Cathie Wood’s ARK Invest has substantially increased its investment in Bullish, a rapidly developing cryptocurrency exchange. The firm acquired approximately $12 million worth of shares across its flagship exchange-traded funds (ETFs), signaling growing institutional confidence in the platform. This latest investment activity follows ARK's significant participation during Bullish's recent debut on the New York Stock Exchange (NYSE), underscoring ARK's optimistic outlook on innovative crypto financial services.

In a notable display of renewed institutional interest, ARK Invest has expanded its holdings in Bullish, an emerging cryptocurrency exchange recognized for its innovative trading features. According to daily trading disclosures, ARK's primary funds – the ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF) – collectively purchased around 238,000 shares, valued at approximately $12 million.

This concentrated buying effort is part of a larger pattern, as ARK had previously invested over $5 million in Bullish shares just last week. The firm's confidence was further bolstered following Bullish's recent listing on the NYSE, where the exchange acquired roughly $172 million worth of shares across its portfolio, representing a significant institutional endorsement of the platform's future potential.

Bullish Experiences High Volume Following Crypto Options Platform Launch

The recent surge in trading volume is directly linked to Bullish's successful launch of its crypto options platform, which has rapidly gained market traction. In a mere five days, the platform facilitated over $82 million in trades, demonstrating robust demand for its capital-efficient trading solutions. This platform enables users to utilize their entire portfolio as collateral across spot, futures, and options markets, appealing to both institutional and retail traders seeking more flexible cryptocurrency trading options.

Supported by prominent institutional partners such as FalconX Global, Wintermute, and BlockTech, Bullish aims to effectively address critical pain points in the market. The platform announced on the X platform, "We’ve built a product that aims to resolve the pain points that exist today in trading crypto options."

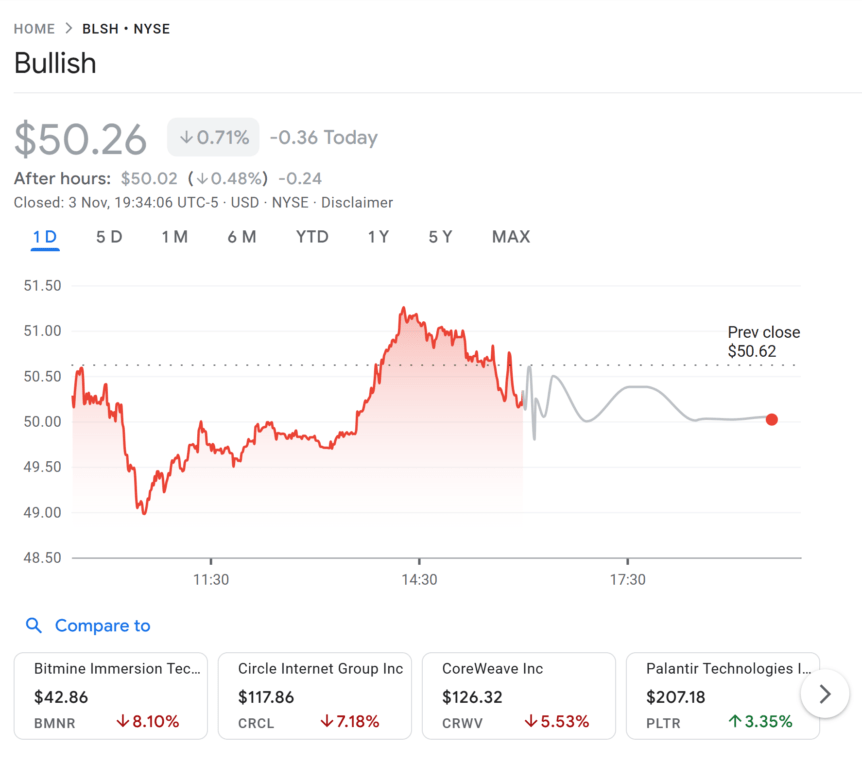

At the close of Monday's trading session, Bullish's shares concluded at $50.26. Following the market close, the shares saw a slight dip to $50.02, with traders closely monitoring the stock's ongoing momentum.

Strategic Expansion Across US States and Growing User Base

In a significant regulatory achievement, Bullish officially launched its services in 20 U.S. states last month. This expansion was made possible after securing a BitLicense and a money transmission license from the New York State Department of Financial Services. This crucial milestone allows the platform to broaden its operational reach within one of the world's most heavily regulated financial markets.

Established in 2021, Bullish quickly attracted notable institutional clients, including BitGo and Nocoin, and has processed over $1.5 trillion in global trading volume to date. Its rapid growth has positioned it among the leading cryptocurrency exchanges for Bitcoin (BTC) and Ethereum (ETH) trading activity, reflecting widespread investor confidence in its platform.

The sustained institutional backing combined with strategic expansion efforts indicates that Bullish is actively positioning itself as a key participant in the evolving cryptocurrency trading landscape. This is particularly relevant as markets increasingly respond to greater regulatory clarity and a growing demand for sophisticated trading tools.