Cardano Holds in Support Range Amid Unconfirmed Bottom

Cardano (ADA) is currently trading within a key long-term support zone. Despite the decline, the technical structure still allows for a potential uptrend if crucial levels hold.

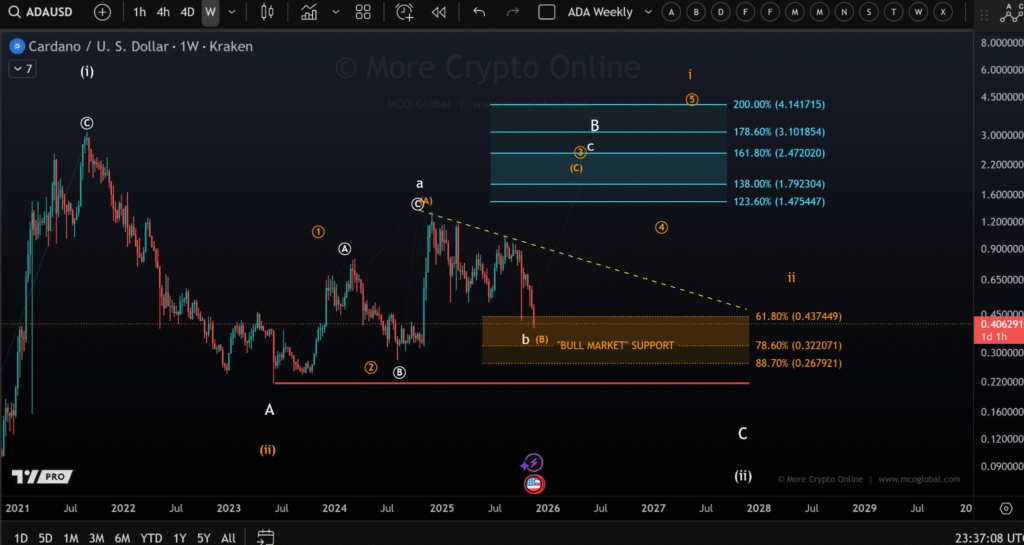

Cardano is trading between $0.322 and $0.437, a zone viewed as “bull market” support. Despite the decline, the price has not yet broken below this range decisively. This zone also includes the 61.8% and 78.6% Fibonacci retracement levels.

According to the chart by More Crypto Online, these levels remain crucial as long as the broader market structure supports a bullish outlook.

The analysis categorizes the ongoing movement as a B-wave pullback. B-waves in Elliott Wave theory often retrace deeper than usual and can break support temporarily. Although ADA remains inside this structure, the price has not confirmed a bottom.

Analysts point out that if ADA breaks below $0.322 decisively, it could next test $0.267, which is the 88.7% retracement. Further downside could bring the June 2023 low at $0.215 into focus.

The price structure still lacks the necessary bullish signals. “Until we see a clear 5-wave move up, the long-term low cannot be confirmed,” the analyst stated.

Broader Trend Depends on Reversal Confirmation

Despite the recent fall, ADA may still be within a larger bullish trend if the current support range holds. However, technical confirmation is essential. A complete 5-wave upward pattern must appear to confirm that a sustainable low has been formed.

Currently, ADA’s chart remains declining, often referred to as a “falling knife.” The structure does not show clear upward momentum, which keeps the market in a cautious state. Until bullish movement develops, traders will continue monitoring the 78.6% and 88.7% Fibonacci levels closely.

If the broader market sentiment improves and the chart confirms upward movement, the next resistance levels could range between $1.39 and $1.47 based on Fibonacci extensions. These levels correspond with the potential C-wave targets illustrated in the analysis.