Alphabet has officially pulled ahead of NVIDIA in 2025 performance, marking one of the most unexpected shifts in this year’s “Magnificent Seven” dynamics. While NVIDIA remains the largest company in the group by market capitalization at $4.630 trillion, new market data shows Alphabet’s momentum is now stronger, with year-to-date gains of +10.1%, surpassing NVIDIA’s +6.5%.

This changing leaderboard reflects a broader realignment in big tech growth drivers as AI demand, cloud expansion, and macro headwinds reshape investor priorities.

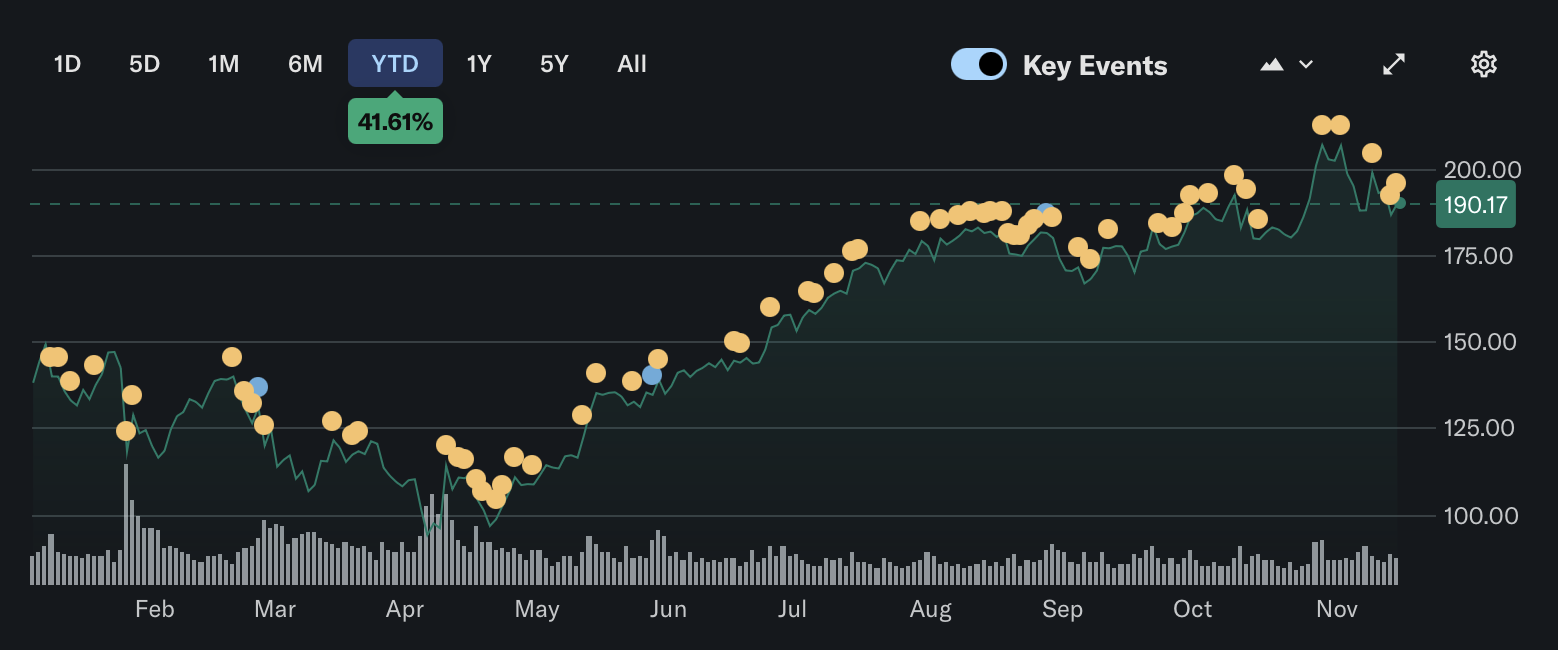

Alphabet’s AI Push and Cloud Strength Drive the Upside

Alphabet’s outperformance this year is tied directly to surging AI-enhanced advertising revenue, improved YouTube monetization, and rapid growth in Google Cloud. The company’s aggressive integration of Gemini and AI-powered search has increased both engagement and advertising efficiency, helping fuel a stronger-than-expected rebound.

Google Cloud’s enterprise adoption growth has also accelerated, offering a second engine of expansion not entirely dependent on advertising cycles.

