The cryptocurrency market experienced a bearish close to the month, with the Bitcoin (BTC) price dipping below $84,000 and the XRP price falling to $1.98. While both tokens have since recovered to trade above $85,000 and $2 respectively, the possibility of a further correction looms over the recent rally. With trading volume surging by nearly 180% and increasing selling pressure, the resilience of the XRP Army in maintaining the rally above the critical support level of $2 is now being tested.

XRP Whales Exhibit Contrasting Behavior: Declining Numbers, Increasing Accumulation

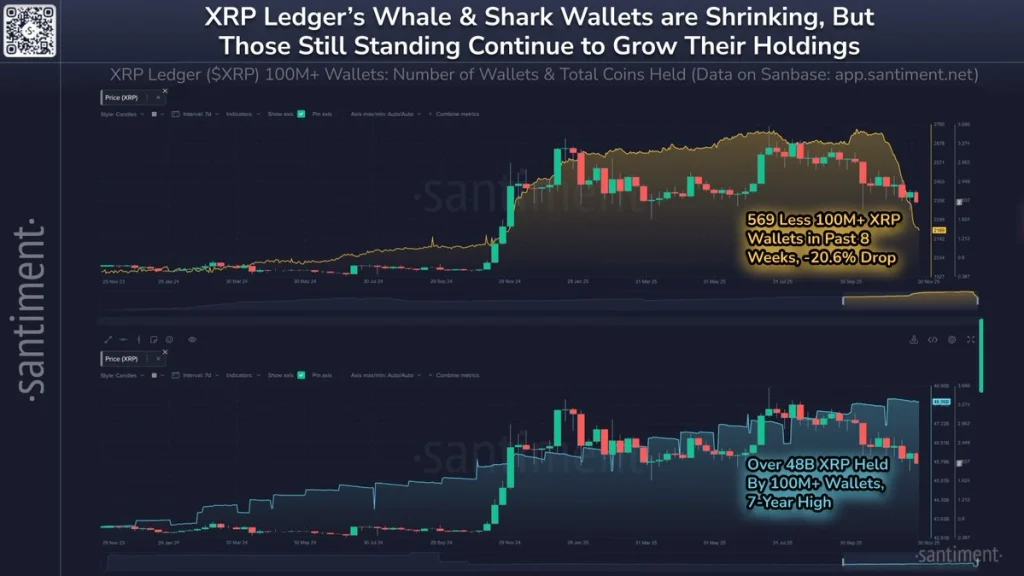

XRP has recently displayed an unusual pattern in its whale activity for the year. The number of significant whale wallets holding XRP has decreased, while the remaining large holders are quietly accumulating their largest holdings in seven years. These conflicting signals suggest a consolidation phase among major investors rather than a complete exit from the market.

Data from Santiment indicates a 20.6% reduction in wallets holding over 100 million XRP during the past eight weeks, with 569 such whale and shark wallets disappearing. This marks one of the most significant contractions in the count of large XRP wallets observed in the 2024–2025 period.

Despite the decrease in the number of whale wallets, the aggregate amount of XRP held by wallets with over 100 million tokens has climbed to a seven-year high of 48 billion XRP. This trend suggests that the whales who remain are absorbing the supply from those exiting the market.

For instance, if a wallet containing 250 million XRP ceases to operate or redistributes its assets such that it no longer falls into the 100 million+ XRP wallet category, the total holdings of this class can still increase if another whale actively accumulates during the same period. This scenario explains the observed decrease in the wallet count alongside a rise in supply concentration, a characteristic sign of market consolidation.

Factors Influencing the Shrinking Whale Count

The sharp decline in XRP's whale count in recent weeks has prompted market speculation regarding the underlying causes. While this trend might initially appear bearish, the situation is more nuanced, reflecting shifts in holder behavior, asset redistribution, and evolving liquidity conditions within the XRP Ledger.

Potential Reasons for Whale Count Decline:

- •Profit-taking post-rally: Following a significant rally earlier in the year, some long-standing whale addresses may be realizing profits or reallocating their capital.

- •Redistribution to custodial or CEX addresses: Certain high-value wallets might have transferred funds to institutional custodians or centralized exchanges. This can lead to a drop in the on-chain "whale count" even if the funds remain within the broader ecosystem.

- •Consolidation or deactivation of dormant wallets: Long-inactive whale wallets may be consolidated into fewer addresses, thereby reducing the overall count without impacting the total supply.

Interpreting the Trend: Bullish or Bearish Outlook for XRP Price?

The current data suggests accumulation by strong hands, a pattern historically associated with bullish market movements. A declining whale count can indicate that weaker or inactive holders are exiting, while increasing supply concentration points to remaining whales strengthening their positions. Notably, similar patterns observed in XRP's market in 2017 and 2020 preceded significant upward price movements.

The weekly price action for XRP indicates that selling pressure has not yet subsided, with the Relative Strength Index (RSI) approaching its lower threshold. Concurrently, the Chaikin Money Flow (CMF) has fallen below zero, suggesting substantial capital outflow from the platform. Consequently, the XRP price is anticipated to enter the support range between $1.97 and $1.92 in the near future. This range has been defended by bulls since the beginning of the year, and there is a strong likelihood they will continue to do so until the year's end.

Conclusion

While XRP's shrinking whale count might initially concern traders, the concurrent increase in the total supply held by whales signifies that stronger hands are consolidating their positions. If accumulation persists around current levels, the XRP price could stabilize above key support levels, potentially setting the stage for a relief bounce. However, a failure to maintain whale demand could expose the price to a more significant pullback before any sustainable recovery can take place.