Bitcoin has posted one of its most significant recoveries, printing a large bullish candle and gaining over $5,000 in a single day. Following this strong close, the price has sustained its gains, signaling a potential revival of strong upward momentum. The BTC price has effectively reversed the persistent bearish pressure that characterized recent weeks, marked by uncertainty and renewed selling. With improving market sentiment and increasing liquidity flowing back into the cryptocurrency market, traders are now focused on the next critical question.

Can BTC price finally surge above the long-awaited $100K mark?

After Grabbing $93,000 Liquidity, Is a $90,000 Retest Likely?

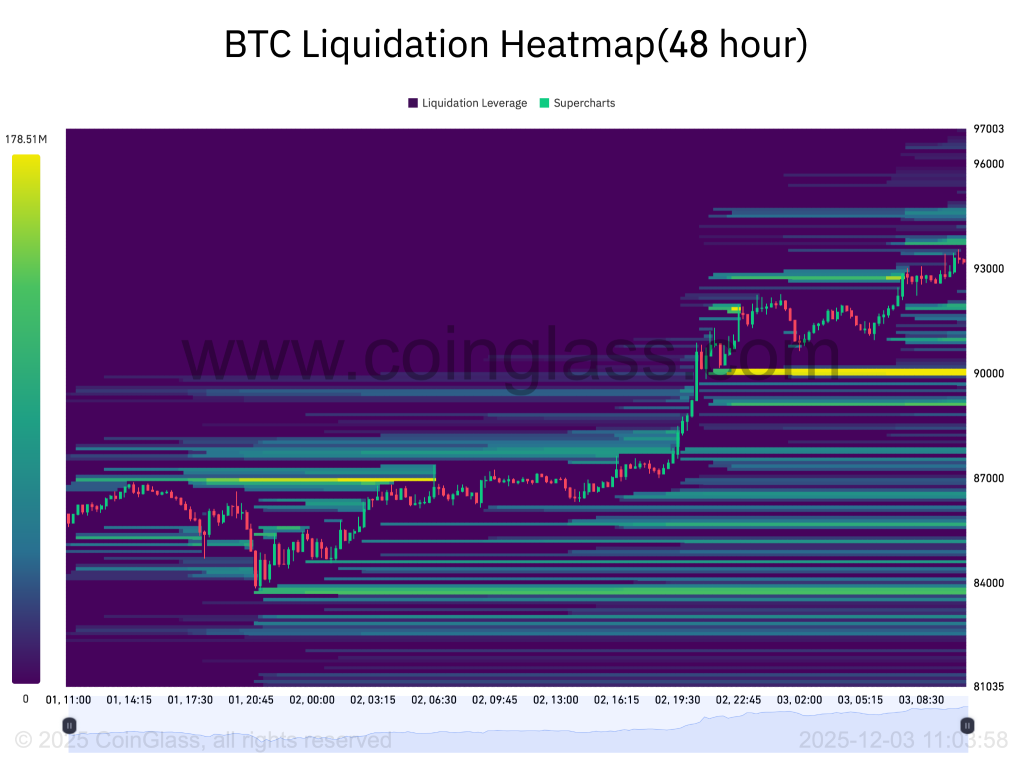

The recent upswing has been significantly fueled by over $387 million in short liquidations within the past 24 hours, with Bitcoin accounting for $223 million of that total. This surge has led to an addition of over $160 billion to the market capitalization, providing strong bullish momentum. Furthermore, after clearing nearly all short-term upside liquidity, the BTC price is now attempting to breach the cluster of resistance around the $93,000 level. Buyers are actively working to absorb this liquidity, but a key price range for Market Makers could be approximately $90,000. Consequently, there is a strong possibility that the price may revisit this range and consume the nearly $400 million in accumulated liquidity.

The current upside liquidity on BTC appears to have cleared the $93,000 cluster level and has risen above the pivotal resistance zone. Buyers are making a concerted effort to absorb this liquidity. However, the price range of interest for Market Makers could be situated around $90,000. Therefore, there is a substantial probability that the price will retest this range and absorb approximately $400 million in accumulated liquidity.

Key Resistances to Watch for the BTC Price Rally

The Bitcoin price is experiencing an aggressive surge, a phenomenon not observed in recent times. On the first day of the US open, following Vanguard's lifting of the ETF ban, IBIT recorded over a billion in volume within the first 30 minutes of trading. This suggests either significant new capital entering the market or that existing demand was finally permitted to utilize their preferred platforms. With a bullish trajectory now seemingly in place, here is what to anticipate from the BTC price in the coming days.

As illustrated in the chart above, the BTC price has surged beyond the critical resistance zone located between $91,210 and $92,043, and is now attempting to solidify its position within this range. The Relative Strength Index (RSI) is showing incremental gains after rebounding from recent lows and exiting the oversold territory. Concurrently, the Bollinger Bands have begun to contract, indicating that the token is preparing for a significant price movement in the near future. Previously, such a squeeze has preceded bearish action, but with the current technical indicators displaying a bullish outlook, an ascending trend is likely to continue, potentially enabling the price to break through the descending trend line and target higher levels.

Will Bitcoin Price Reach $100K in 2025?

As the markets approach the final trading phase of the year, volatility is on the rise. This increase in volatility suggests a strong possibility that the Bitcoin (BTC) price may maintain a robust ascending trend, provided it can surpass specific resistance levels. A prominent analyst, ALI, has identified two key upcoming resistances at $99,070 and $122,060, based on pricing bands. Clearing these levels is crucial for the token to achieve new all-time highs.

Therefore, the unfolding trade in the coming days will be particularly interesting to observe, especially given the year-end trading volatility that has impacted the BTC price and the broader cryptocurrency markets.