The world of staking crypto is heating up as investors chase passive income while early-stage projects explode in value.

Yet not every yield opportunity is built to last, and knowing what is staking crypto can mean the difference between compounding gains and locked losses.

Transparent, audited ecosystems like Noomez ($NNZ) are leading a new wave of staking models, where deflationary tokenomics and real utility fuel sustainable rewards.

With 28 stages, live on-chain tracking, and a staking system ready to launch, timing is everything. This five-point checklist shows how to find the safest, highest-potential staking opportunities before the next rally leaves you behind.

1. Understand the Core: What Is Staking in Crypto?

To start identifying the best staking opportunities, you first need to know what is staking in crypto at its core. Staking involves locking up your tokens in a blockchain network to support its security and operations, and in exchange, you earn rewards.

Instead of traditional mining, which uses energy-intensive hardware, staking relies on ownership and participation. The more tokens you stake, the greater your influence and potential yield.

But here’s the catch: not all staking programs are transparent or sustainable. Before committing your funds, check whether a project’s staking mechanism is verifiable on-chain and backed by an audited smart contract.

Leading examples like Noomez ($NNZ) take this seriously, its staking system is tied to real on-chain metrics and audited token burns that guarantee authenticity.

2. Evaluate Tokenomics and Deflation

Once you understand the basics, the next step in mastering staking crypto is analyzing tokenomics, how a project’s supply, burns, and reward structure affect long-term value. A staking system is only sustainable when its emissions are balanced by scarcity.

If a token inflates endlessly, your staking rewards lose real value over time.

This is where deflationary systems like Noomez ($NNZ) stand out. The project’s fixed 280 billion supply and 28-stage presale ensure every stage burns unsold tokens permanently.

That shrinking supply directly supports future staking strength: fewer tokens in circulation mean higher yield power for long-term holders.

When each stage’s price rises and the supply tightens, it turns early stakers into real beneficiaries of scarcity-driven growth.

3. Check Liquidity Locks and Vesting

Even the most promising staking setup can collapse without solid protection behind it. That’s why every investor serious about what is crypto staking must look beyond rewards and inspect how liquidity and team tokens are managed.

Liquidity locks prevent developers or insiders from pulling funds that back the market, a move that would instantly tank both the token and your staked assets.

Vesting, on the other hand, ensures that team and early contributors can’t dump large amounts immediately after launch. Together, these measures prove that a project is built for long-term growth, not short-term gain.

Projects like Noomez ($NNZ) have made this a cornerstone of their system. Fifteen percent of total supply is locked into liquidity, while team wallets are vested for 6 to 12 months. That structure gives stakers confidence their rewards are tied to genuine market health, not temporary hype.

4. Gauge Community Growth and On-Chain Activity

Strong staking ecosystems grow from active participation, not empty promises. When researching staking crypto, look for projects that show live on-chain movement, real wallets joining, tokens being locked, and visible progress tracked publicly.

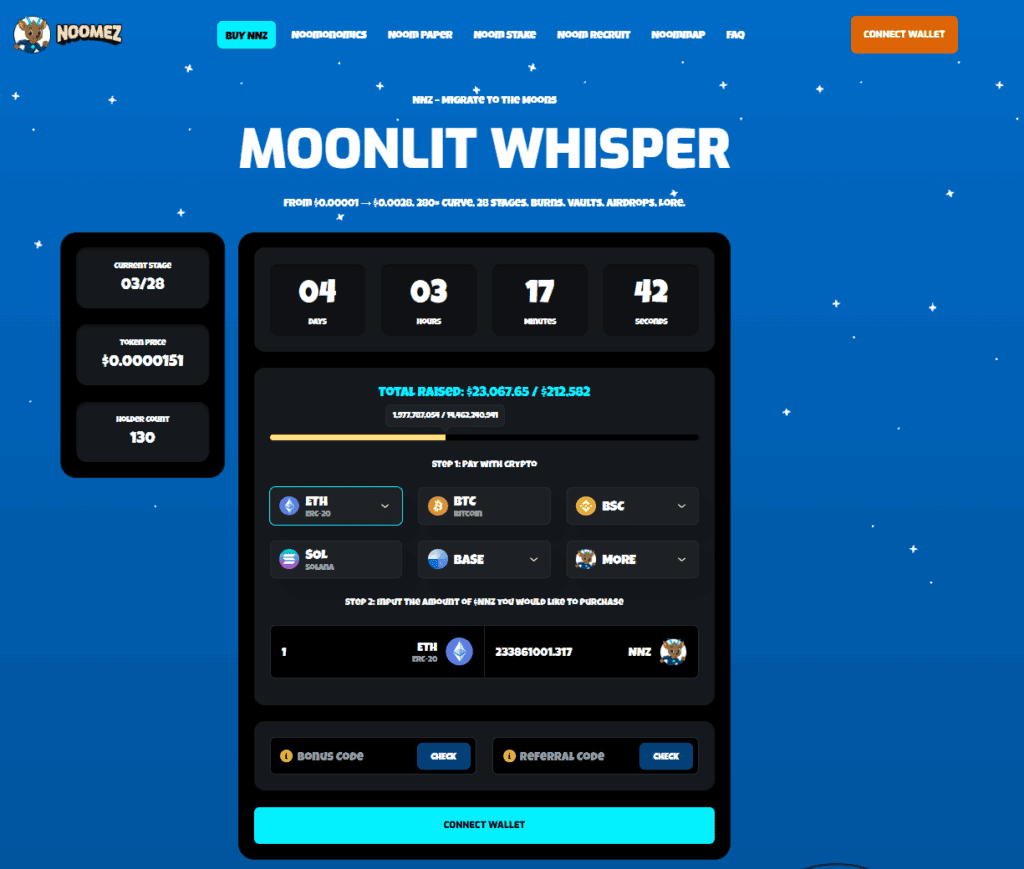

That’s exactly what’s happening with Noomez ($NNZ) right now. The project sits in Stage 3 of its 28-stage presale, priced at $0.0000151, with more than $23,067.65 raised and over 130 holders already onboard.

The Noom Gauge, a live tracker showing each stage’s completion, makes this growth fully transparent. With only a few days left before Stage 4 opens, and the price rises again, every new wallet joining today strengthens the network’s momentum and raises the bar for the next wave of stakers.

5. Look for Long-Term Utility and Ecosystem Rewards

The best staking crypto opportunities reward loyalty, not luck. Sustainable systems combine yield, scarcity, and ecosystem rewards, and Noomez $NNZ nails all three. Its staking pools unlock after Stage 28 with flexible locks from 30 to 365 days, offering up to 66% APY based on duration and multiplier tiers.

Add the 10% Noom Recruit referral (split equally between inviter and invitee) and the Noom Engine, which auto-airdrops verified partner tokens to stakers, and you get continuous yield beyond the presale.

Each Vault Event and burn further tightens supply, meaning long-term holders earn more as scarcity compounds.

Pro Tip: Always read a project’s staking contract and audit summary before locking funds. If you can’t verify how rewards are generated or claimed, it’s not worth staking.

For More Information

Website: Visit the Official Noomez Website

Telegram: Join the Noomez Telegram Channel

X (Formerly Twitter): Follow Noomez ON X