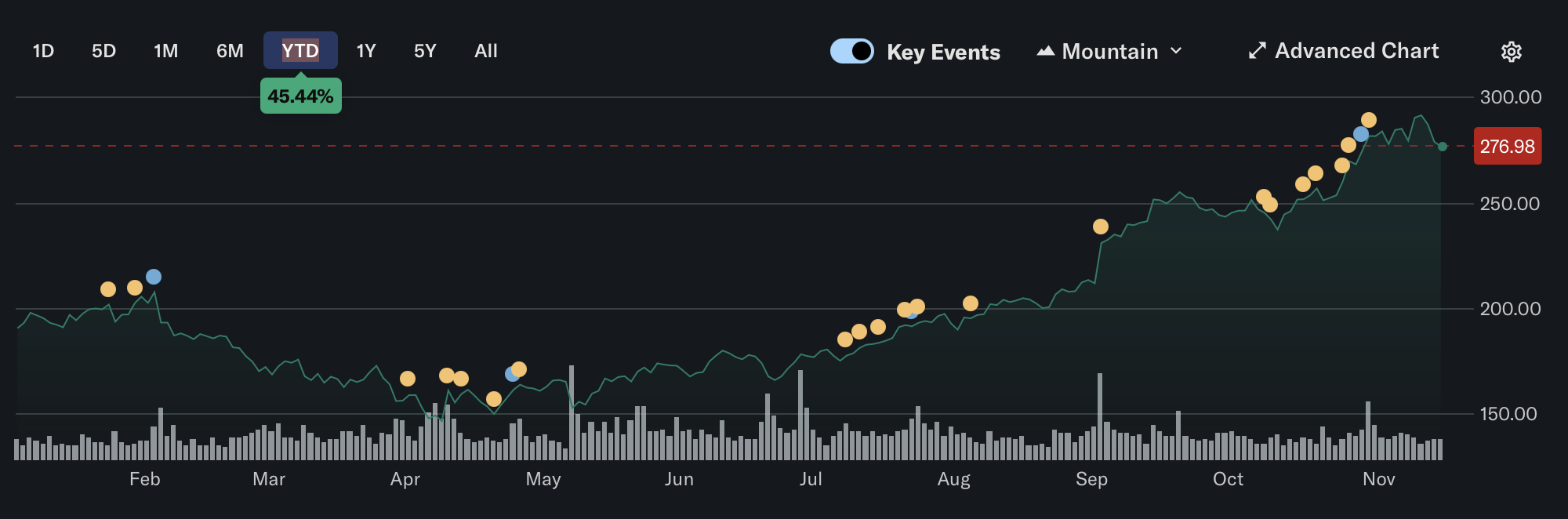

NVIDIA Remains a Titan But Growth Has Stabilized

Despite lagging Alphabet in 2025 gains, NVIDIA continues to dominate the AI semiconductor market, still standing at the top of the Magnificent Seven with a market cap above $4.6 trillion.

But after two years of explosive GPU demand, growth is naturally moderating. Supply constraints, rising competition from AMD and custom AI chips, and cyclical purchasing patterns have cooled the pace of new upside, even though overall fundamentals remain extremely strong.

Microsoft, Apple and Amazon Add Fuel to the Rally

The chart also reveals broader trends inside the Magnificent Seven:

- •Microsoft (+19.4%) continues benefiting from enterprise AI deployments and record Azure demand.

- •Apple (+38.1%) is experiencing its strongest year in a decade thanks to Vision Pro ecosystem expansion and AI-driven device upgrades.

- •Amazon (+4%) remains steady but modest, supported by AWS stabilization and logistics efficiency improvements.

Meta and Tesla trail the group, with Tesla recording only +3.1% amid EV sector weakness and rising competition.

The Bigger Picture: Big Tech’s Market Cap Race Is Shifting

While NVIDIA dominated 2023–2024, 2025 is shaping up differently. Alphabet’s rise highlights a renewed balance inside big tech:

- •AI hardware demand remains strong, but

- •AI software, cloud infrastructure, and monetization layers are becoming the next major growth frontier.

That shift is pulling market leadership from chip manufacturers back toward diversified platforms like Alphabet and Microsoft.

Conclusion

The 2025 “Magnificent Seven” rally is no longer a one-company show. Alphabet overtaking NVIDIA year-to-date marks a turning point in market leadership, driven by AI-enhanced advertising, cloud growth, and stronger-than-expected earnings momentum. As the year continues, the battle between AI infrastructure (NVIDIA) and AI platforms (Alphabet, Microsoft) is likely to define the next phase of the tech bull cycle.