Key Insights:

- •Analysts are closely monitoring ETH/BTC, XRP/BTC, and ADA/BTC for early indicators of an altcoin season.

- •Current market consolidation and liquidity trends suggest that altcoins may soon experience a surge in strength.

- •An increase in trading volumes is being interpreted as a potential sign of a shift towards an altcoin season.

The possibility of an altcoin season is once again a prominent topic of discussion, with analysts identifying new signals within the market that suggest its potential return. These observations come at a time when traders are keenly focused on Bitcoin's performance, prevailing chart patterns, and the recent price action of major altcoins such as Ethereum (ETH), Ripple (XRP), and Cardano (ADA).

Shift in Altcoins/BTC Correlation Raises New Questions

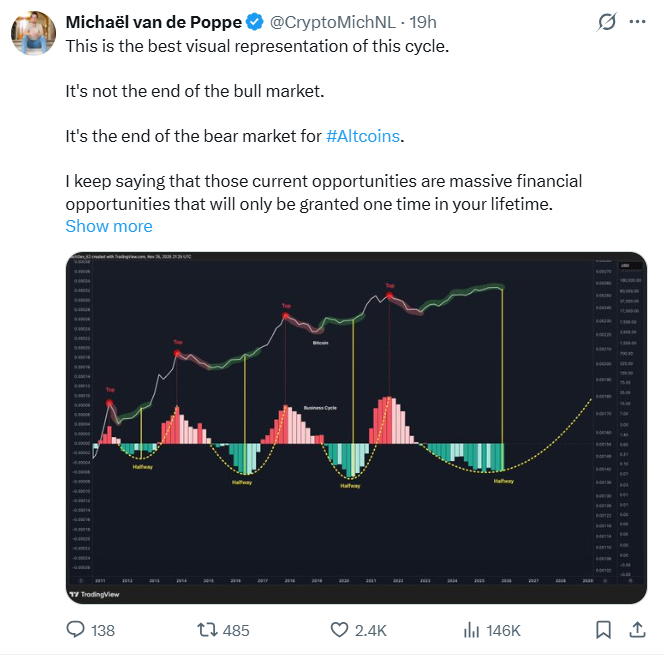

Michael van de Poppe, a market analyst, has indicated that the future direction of the cryptocurrency market hinges on the performance of altcoins relative to Bitcoin. He posits that altcoins typically gain significant momentum only when Bitcoin's price movement begins to stabilize. Van de Poppe also noted that traders often adopt a strategy of waiting for Bitcoin to establish a firm trading range before reallocating their capital into altcoins.

Michael van de Poppe further elaborated that this pattern has been observed in previous market cycles, and he believes the current chart formations bear a resemblance to those historical periods.

He also highlighted that investors are currently paying close attention to trading pairs like ETH/BTC, XRP/BTC, and ADA/BTC to ascertain if these key altcoin-to-Bitcoin ratios can maintain their support levels. These specific pairs often provide early indications of broader market sentiment shifts before they become widely apparent.

Van de Poppe emphasized that market confidence is a crucial factor, stating that traders require clear signals of stability and potential upside before they are willing to assume increased risk.

He pointed out that liquidity has remained predominantly concentrated around Bitcoin in recent months, consequently limiting the available capital for altcoins. However, the expert suggested that this situation could change if Bitcoin experiences a period of price consolidation.

It is important to note that Van de Poppe maintained a cautious outlook, refraining from declaring that an altcoin season has definitively begun. Nevertheless, he observed that the prevailing market conditions are increasingly aligning with the typical prerequisites for such a period.

Gambardello Rejects Claims That Altcoin Season Is Impossible

Dan Gambardello has publicly addressed and refuted assertions that an altcoin season is an impossibility in the current market environment. He shared that he has encountered numerous comments expressing skepticism, such as, "There will be no altseason. 36 million tokens. Liquidity diluted. No rotation coming."

Gambardello stated that he conducted a thorough review of the current market data and arrived at a different conclusion.

According to his analysis, the prevailing market conditions do not support the claims of impossibility. He noted that the underlying cycle structure of the market continues to exhibit a discernible pattern.

He further explained that altcoins often experience extended periods of underperformance before they begin to appreciate in value. Gambardello pointed out that this phase is a normal component of the market cycle and should not be misinterpreted as a sign of systemic failure.

Gambardello characterized the current market as operating in "hard mode," noting that traders have endured prolonged periods of consolidation and sluggish price action.

He clarified that this current stage does not necessarily indicate a breakdown of the market's fundamental structure. He remains of the opinion that the established pattern is still intact.

During his discussion, it was highlighted that the full-fledged altcoin season has not yet commenced, and this current phase is expected to conclude in the near future if the cycle progresses as anticipated.

Additionally, Gambardello observed that early indications of increasing trading volume are beginning to emerge. He stated that a rise in trading volume is frequently the initial precursor to a significant market shift.

Top Altcoin Spotlight

As of the latest available data, CoinMarketCap reports that Ethereum (ETH) was trading near $3,035.11, XRP was priced around $2.19, and Cardano (ADA) was valued at approximately $0.4315.

These specific cryptocurrencies often attract early investor attention because they tend to be leading indicators of evolving market interest and sentiment.

Ethereum continues to command a substantial portion of market activity, serving as a benchmark for traders assessing the flow of capital into riskier assets. XRP has maintained a relatively stable trading range, while ADA has demonstrated consistent movement around its established support levels.

The current price action for these assets presents a mixed picture. While ETH has successfully defended its support levels, XRP has experienced sideways trading. Cardano, meanwhile, has continued to trade within a narrow price band.

Despite these observations, traders interpret these movements as typical behavior during periods of market quietude. They also view these price actions as potential early signals if market conditions begin to improve.

Market observers anticipate that the trading activity and price movements over the next few weeks will be instrumental in determining the overall market direction.

It has been argued that the performance of these prominent altcoins could provide valuable insights for traders seeking to gauge whether investor interest is on the rise again.

The ongoing debate surrounding the onset of an altcoin season continues, but the market now possesses more data points to analyze as traders await definitive confirmation of a sustained upward trend.