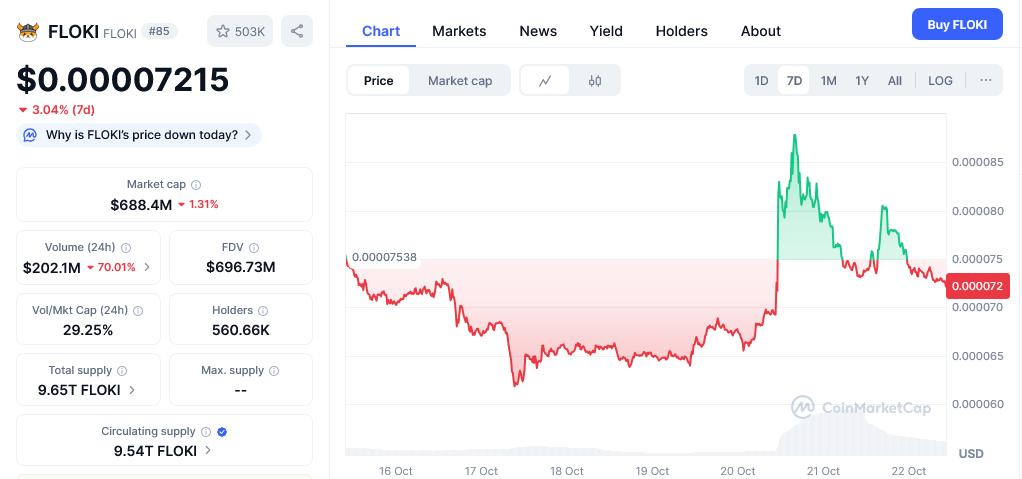

FLOKI continues to be a top cryptocurrency on investor watchlists, despite experiencing recent price fluctuations. The token is currently trading around $0.00007215, reflecting a 3.04% decrease over the past week. This volatility follows a recent dip in Bitcoin's price to $103,000, although Bitcoin has since recovered and is trading near $108,000. The broader market remains subject to high volatility.

Despite these market swings, investors remain confident in Floki's potential for a surge before the year concludes. This optimism is fueled by expectations of further interest rate cuts and sustained high network activity on the Floki platform, driven by ongoing ecosystem partnerships.

Throughout 2025, the FLOKI team has been actively expanding its partnerships, focusing on NFT utility and staking pools. These initiatives have helped maintain holder engagement even during periods of market turbulence. Analysts project that the token could see another significant price increase if Bitcoin reclaims the $120,000 level in the fourth quarter.

ASTER's Network Growth and Potential December Rebound

While ASTER's recent momentum may appear to be slowing, its DeFi participation rate has seen an increase. This development has led to speculation that the network is positioned for a strong rebound. The growing popularity of Aster is further evidenced by its listing on several cryptocurrency exchanges. Notably, Kraken officially listed Aster on October 22nd, drawing increased attention to its ecosystem.

Investors looking for the best cryptocurrencies to hold in November are increasingly considering Aster, believing that the next market upswing could propel it to new heights. Aster is currently trading at $1.04, following a 31% drop in the past week. Nevertheless, investors anticipate a considerable price surge for the token before the year ends.

PayDax Protocol: A Leading Contender for Best Crypto Holdings

PayDax is emerging as a next-generation decentralized finance project that facilitates seamless borrowing and lending through a peer-to-peer system. This system is supported by both cryptocurrency and tokenized physical assets. A key differentiating feature of PayDax is its high loan-to-value ratio of 97%, which allows borrowers to access nearly complete liquidity without needing to sell their existing holdings.

This unique proposition positions PayDax as a crucial bridge between traditional finance and blockchain-based banking solutions. Unlike purely speculative tokens, PayDax derives its value directly from its lending operations, staking pools, and a robust redemption mechanism, providing it with practical, yield-generating use cases.

How PayDax Rewards Users

Lenders on the PayDax platform can earn up to 15.2% Annual Percentage Yield (APY) by providing stablecoin loans. Users also have the option to stake funds in PayDax's Redemption Pool, which is utilized to cover loan defaults.

By staking funds in the Redemption Pool, users can earn up to 20% APY while simultaneously safeguarding lenders from potential defaults. Standard protocol staking offers a 6% APY, and advanced yield farming opportunities can yield as high as 41% APY.

These impressive returns are generated through actual protocol usage rather than artificial inflation. This approach helps PayDax distinguish itself as one of the best cryptocurrencies to hold in late 2025 for sustainable and reliable earnings.

Strategic Partnerships and Presale Momentum Build Trust

PayDax has successfully built credibility through high-profile partnerships. Collaborations with Sotheby's and Brink provide essential asset verification and custody services. Furthermore, Chainlink's data oracles ensure the provision of real-time pricing data, contributing to transparent lending operations. The project has also undergone a comprehensive security audit conducted by DeFi Assure, further solidifying its reputation for safety and reliability.

Currently in its first stage, PayDax's presale has successfully raised over $1.3 million, with the PDP token priced at $0.015. The upcoming second stage will see the token price increase to $0.017, representing a 13% gain for early investors. Analysts project that PDP's potential upside post-launch could rival that of early-stage DeFi tokens that later achieved blue-chip status.

Why PayDax Leads November's Best Crypto List

While FLOKI thrives on community engagement and ASTER focuses on network scalability, PayDax offers tangible banking solutions that effectively bridge decentralized finance with traditional real-world finance. Its transparent operational structure, high-yield model, and current under-$1 valuation present a strong combination of stability and growth potential heading into the fourth quarter of 2025.

For investors seeking the best cryptocurrencies to hold this November, prioritizing practical, yield-driven projects built for long-term value over solely hype-driven assets, PayDax Protocol stands out as a compelling choice.