Arbitrum's ecosystem is experiencing explosive growth, yet the ARB token has seen a consistent decline for months. This disconnect has been highlighted by analyst Michaël van de Poppe, who described ARB as "one of the most exciting protocols in the ecosystem" while questioning the token's downward trajectory despite strong market fundamentals.

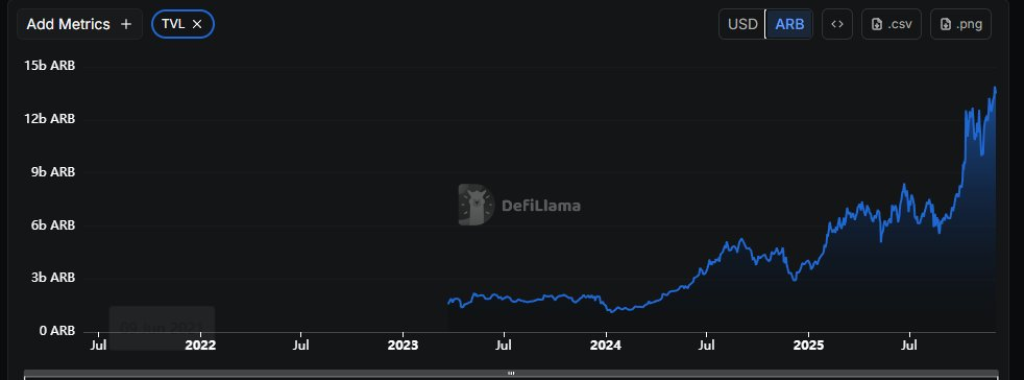

Surging Total Value Locked (TVL) Signals Ecosystem Strength

Supporting van de Poppe's observation, Arbitrum's Total Value Locked (TVL), measured in ARB terms, has shown a parabolic increase. Since mid-2024, the TVL has climbed nearly vertically, consistently breaking through previous all-time highs. Even during periods of broader market weakness, Arbitrum's TVL experienced minimal interruption. By late 2025, TVL had surged beyond 12 billion ARB and is now approaching 15 billion. These figures strongly indicate significant growth in ecosystem activity, liquidity, and capital demand.

In stark contrast to this fundamental growth, ARB's price has fallen by approximately 70% over the past three months.

Divergence Between Fundamentals and Price

The divergence between Arbitrum's expanding network metrics and its depreciating token price presents an interesting analytical challenge. Typically, a network experiencing rapid expansion in users, capital, and applications would see its token appreciate, not decline. However, short-term market sentiment often diverges from underlying fundamentals. Speculators are known to react more swiftly to macroeconomic conditions, ETF flows, and shifting narratives than to data points like TVL or Decentralized Exchange (DEX) volume, which tend to lag behind price movements.

On-Chain Metrics Reinforce Growth Narrative

Fundamentally, Arbitrum's on-chain metrics appear stronger than ever. The daily new highs in TVL demonstrate accelerating liquidity within the ecosystem. DEX volume has also been on an upward trend, confirming that users are not only depositing funds but are actively engaging in transactions across the network. Furthermore, new applications continue to launch on Arbitrum weekly, expanding the protocol's reach and solidifying its position as a prominent hub for tokenization and DeFi expansion.

While active addresses are lower than during the peak of 2023, this is a common trend when markets cool down. What is noteworthy is that, unlike many other blockchain networks that saw both activity and TVL decline, Arbitrum is successfully maintaining user engagement while simultaneously attracting new capital. This means the chain continues to grow even as much of the broader market experiences contraction.

Potential for Undervaluation

This combination of falling token price and rising fundamental metrics leads many analysts to believe that ARB may be significantly mispriced. Van de Poppe has suggested that ARB could potentially return to a "fair value" multiple by 2026 if the market begins to account for the ecosystem's actual strength rather than succumbing to short-term fear.

For investors with a long-term perspective, such market conditions often represent an opportunity rather than a sign of weakness. Arbitrum's core narrative—focused on tokenizing real-world assets, scaling Ethereum, and supporting a vast L2 developer ecosystem—remains intact. The primary change has been in market sentiment, which is known to shift back towards fundamentals much more rapidly than fundamentals themselves evolve.

Future Outlook

If Arbitrum sustains its current trajectory of achieving all-time high TVL, increasing DEX activity, and experiencing rapid application growth, the ARB token may eventually reflect the positive story that the data is already conveying.