Bitcoin's Bullish Momentum and Potential Short Squeeze

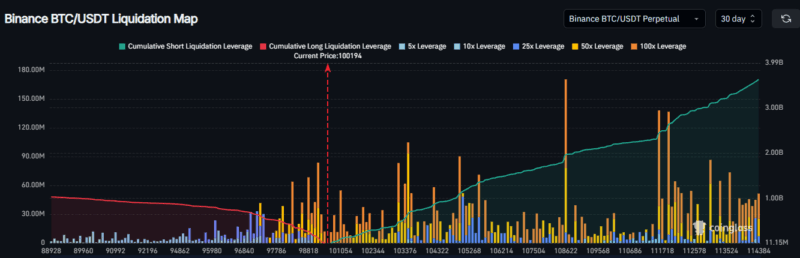

The bullish momentum for Bitcoin is building. Recent data show that if Bitcoin climbs back toward the $115k level it once tested, roughly $5B in short-positions are at risk of forced liquidation. That potential cascade of buys could amplify an already powerful breakout. For traders watching risk rotations in crypto markets, it’s a technical setup worth marking.

Bitcoin currently hovers just under the $100k range. As reported in a recent analysis, breaching into the $108K zone would trigger ultra-vulnerable short positions. Then, a further push toward $115K would unwind close to $5B of shorts, with the majority of liquidity sitting at around $112K.

That kind of forced buying acts like fuel in a parabolic move. At the same time, crypto market derivatives show elevated open interest and compressed ranges, suggesting significant ‘coiled energy’ is present now.

Introducing Bitcoin Hyper ($HYPER)

For investors seeking to capitalize on that dynamic – especially in altcoins that ride Bitcoin’s wave – one project stands out. That project is Bitcoin Hyper ($HYPER), which launches just at a time when Bitcoin-centric altcoins may benefit disproportionately from a short-squeeze-driven rally.

With $26M already raised and staking rewards of 45% on offer, this presale is for those who believe the next leg up is just beginning.

Why Bitcoin Hyper ($HYPER) is Positioned for a BTC-Dominant Move Up

Bitcoin Hyper ($HYPER) aims to solve Bitcoin’s biggest limitations: slow transaction speeds, high fees, and lack of smart contract functionality. The idea is to introduce a high-performance Layer 2 network built on Solana’s Virtual Machine.

Bitcoin Hyper wraps $BTC via a secure canonical bridge, enabling instant transfers and DeFi functionality without compromising Bitcoin’s core security. This transforms Bitcoin from digital gold into programmable, spendable money.

The project has a sharp focus: capitalize on Bitcoin’s momentum by structuring its protocol to benefit directly from Bitcoin-centric flows. It merges homage to Bitcoin’s supremacy with a token model that thrives when BTC surges. In a market where Bitcoin leads and altcoins follow, Bitcoin Hyper is built to amplify that trend.

The tokenomics show a lean supply and early distribution to staking participants and ecosystem builders. This suggests if Bitcoin triggers a short squeeze, $HYPER could catch speculative momentum ahead of traditional altcoin entry points.

Crucially, as Bitcoin squeezes shorts, liquidity rotates into risk assets. A Bitcoin-centric altcoin stands to gain more than a niche use-case token in that environment.

For traders watching for Bitcoin’s move toward $115K, Bitcoin Hyper provides a thematic, leveraged way to ride the cycle.

Presale Dynamics: The $HYPER Opportunity

Here’s how the Bitcoin Hyper ($HYPER) presale stacks up – and why the structure matters in the current environment.

- •Token price: $0.013235 – this entry point reflects early-stage risk and exposure to the entire Bitcoin-cycle narrative.

- •Raised amount: Over $26M already committed – a solid showing for presale phase, indicating investor conviction ahead of broader market inflation.

- •Staking rewards: 45% – high APY, yes, but also indicative of early-stage incentive design rather than guaranteed long-term yield. That aligns with the risk-reward profile: you’re staking for cycle capture, not passive income.

The project’s roadmap emphasizes compatibility with Bitcoin flows, ecosystem integrations, and token-holder alignment with Bitcoin rallies. That means if Bitcoin triggers liquidation-led upside, $HYPER could be quick to participate.

Given the $5B bracket of potential short liquidations looming above Bitcoin, this early-stage entry into an altcoin keyed to that event makes strategic sense – especially when many altcoins will only begin moving after Bitcoin confirms its breakout.

If you believe the short-squeeze narrative around Bitcoin is more than just hype, now might be the window to act on Bitcoin Hyper ($HYPER).