Abraxas Capital's $690 Million Crypto Short Surge

Abraxas Capital has significantly increased its short positions on Bitcoin and Ethereum via the Hyperliquid platform. The total notional value of these positions reached $690 million by October 29, 2025. This strategic positioning indicates a bearish outlook, potentially impacting crypto market volatility if support levels breach, given Abraxas' status as a leading participant on Hyperliquid.

Abraxas Capital's activity on the Hyperliquid platform has been notable for its aggressive $29 million deposit over the past three days. Both the main and subsidiary addresses have increased short positions. Specifically, Ethereum (ETH) shorts climbed from $226 million to $273 million, and Bitcoin (BTC) shorts increased from $124 million to $239 million.

The immediate implications of these actions suggest a possible market downturn. Potential sell-offs could occur if major support levels break, causing increased market volatility. As one anonymous derivatives strategist noted, "The scale of Abraxas' positions indicates a high conviction trade. If prices break key support levels, their strategy could amplify sell-offs."

There have been no official statements from Abraxas executives despite their market impact. Analysts have noted the scale of their positions, suggesting high confidence in a bearish market.

Historical Crypto Volatility and Potential Market Impact

Historically, major short positions like those of Abraxas Capital have led to significant price swings in the crypto market, demonstrating the influence of large players on market dynamics.

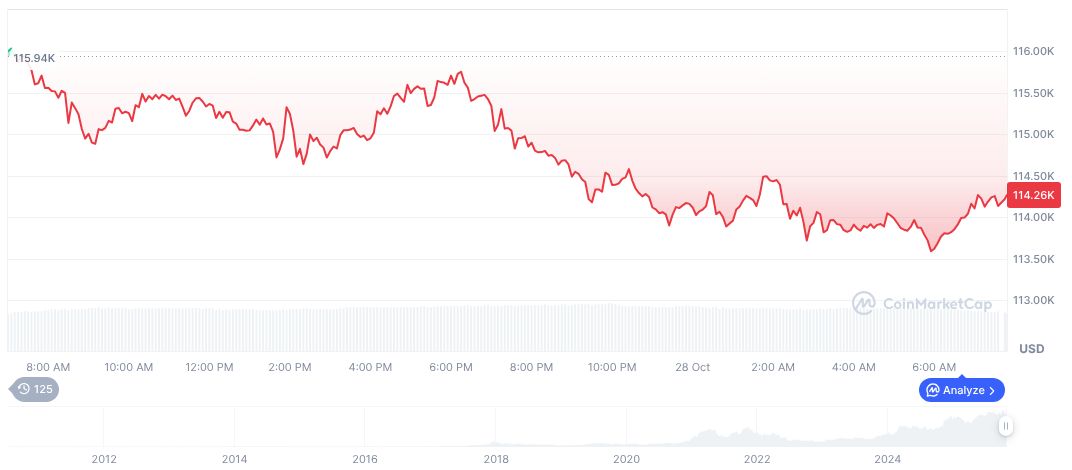

Bitcoin's price stands at $113,280.42, with a market cap of $2.26 trillion and a dominance of 59.22%, according to CoinMarketCap. Recent data indicates a 24-hour trading volume of $64.02 billion, a decrease of 0.76% in the past 24 hours, while reflecting a 7-day increase of 4.84%.

Insights from the Coincu research team suggest these movements could lead to greater regulatory scrutiny or influence future trading strategies on platforms like Hyperliquid. The outcome may depend on whether market support levels hold amid these elevated short positions.