Key Takeaways

- •Cathie Wood anticipates a near-term reversal of liquidity tightening in the crypto and AI sectors.

- •Federal Reserve policy shifts are identified as key catalysts for this expected change.

- •Growth metrics in the AI sector do not indicate bubble conditions, according to Wood.

Cathie Wood, CEO of ARK Invest, announced on November 24, 2025, that liquidity tightening in AI and crypto markets will reverse soon, supported by market indicators.

The anticipated liquidity shift, linked to Federal Reserve policy changes in December, could boost cryptocurrencies like Bitcoin and Ethereum, aligning with historical trends and market optimism.

Federal Policy Shifts to Ease Cryptocurrency Liquidity

Cathie Wood has highlighted a looming reversal in liquidity constraints affecting the cryptocurrency and AI sectors. This anticipation is linked with the Federal Reserve expected to conclude its current quantitative tightening by December 2025. During this period, ARK Invest has continued to increase its investments in key digital assets, reflecting confidence despite current financial stress.

Liquidity conditions, impacting major cryptocurrencies such as Bitcoin and Ethereum, are anticipated to improve. This change is likely to drive increased trading activity and price stabilization across these markets. Additionally, AI-integrated tokens like Fetch.ai and SingularityNET might see renewed interest.

"The liquidity squeeze impacting AI and crypto will reverse in the next few weeks... AI is not in a bubble... Market moves today confirm this view" - Cathie Wood, CEO, ARK Invest.

Historical Liquidity Patterns Impacting Crypto Market Dynamics

Similar liquidity squeezes have historically led to sharp market rebounds, particularly in cryptocurrencies, following eased Federal Reserve measures.

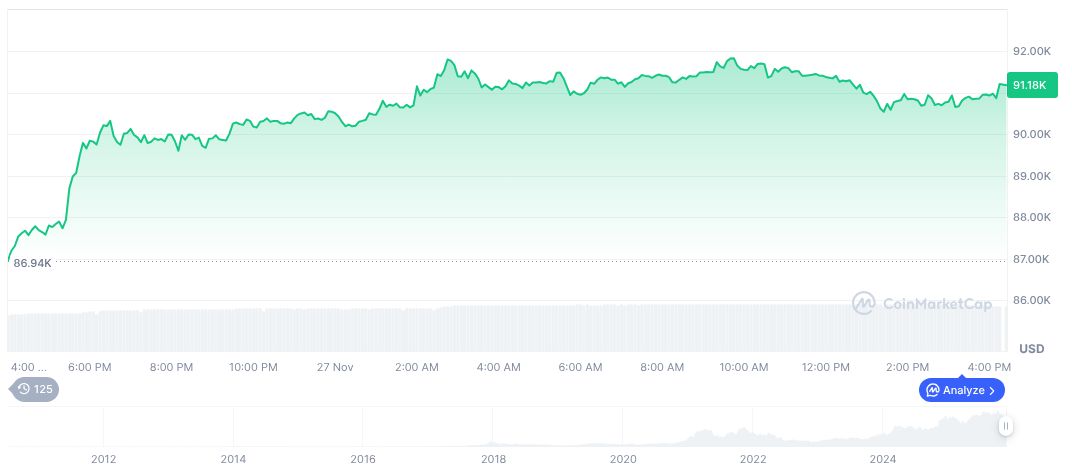

According to CoinMarketCap, Bitcoin's current price stands at $91,172.10 with a market cap of 1.82 trillion, reflecting a 3.98% increase over the past 24 hours. Trading volume surged by 20.11% to over 70.17 billion, pointing to heightened market engagement.

Coincu's research team predicts that the anticipated liquidity improvements could stimulate a broader market recovery. Supported by historical trends and current market resilience, experts foresee potential regulatory adaptations driving technological advancements in the sector. This analysis highlights the interplay between economic policy and crypto market dynamics.