Several mid-cap and small-cap cryptocurrencies are pushing sharply higher, according to CoinMarketCap’s momentum algorithm, which tracks a blend of price action, trading activity, news flow, and social engagement. Quant, Axie Infinity, and Dusk have emerged as the standout movers, each driven by a distinct catalyst rather than broad market drift.

Quant Leads With Institutional Narrative

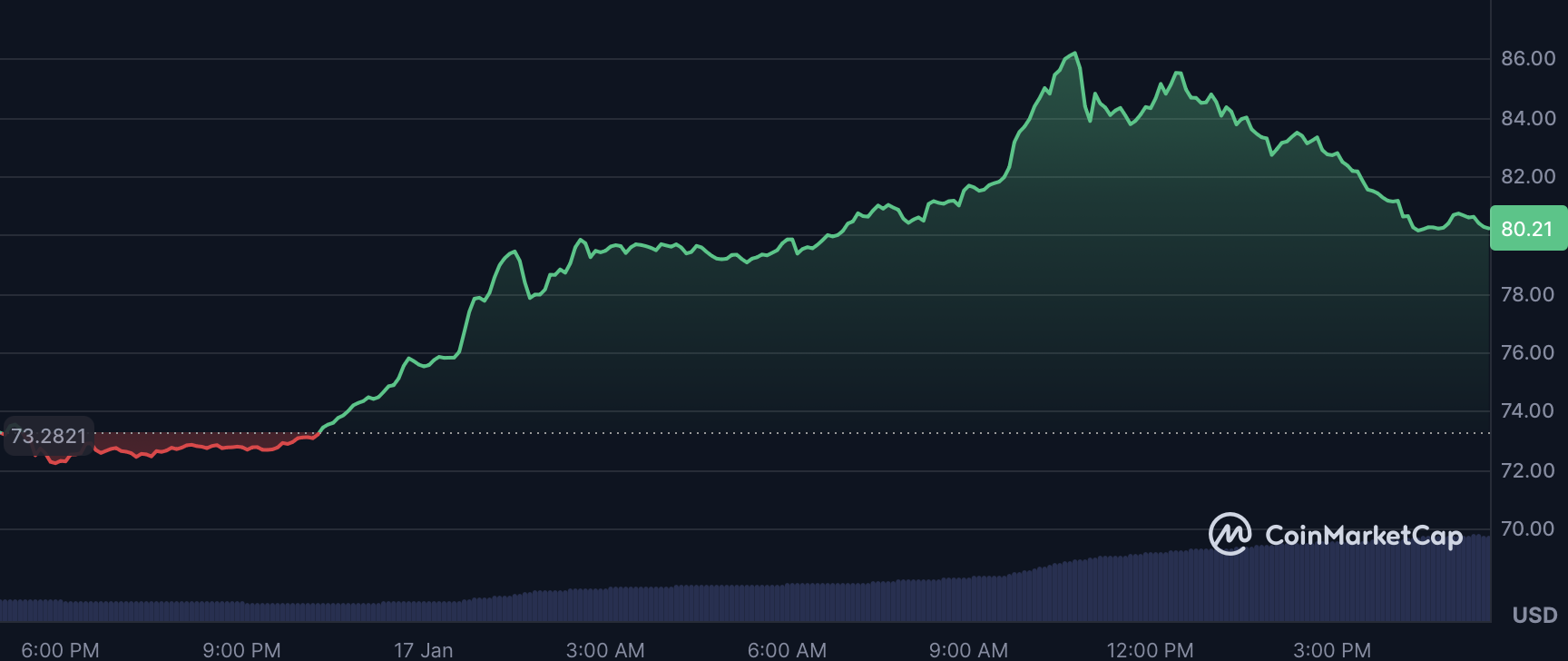

Quant’s QNT token climbed 12.8% over the past 24 hours and 12% on the week, lifting its market capitalization to $1 billion. The move carried QNT through the key $79 resistance level, a zone that had capped price for weeks.

The rally coincides with Quant’s involvement in the European Central Bank’s digital euro pilot and growing attention around its upcoming Overledger Fusion upgrade, scheduled for June 2025. Trading volume jumped 84% to $23.9 million, while active addresses rose 47% in 24 hours, pointing to broad-based participation rather than thin liquidity.

The price structure now hinges on whether QNT can sustain trade above $83. A clean hold at that level would confirm a larger reversal pattern that traders are closely monitoring.

Axie Infinity Rebounds on Structural Changes

Axie Infinity delivered the strongest large-cap move, with AXS surging 27% in 24 hours and extending its seven-day gain to 62%. Market capitalization stands near $260 million, supported by a sharp increase in turnover. Trading volume expanded 177% to $289 million, reflecting renewed speculative interest.

The upside follows a January 2026 tokenomics overhaul that removed inflationary Smooth Love Potion rewards, reducing persistent sell pressure. That shift was reinforced by a governance decision to stake $9 million worth of treasury ETH, signaling a more conservative balance-sheet approach.

Despite the bounce, context remains important. AXS is still down 76.7% year-on-year, underscoring how much damage previous inflationary mechanics inflicted. In the near term, price acceptance above $1.50 would open the door to a test of the $2.25 resistance zone.

Dusk Explodes After Multi-Month Breakout

Dusk posted the most aggressive move of the group, soaring 88% in the last 24 hours and 129% over seven days, bringing its market capitalization to $59.7 million. The surge followed a confirmed breakout from a seven-month downtrend, triggering rapid momentum expansion.

Volume tells the story. Trading activity spiked 683% to $88.35 million, a sharp contrast to the subdued liquidity that defined prior months. The move aligns with growing attention on privacy-focused and real-world asset (RWA) narratives, supported by partnerships such as Chainlink and Dutch exchange NPEX.

On-chain behavior also shifted, with whale accumulation visible in the $0.05–$0.06 range before the breakout. Price is now testing higher levels, where a sustained close above $0.12 would put $0.25 back into focus, though thin liquidity leaves room for sharp volatility.

Momentum With Diverging Risk Profiles

While all three assets are trending higher, their drivers differ meaningfully. Quant’s move is anchored in institutional infrastructure, Axie Infinity’s rally reflects internal restructuring and renewed speculation, and Dusk’s surge is driven by technical breakout dynamics and narrative rotation.

Together, they highlight how momentum in the current market is being driven less by blanket risk-on behavior and more by project-specific developments that attract focused capital.