Digital payment is transforming every sector by facilitating trade and transactions, and the Nigerian oil and gas industry is a beneficiary of this transformation.

A December 2025 report by Moniepoint revealed that 43% of payments at Nigerian fuel stations are made via digital channels, including cards, mobile money, and transfers. This indicates that while approximately 2 in 5 transactions are made with digital payments, fewer people are bringing cash to the pump.

The findings highlight how fuel stations are adapting to the ongoing digital shift.

Moniepoint Report Details Digital Payment Integration

The report, titled Fueling the Nation: How Moniepoint powers Nigeria’s oil and gas industry, shows that digital payment has become an integral part of Nigeria’s fuel stations’ daily payment activities. The shift from cash also stems from the Federal Government’s 2023 directive, which instructed all petrol stations to accept POS and bank transfers.

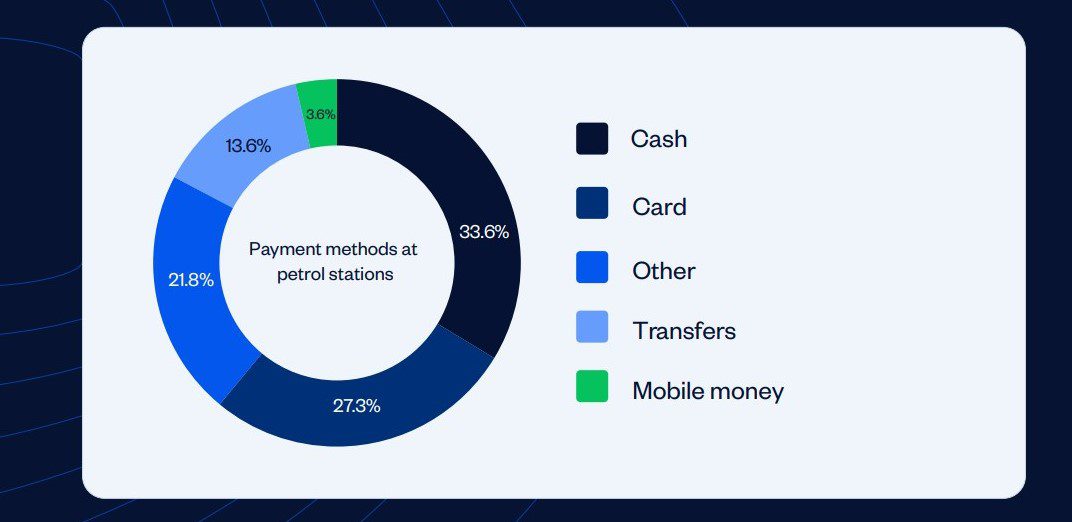

While 43% of payments at Nigerian fuel stations move through the digital line, 57% are made using cash and other unspecified means of payment. A further breakdown of transaction methods is as follows:

- •Cash: 33.6%

- •Card: 27.3%

- •Transfers: 13.6%

- •Mobile Money: 3.6%

- •Others: 21.8%

For fuel stations, this trend has enabled their business operations to adjust to shifts in the medium of payment. Digital payments are faster, reduce the risks associated with handling large amounts of cash, and enable operators to track sales more easily and accurately.

While the 43% adoption rate is encouraging, it also suggests that Nigerian fuel operators are still in the process of fully adapting. Meanwhile, the expected increase in digital payment adoption rates and the surge in fintech operators are creating solutions.

“Fintech-led innovations in payments, instant settlement, and credit are helping to close the gap. At the same time, the way Nigerians pay for petrol is changing fast,” part of the report reads.

The report reveals that 91% of fuel stations use Point of Sale (POS) terminals, demonstrating how operators are beginning to view POS systems as a standard component of their daily transactions.

For many station owners, POS systems have become an essential tool for managing the high volume of daily transactions and navigating congested situations. Conversely, only a small fraction of operators, at 9%, continue to rely solely on cash.

Considering Nigeria has tens of thousands of fuel stations, the report illustrates how the oil and gas sector is adapting to enhance mobility for over 200 million Nigerians. While it is an essential service, the adoption of digital payment and credit for working capital is rapidly shaping the sector's growth.

Challenges Persist Amid Digital Payment Adoption

Despite the adaptation to digital payments, Nigerian fuel stations still face uncovered gaps, such as payment bottlenecks. For instance, some merchants operating on traditional bank rails experience T+1 settlement, meaning payments are received the next day. For stations that require immediate cash flow, this delay in settlement can hinder operations, particularly for subsequent day requirements.

Although regulations by the Central Bank of Nigeria have tightened dispute windows, ensuring faster reversals, the report indicates that typical settlement experiences still vary, ranging from instant to 24–72 hours on legacy systems. In scenarios where 9 out of 10 fuel stations depend on same-day settlement for managing their daily operations, any delay can be detrimental.

“When settlement is delayed, or terminals go down, managers must choose between (a) delaying supplier payments and risking stockouts, or (b) paying suppliers with stored cash and reducing working capital for other needs. Both options hurt margins and operational reliability,” the report stated.

Access to working capital presents another significant bottleneck. While many operators rely on short-term and inventory-style credit finance, the strict rules and repayment periods associated with these facilities often prove challenging. Under this model, operators are typically required to repay the credit within five days of loading fuel.

Furthermore, obtaining credit can be a slow process and may necessitate extensive documentation. When formal financing is inaccessible, station owners often resort to personal savings, family support, or informal money lenders, which further contributes to the financial fragility of many fuel stations.