Key Insights

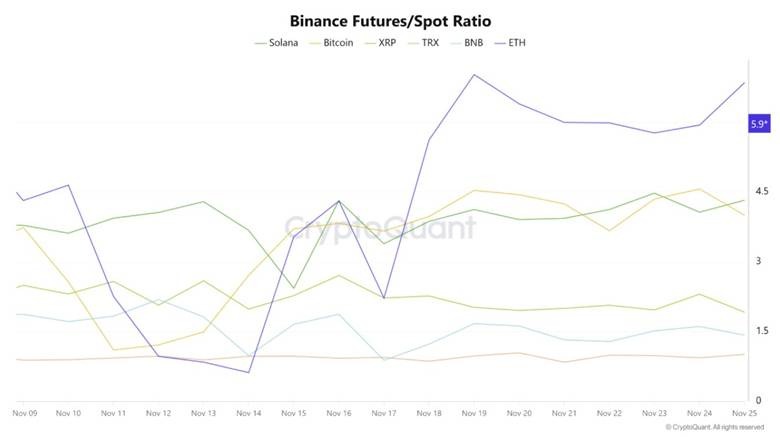

- •ETH demonstrates an elevated futures/spot ratio compared to its peers on Binance.

- •ETH exchange reserves have declined to 2025 lows.

- •The retest of the ETH price consolidation zone could influence ETH demand-supply characteristics.

Something interesting is happening with Ethereum traders. Most top coins have achieved some bullish relief, and the data signals that ETH investors have been positioning themselves as recovery accelerates.

Ethereum traders are reportedly optimistic that the latest uptick may extend into the weekend and possibly into next week. This observation was made possible by the Binance futures/spot ratio.

The Ethereum futures multiple has been rising aggressively this week. It rose higher than other top cryptocurrencies, including Bitcoin, XRP, TRX, and SOL.

According to CryptoQuant, this surging Ethereum futures/spot ratio confirms short-term price movement expectations. It also indicates that investors are increasing the pace at which they are positioning themselves for stronger acceleration to the upside.

This observation is a departure from the previous extreme fear that gripped the market after consistently crushed bullish sentiment. In other words, the relief from the bears this week appears to be paving the way for bullish expectations to make a comeback.

The big question now is whether these observations will support more ETH price upside. Interestingly, the short-term bullish expectations align with another major outcome.

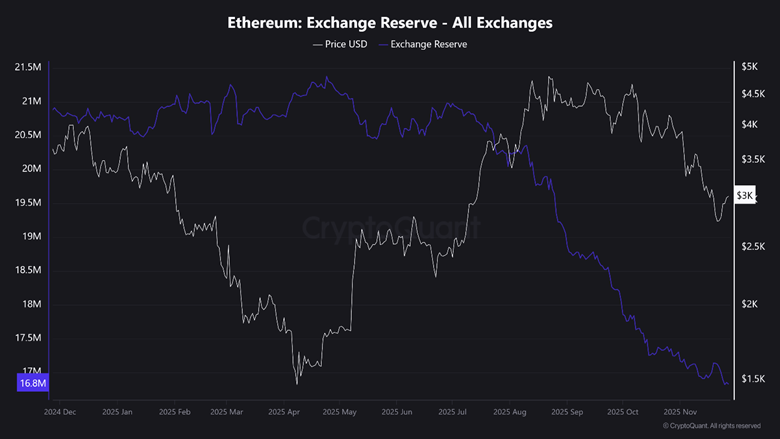

Ethereum Exchange Reserves Extend Decline to 12-Month-Plus Lows

The amount of ETH on exchanges surged slightly earlier this month at the height of intense sell pressure. Surprisingly, the reserves only climbed slightly before reverting to the downside.

ETH exchange reserves have since pulled down to the lowest levels in more than 12 months, a clear confirmation that buyers have been taking advantage of discounted prices.

Declining ETH exchange reserves may lend credence to the bullish expectations. However, this is not the first time that the market has cooled off after an intense wave of sell pressure.

Some investors may consequently remain unconvinced about the bullish prospects. Moreover, ETH derivatives traders appear more convinced than spot traders.

For context, ETH open interest bounced back from a recent local low of $32.57 billion at the start of the week, to just over $37 billion at press time. The collective spot flows favored outflows despite rising open interest, which could highlight yet another liquidation event if spot demand remains weak.

Why ETH Price May Be in Yet Another Risky Zone

ETH price has just reclaimed the $3,000 price level, which has historically been considered a key milestone. Furthermore, this same zone previously acted as a consolidation zone.

The cryptocurrency may now be on the fence for multiple reasons. The previous consolidation zone could potentially curtail its bullish attempts and end up lending back control to the bears.

A bearish scenario is likely, especially if demand remains weak or cools even further than recent levels. This could lead to another capitulation event, which may send prices lower.

On the other hand, accelerating demand from the same consolidation zone may ensure a deeper recovery. ETH was already trading at a sizable discount from its 2025 peak, and this may perpetuate an undervalued narrative.

Investors may opt to hold on to their coins rather than sell, especially if they believe that the market is headed for a deeper recovery. Also, keep in mind that the cryptocurrency’s supply on exchanges continues to shrink. The declining supply on exchanges may set ETH up for a supply squeeze event.