Cardano is currently at a critical juncture. The price has slipped beneath a short-term rising trendline, and intraday volatility suggests indecision rather than strong conviction from traders.

The current market structure indicates that price is compressing below resistance levels, while broader momentum indicators are beginning to show a downward tilt.

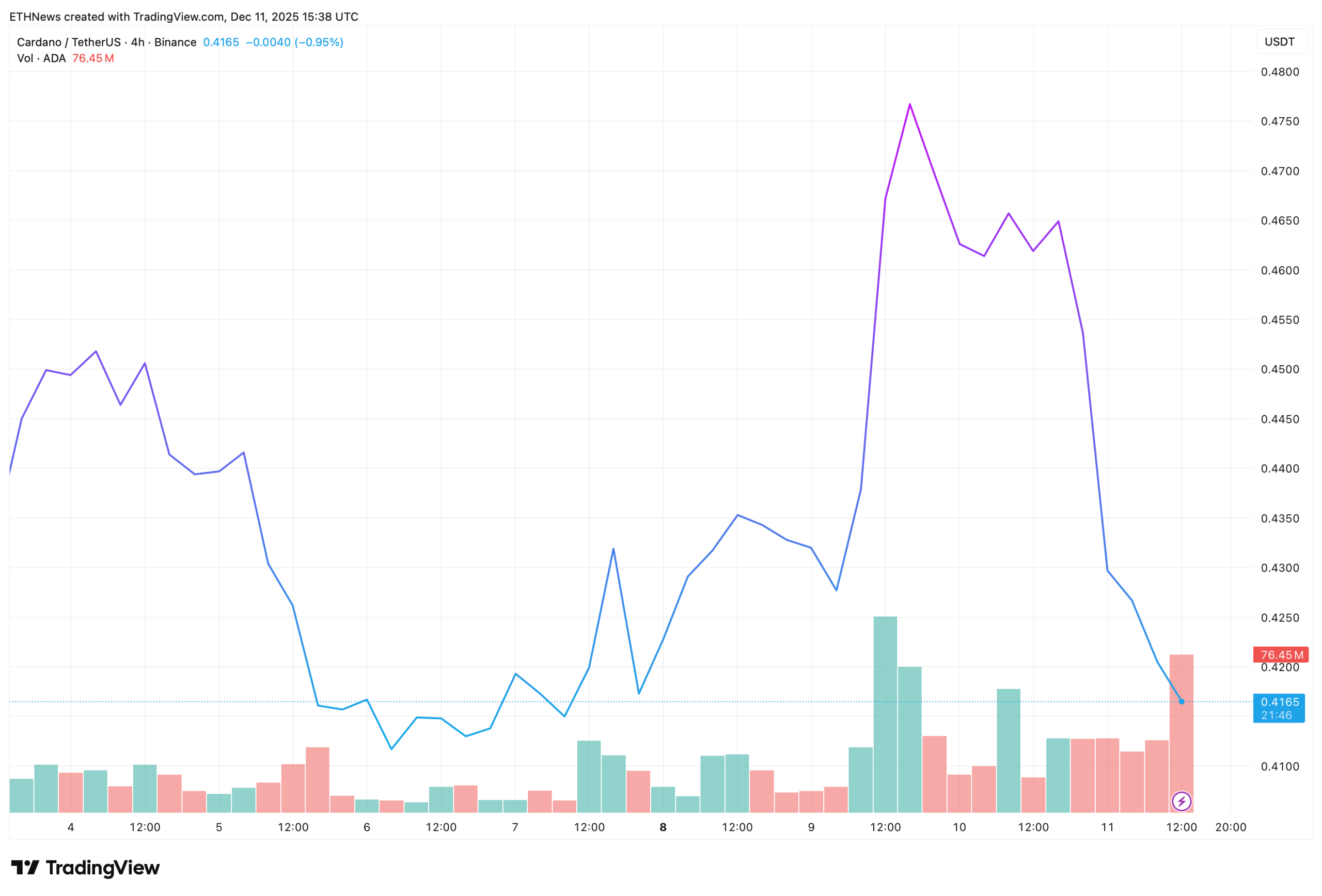

Chart Analysis: ADA Stalling Beneath a Broken Trendline

Analysis of the chart reveals that ADA has experienced a sharp pullback after losing its established rising structure. The cryptocurrency has retested the underside of this broken trendline.

The price is now consolidating just below a resistance level, forming a tight trading range. This range highlights a decrease in buying pressure. Each minor upward movement is being met with selling pressure from overhead supply, a pattern that often precedes further declines if buyers cannot regain control.

While the short-term price structure still allows for a modest rebound, the overall market sentiment appears to be leaning towards caution. ADA continues to be capped by a descending resistance level that has repeatedly halted upward advances, thereby sustaining bearish momentum.

Volume Data Confirms Waning Strength

TradingView charts illustrate a pattern of declining volume during upward price attempts. Conversely, there has been heavier selling interest observed during the recent drop towards the $0.4165 level. This volume imbalance suggests that buyers are facing challenges in establishing upward momentum, reinforcing the notion that the price is currently trapped beneath a significant resistance threshold.

If bulls are unable to reclaim the area of the recent breakdown, ADA risks falling towards lower support zones. The mid-$0.40 region has been identified as a key area of interest within the current price structure.

Future Outlook and Potential Scenarios

A decisive break back above minor intraday resistance levels could alleviate short-term downward pressure. However, a failure to achieve this would increase the likelihood of a deeper continuation of the current trend.

Conversely, a clean move below local support levels would signal a renewed downside momentum and indicate a shift in market control to sellers.