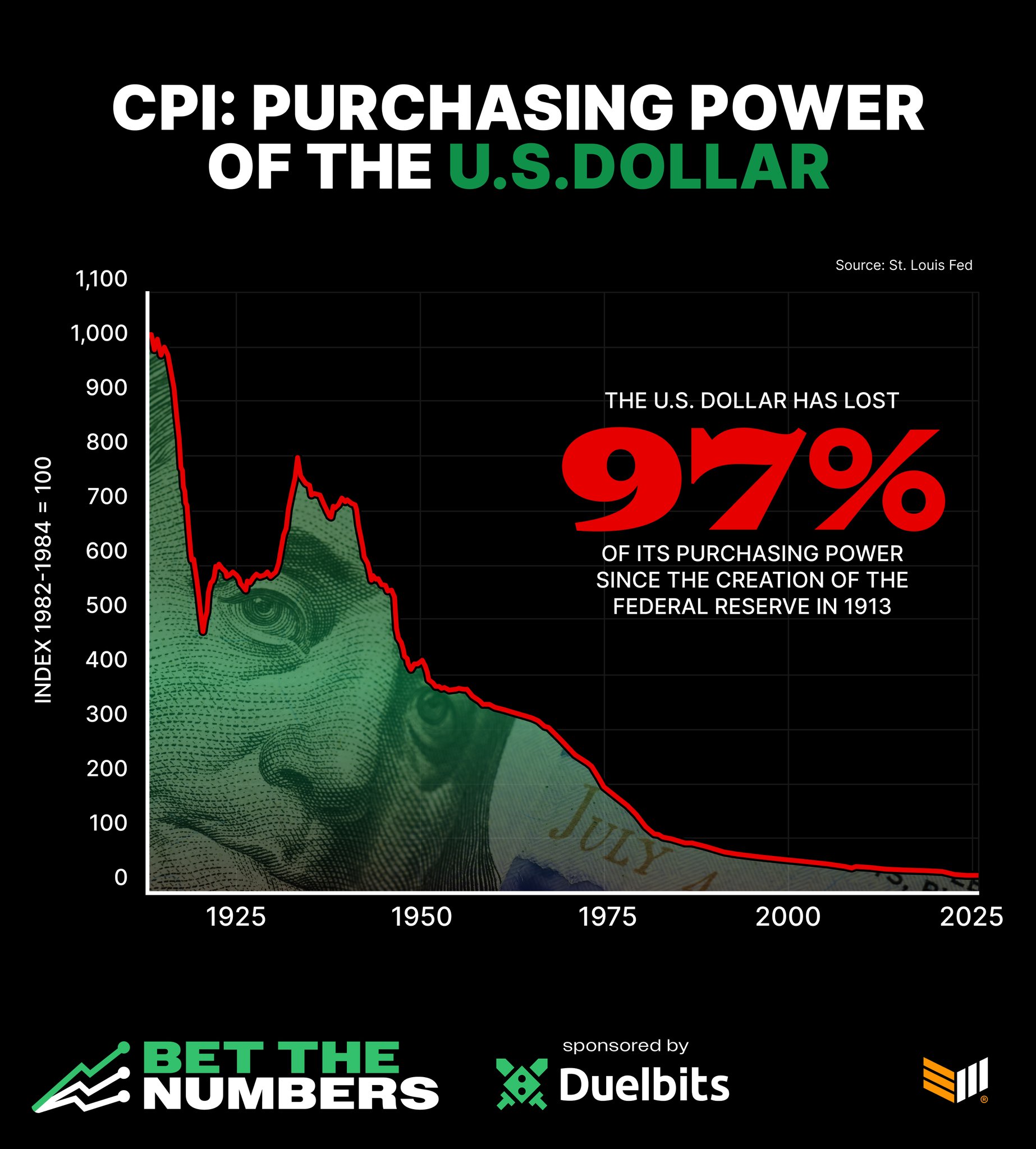

For more than a century, the U.S. dollar has been considered one of the world’s strongest and most reliable currencies. It dominates global trade, sits at the core of international reserves, and acts as the default store of value for governments and institutions. Yet beneath that surface of strength lies a harsh economic reality: according to official data from the St. Louis Federal Reserve, the U.S. dollar has lost 97% of its purchasing power since 1913, the year the Federal Reserve was created.

The chart illustrates a century-long downward slope that captures a structurally declining currency, one that buys dramatically less every decade while nominal asset prices continue to rise. What looks like stability on the surface is actually long-term erosion accelerated by inflation, monetary expansion, and policy cycles.

A Century of Decline, One Policy Regime at a Time

The steep decline isn’t the result of a single crisis but rather a cumulative effect of many:

- •The creation of the Federal Reserve in 1913, giving the U.S. a centralized, elastic currency supply

- •The move away from the gold standard, first partially in 1933 and fully in 1971

- •A long series of inflationary periods, particularly the 1940s, 1970s, and post-2008 phases

- •Unprecedented quantitative easing following the global financial crisis and pandemic-era stimulus

Each cycle contributed to a permanent reduction in the dollar’s spending power. Goods, services, and assets became more expensive not because they fundamentally changed but because the currency holding their price weakened.

Even though the dollar still functions as the world’s reserve currency, its long-term purchasing power has been on a clear, measurable downward path for over 100 years.

Why This Matters Today More Than Ever

The timing of this renewed spotlight on dollar debasement comes as the U.S. faces a combination of pressures:

- •Record levels of federal debt, now above $35 trillion

- •A structurally high inflation environment, well above the target for over two years

- •Political gridlock on fiscal reform, with deficits widening annually

- •Global trading partners accelerating diversification away from USD

Investors are increasingly asking a critical question:

If the strongest currency in the world loses purchasing power every decade, what does long-term protection look like?

That question has become central to the rise of alternative stores of value, from gold to Bitcoin.

Bitcoin Enters the Debate as the Dollar’s Mirror Image

Bitcoin’s fixed supply model is intentionally designed to contrast with fiat currencies, especially the U.S. dollar. Where the dollar expands as policy demands, Bitcoin’s issuance schedule becomes more restrictive over time.

This contrast has not gone unnoticed:

- •Long-term BTC holders point to charts like this as evidence of structural fiat dilution

- •Institutions increasingly buy Bitcoin as a hedge against long-term monetary expansion

- •Younger investors see Bitcoin as a “digital defense mechanism” against the same 97% decline highlighted here

While Bitcoin remains volatile in the short term, its long-term narrative is strengthened every time new data illustrates fiat depreciation.

The Dollar Is Still Dominant But Not Untouchable

Despite the dramatic loss of purchasing power, the dollar remains the backbone of the global financial system. However, the chart shows a clear truth: dominance does not equal stability, and purchasing power loss is a feature of modern fiat design, not an accident.

As inflation remains elevated and the Federal Reserve continues navigating between growth and tightening cycles, investors and policymakers are forced to confront a difficult reality. The dollar will remain strong relative to other currencies, but internally, it continues a century-long decline against real goods, real assets, and increasingly, digital alternatives.

Final Outlook

The U.S. dollar’s 97% loss in purchasing power since 1913 is not just historical trivia. It is the story of how modern monetary policy works, how inflation compounds across generations, and why more investors now look beyond traditional finance to protect long-term wealth.

In a world where fiat currencies weaken over time by design, the search for durable stores of value, whether gold, real estate, or Bitcoin, has never been more relevant.