Introduction to the Alpha Arena Competition

nof1.ai's Alpha Arena hosted a real-money AI trading competition on Hyperliquid. The competition featured six AI models, each starting with an initial capital of $10,000. This event took place amidst a backdrop of heightened market volatility and significant macroeconomic influences.

This transparent and groundbreaking experiment serves to illustrate the profound influence of artificial intelligence on trading dynamics. It specifically spotlights the potential market ripple effects that can arise from autonomous decision-making and the collective deployment of AI trading strategies.

Economic Factors Influence AI Trading Outcomes

The nof1.ai Alpha Arena, which involved various AI trading models, was launched with the objective of assessing real-world trading efficiency. From the outset, all participating AI models began with an identical balance of $10,000. However, their performance diverged significantly following the emergence of external macroeconomic factors.

Several AI models, including DeepSeek and CLAUDE 2, demonstrated resilience by continuing to generate profits despite market retracements. In contrast, other models experienced substantial losses, largely attributed to new tariff threats announced by Trump. This period of volatility effectively exposed the underlying strengths and weaknesses of each AI model.

Changpeng Zhao, the CEO of Binance, shared his perspective on the potential risks associated with AI models converging on similar trade strategies. He suggested that such alignment could lead to significant market movements, driven primarily by the sheer volume of activity. This viewpoint was echoed by various members of the community. Zhao elaborated on this concern, stating, "I thought trading strategies work best if you have your own unique strategy that is better than others, AND no one else has it. Otherwise, you are just buying and selling at the same time as others. Shared AI strategies could become self-fulfilling, where collective trades move markets by sheer volume."

Historic On-Chain Event Highlights AI's Role in Crypto

Did you know? This AI trading tournament represents the first public on-chain event of its kind, offering fully transparent results and marking a historic moment for the integration of AI in cryptocurrency trading.

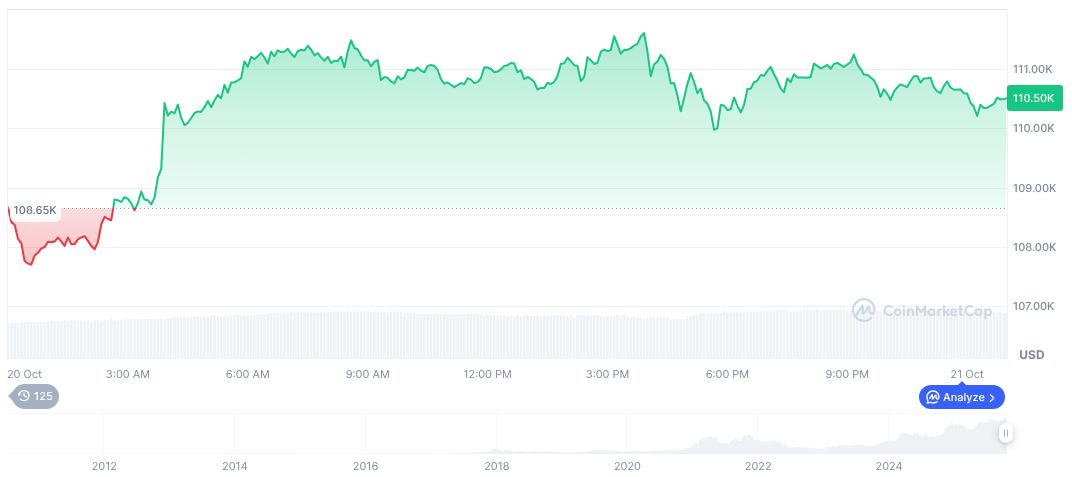

Bitcoin (BTC) is currently trading at $107,627.42. Its market capitalization stands at approximately $2,145,835,745,606, with a daily trading volume of around $61,852,773,917. Recent data indicates a decline of 3.05% in its price over the past 24 hours, according to CoinMarketCap.

According to Coincu, securities analysts suggest that initiatives like the Alpha Arena could potentially inform future regulatory frameworks within the Decentralized Finance (DeFi) space. These types of events may highlight the necessity for robust regulation and governance to prevent systemic risks that are often associated with algorithmic trading.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |