Most people who get into cryptocurrency start by buying and holding coins, hoping the price will rise. But trading and investing without understanding how crypto economics work can be risky. Seasonal Tokens were designed to change that — making it possible to learn by doing, with a system that implements real-world crypto principles in a more predictable environment.

Learning Through Real Economic Behavior

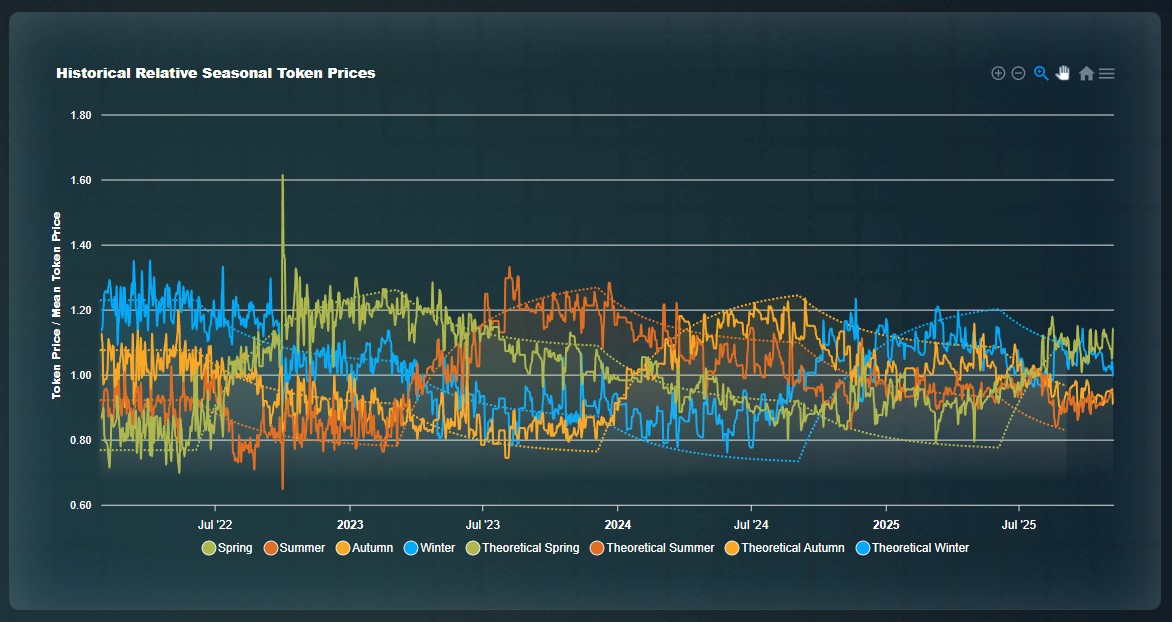

Each of the four tokens — Spring, Summer, Autumn, and Winter — is mined using Proof-of-Work, just like Bitcoin. Over time, the amount of tokens miners receive is reduced through scheduled halvings, which occur every three years for each token, but scheduled so that every nine months the mining supply of the token produced at the fastest rate is cut in half. This controlled reduction in supply teaches one of the key lessons of crypto economics: scarcity drives relative value.

Trading Without the Stress of Big Losses

In many crypto markets, traders face the constant risk of large price swings. Seasonal Tokens work differently. Because the tokens are designed to fluctuate relative to each other rather than against the dollar, traders can practice swapping between tokens as the seasons change without being exposed to the full volatility of the broader market.

This design helps participants build confidence and skill. By watching the price relationships evolve — and adjusting their holdings accordingly — traders learn how to recognize market cycles, manage risk, and understand how mining rewards affect supply and demand. The focus shifts from chasing quick profits to understanding economic patterns. Although this does not guarantee that the dollar prices of the tokens will rise, the system allows participants to increase the total number of tokens they have without investing more fiat.

Instead of relying on market hype or speculation, the value of each token changes in cycles. The tokens’ relative prices shift naturally as new tokens become harder to mine, providing traders with the chance to observe and act on predictable supply changes — the same dynamics that shape Bitcoin’s long-term price cycles.

Understanding Before Investing

By engaging with Seasonal Tokens, users gain firsthand experience with concepts like scarcity, mining difficulty, and seasonality in markets — all without needing large capital or advanced trading skills. The goal is to increase the total number of tokens you have, at the same time making the mechanics of cryptocurrency tangible and understandable.

In an industry often dominated by speculation, Seasonal Tokens offer something rare: a system where risk management is built into the design itself.