Trump-Xi Confirmation and The Immediate Crypto Reaction

Cryptocurrency markets experienced a notable boost following the confirmation that US President Donald Trump would meet with Chinese President Xi Jinping on October 31st at the APEC summit in South Korea. This announcement was reported to have positively impacted crypto market sentiment, as traders interpreted the proposed meeting as a potential de-escalation of US-China trade tensions.

This development comes after a period of market uncertainty, during which Trump's tariff threats had spooked traders, leading to a significant liquidation event in the crypto derivatives market.

President Trump, speaking with news sources, confirmed the meeting to Fox News’ Maria Bartiromo, stating, “We’re going to meet in a couple of weeks. We’re going to meet in South Korea, with President Xi and other people, too.” He further described President Xi as “a very strong leader, a very amazing man… It is going to be fair.”

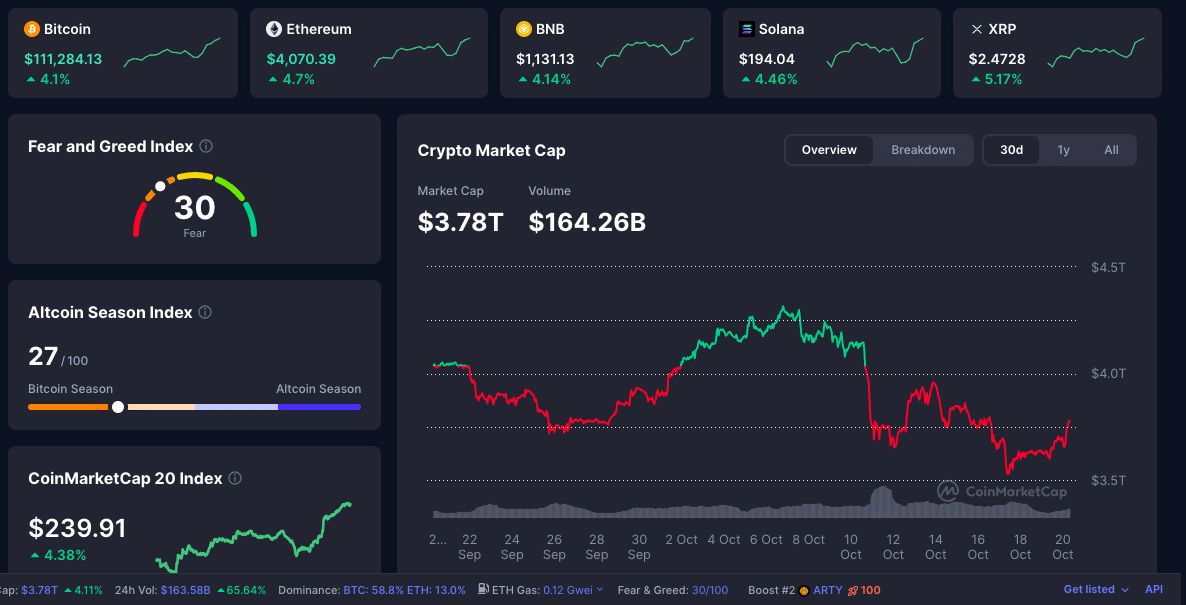

The market reacted almost immediately. Bitcoin saw a jump of approximately 2%, while Ethereum and BNB each increased by about 4%. Solana also experienced a gain of nearly 4%. Analysts attributed this surge to renewed hope among traders that trade tensions would ease, creating a more favorable environment for risk assets, including cryptocurrencies.

Background: Trade Tensions and the Derivatives Wipeout

Earlier in October, the crypto market had endured one of its most severe liquidation events, with over $19 billion in leveraged positions being wiped out within a single 24-hour period. This downturn followed President Trump's threats of imposing 100% tariffs on Chinese imports, to which China responded by implementing export controls on rare earth metals.

These actions caused Bitcoin and other digital assets to decline sharply, triggering a broader sell-off. The Crypto Fear & Greed Index fell to 22, reflecting significant investor uncertainty about the future market direction.

Amidst these challenges, news of the upcoming summit between President Trump and President Xi has emerged as a significant positive development. Market observers are hopeful that this meeting could mark a turning point for crypto market sentiment.

What to Watch

Several indicators are being monitored by market participants to assess the sustainability of the current rally. A key metric is the open interest in crypto derivatives; an increase in this area would suggest a return of investor confidence and participation.

Another important indicator is the funding rate for perpetual futures. A rising funding rate could signify increased optimism among investors, who may be more willing to place bets on upward price movements of specific cryptocurrencies.

The movement of large wallet flows and whale activity is also being closely observed. For instance, a reported $255 million in new long positions for Bitcoin and Ethereum emerged shortly after the summit announcement.

Furthermore, the performance ratio of altcoins relative to Bitcoin can indicate a return of risk appetite. The recent gains observed in Solana and BNB suggest that this may indeed be occurring.

Conclusion

The confirmation of President Trump and President Xi meeting on October 31st has provided a significant boost to the cryptocurrency market. Major cryptocurrencies saw immediate gains, signaling a clear increase in trader optimism.

The crucial question remains whether this shift in crypto market sentiment will translate into a substantial influx of capital and an improvement in derivatives metrics, leading to sustained growth.

Glossary

Open interest: Total number of open futures or options contracts.

Funding rate: Regular payments between long and short positions in perpetual futures to balance demand.

Derivatives liquidation event: Forced closure of leveraged positions when collateral thresholds are breached.

Risk-on asset: An asset that generally goes up when investors are willing to take more risk.

Margin market: Trading with borrowed funds to amplify price moves.

Frequently Asked Questions About Trump and Xi Meeting

Why does a Trump and Xi meeting affect cryptocurrencies?

Cryptocurrencies are sensitive to macro-geopolitical risks. When major trade tensions ease, risk-on assets, including crypto, tend to appreciate, and crypto market sentiment generally improves.

What is the evidence of the crypto reaction to this news?

Following Trump’s announcement, Bitcoin increased by 2%, Ethereum ($ETH) and BNB ($BNB) rose by 3.5%, and Solana ($SOL) gained 4%.

Does improved sentiment mean a crypto rally?

Not necessarily. Sentiment is only one component of a sustained rally. Capital flows, improving derivatives metrics, and a stable macroeconomic environment are also required.

What can reverse the sentiment?

A breakdown in the Trump-Xi talks, renewed trade escalations or tariff increases, or another significant derivatives liquidation event could quickly reverse positive sentiment and lead to market weakness.