Decentralised exchange Bunni has announced it is shutting down operations, marking another casualty in the ongoing crypto winter. The decision follows an $8.4 million exploit that occurred in September, which depleted the platform's liquidity and rendered it unable to continue. This announcement comes shortly after layer-1 blockchain Kadena also revealed it was winding down its operations.

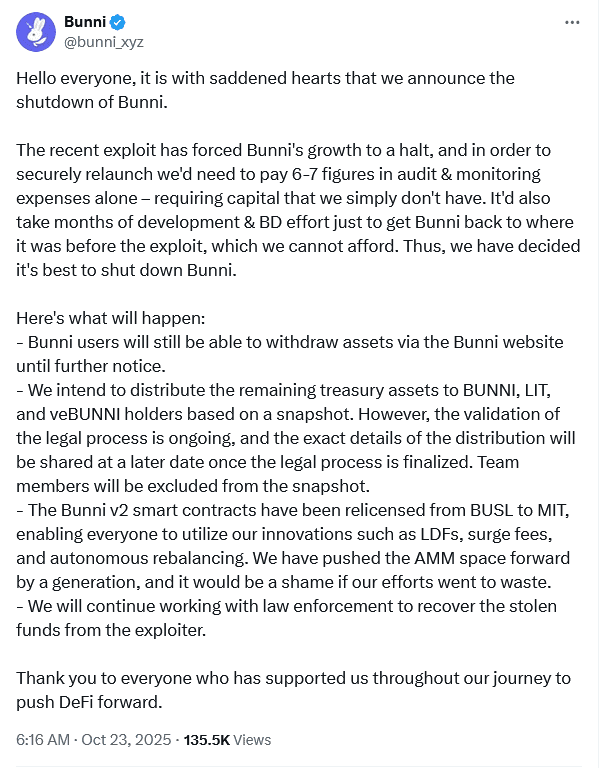

The Bunni team stated in a post on X that the primary reason for closing operations is a lack of funds. The exploit not only drained the protocol’s liquidity pools but also significantly eroded user confidence, making it impossible for the team to sustain further development or afford new security audits.

“We simply no longer have the financial capacity to rebuild, re-audit, and re-establish Bunni as a secure trading environment,” the developers explained.

This development represents a significant blow to the decentralised finance (DeFi) sector, which continues to face challenges from hacks, liquidity shortages, and declining investor confidence.

The $8.4 Million Exploit

Bunni, built on Uniswap v4 hooks, initially garnered attention for its novel approach to liquidity management and tokenised pool positions. However, these same innovative features may have contributed to its downfall.

In early September, an attacker identified a subtle rounding-error vulnerability within Bunni’s custom Liquidity Distribution Function (LDF). By leveraging this flaw with flash loans and micro-withdrawals, the attacker was able to trick the protocol into approving unauthorised fund transfers. This resulted in the draining of two pools: weETH/ETH on Unichain and USDC/USDT on Ethereum.

Bunni’s Total Value Locked (TVL) experienced a drastic decline, falling from tens of millions of dollars to near zero almost overnight. The Bunni team offered a 10% white-hat bounty to the attacker for the return of the stolen funds, but this offer was not accepted. The stolen assets were subsequently laundered through Tornado Cash, a privacy-focused Ethereum mixer known for its use in high-profile security incidents.

The attack severely impacted the protocol's operational capabilities. Within days, liquidity providers withdrew their funds, token prices plummeted, and user trust vanished.

Insufficient Funds for Relaunch

In its shutdown announcement, Bunni indicated that relaunching the exchange would necessitate a comprehensive security overhaul. This would include new smart contract audits, restoration of liquidity, and a complete brand rebuild. The team estimated the projected costs to be “well into the six- to seven-figure range,” an expenditure the project could not absorb after the exploit.

The team also highlighted the erosion of user and investor confidence as a significant hurdle. Following the attack, trading activity decreased sharply, and liquidity providers began withdrawing their remaining capital from the pools. Without sufficient capital and trust, Bunni faced insurmountable challenges.

Despite the circumstances, the team stated its intention to manage the wind-down responsibly. Users will retain the ability to withdraw any remaining assets. A snapshot of token holders, including BUNNI, LIT, and veBUNNI, will be used for the distribution of any remaining treasury funds. Notably, team members will not be eligible for compensation.

As a final measure, Bunni’s developers have relicensed the project’s code under the MIT license, making its core smart contracts open source. This allows developers in the broader ecosystem to freely use or modify Bunni’s technology, including its liquidity management tools and rebalancing mechanisms, potentially enabling Bunni’s concepts to find new life within the wider DeFi ecosystem.

Kadena's Shutdown: Another Significant Blow

Bunni’s closure follows closely on the heels of Kadena’s announcement that it would cease all business operations. Kadena, once promoted as a scalable, enterprise-ready layer-1 blockchain, cited financial strain and the inability to sustain the network’s infrastructure as the reasons for this decision.

While Kadena’s blockchain is expected to continue operating in a limited capacity, supported by independent miners and community members, Bunni’s closure signifies a complete cessation of its services. Once its smart contracts are retired, the platform’s trading and liquidity functions will cease entirely.

These two significant collapses occurring within the same week have heightened concerns within the crypto ecosystem. They indicate a new phase of contraction in the DeFi sector, where technical innovation alone is no longer sufficient for projects to remain viable.

Lessons from Bunni's Demise for DeFi

Bunni’s trajectory is becoming an increasingly common narrative within the DeFi space. Even with audits and careful design, complex smart contracts remain susceptible to unforeseen logic errors.

The exploit has underscored a more profound issue in DeFi: many projects operate with minimal reserves, heavily relying on user liquidity and token valuations. When adverse events occur, such as hacks or market downturns, there is often insufficient financial buffer to mitigate the impact.

Security analysts suggest that Bunni’s situation should serve as a cautionary tale. While the industry celebrates innovation, the pressure to launch quickly and integrate experimental features frequently outpaces the development of robust security measures designed to protect users.

Rebuilding trust presents another significant challenge. Once a DeFi project experiences a major breach, it faces not only financial losses but also severe reputational damage. In Bunni’s case, even a technically sound relaunch might not have been enough to restore user confidence.

The concurrent collapse of Kadena and Bunni in a single week highlights the inherent fragility of the current crypto ecosystem. It also raises critical questions about the long-term sustainability of decentralised projects, which often depend on centralised teams, treasury funds, and user faith.

Bunni’s decision to open-source its code offers a potential positive outcome. Its technology could be adopted by other projects, and its closure might encourage more rigorous engineering practices across the sector. However, the overarching conclusion is sobering: as the DeFi market matures, only projects demonstrating robust security, sustainable funding models, and transparent governance are likely to endure.

While the crypto industry often thrives on bold ideas, Bunni’s downfall illustrates that innovation without sustained resilience is ultimately insufficient.