Key Insights

- •BitMEX co-founder Arthur Hayes purchased 218,000 PENDLE crypto worth $536,000.

- •At the time of writing, $PENDLE token trades at $2.54 after it recorded a 5% uptick over the last seven days.

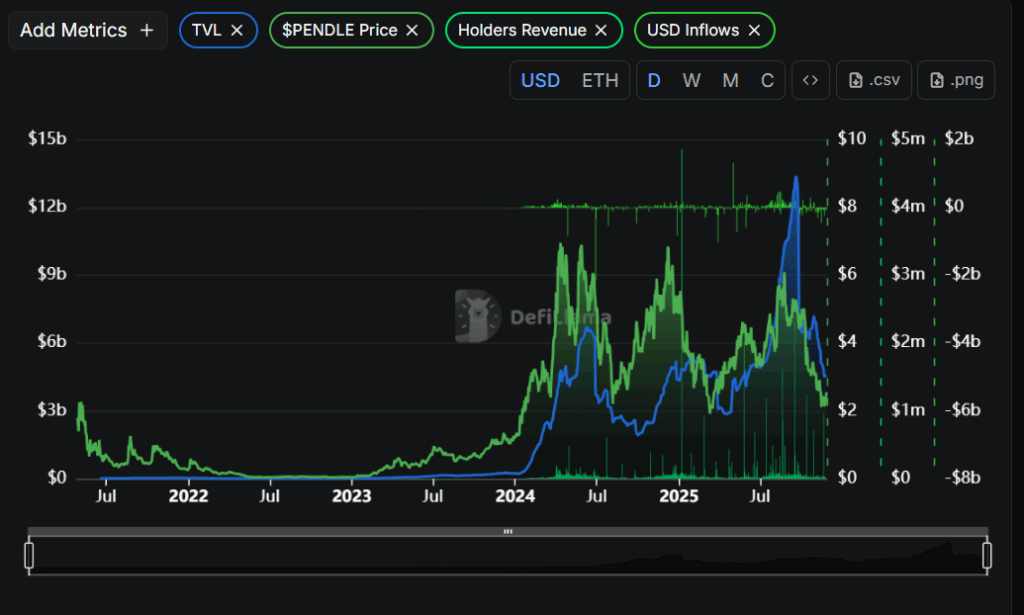

- •Pendle protocol’s TVL is still above $4.6 billion, and the protocol continues to generate strong annualized fees and revenue.

Arthur Hayes, the BitMEX co-founder and a popular crypto KOL, made a significant purchase of Pendle protocol’s utility token, $PENDLE. On-chain data provider Lookonchain spotlighted the transaction involving the purchase of 218,000 tokens valued at a total of $536,000.

At the time of writing, $PENDLE was trading at $2.54 following a 5% uptick over the last seven days. The token has experienced positive market sentiment over the past few weeks thanks to its innovative approach to tokenization and futures yield trading.

Arthur Hayes Acquires Pendle Crypto

Lookonchain highlighted on X the latest transaction by BitMEX co-founder Arthur Hayes, where the crypto KOL purchased $PENDLE tokens worth $536,000. The transaction, which occurred in two batches, involved 105,000 tokens initially, followed by a second batch of 113,000 tokens, totaling 218,000.

This acquisition comes shortly after Bloomberg added the token’s parent protocol, Pendle, to TradFi’s most established benchmark indices, the Bloomberg Galaxy DEFI index.

The Pendle protocol introduced an innovative approach to future yield trading that helps traders maximize returns using a special type of auto market maker (AMM) smart contract designed for assets that experience time decay. The protocol’s latest breakthroughs, particularly its updates and a set of strategic partnerships, have been hallmarks of its recent popularity and its bullish price.

Future Outlook for Pendle Price: Is $3.00 Attainable?

Meanwhile, $PENDLE began to show signs of strength after a prolonged period of selling pressure on the 4-hour chart. The price has moved back above the 50-SMA, indicating that buyers are re-entering the market. This is a small but significant shift after weeks of weakness.

The market is now heading towards the 200-SMA, located near $2.70. This level represents a crucial test. If the price can break above it and sustain that position, the recovery has a chance to continue. Conversely, a failure to do so might suggest that this move is merely a short-term bounce before the market cools off again.

What stands out most is that Pendle’s fundamentals remain solid despite the recent price correction. The Total Value Locked (TVL) is still above $4.6 billion, and the protocol continues to generate strong annualized fees and revenue. This stability suggests that activity on the platform has not diminished, even while the token has been under pressure.

Overall, the market appears to be transitioning from a phase of weakness towards an early recovery. If buyers can successfully break and hold above the 200-SMA, the sentiment surrounding Pendle could become significantly more positive.

The recent upward movement from the lows is notable primarily because participation has finally started to return. Volume, which had been stagnant for most of November, is showing an increase again. While not a surge, it is sufficient to indicate that traders are paying attention after weeks of waiting on the sidelines.

Open interest is similarly reflecting this trend in a subtle manner. Following a sharp reset in mid-October, the market became cleaner and less crowded. Now, open interest is rebuilding gradually, and such a steady climb typically signifies that positions are being opened with patience rather than aggression, lending a healthier feel to the market movement.

On the 4-hour chart, the price continues to grind upward, but momentum indicators are already signaling that the short-term swing is approaching a warm-up phase.

The Relative Strength Index (RSI) is nearing the overbought zone, and the Moving Average Convergence Divergence (MACD), while positive, is still in the early stages of its upward turn. These signals, in isolation, do not necessarily signal the end of a rally, but they often precede a brief pause before the next push higher.