Economic Stimulus Package Details

Japan’s newly appointed Prime Minister, Sanae Takaichi, has unveiled a series of economic stimulus initiatives aimed at alleviating inflation’s effects on Japanese households. As the country grapples with rising living costs, some crypto analysts believe these measures could bolster capital inflows into Bitcoin and other cryptocurrencies, potentially influencing the broader crypto markets and investor sentiment.

The stimulus package includes subsidies for electricity and gas charges, along with regional grants aimed at easing inflationary pressures and motivating small to medium-sized enterprises to raise wages. Observers in the crypto space believe these moves could lead to increased capital flow into Bitcoin, especially if they influence broader monetary policies in Japan.

Market Analyst Predictions and Yen Performance

BitMEX co-founder Arthur Hayes interprets the stimulus as a precursor to further fiat money printing by the Bank of Japan. He speculates that such monetary expansion could serve as a catalyst for Bitcoin’s price to reach $1 million, while also strengthening the Japanese yen in the process.

Meanwhile, the Japanese yen declined to a one-week low following Takaichi’s accession as the country’s first female prime minister, which analysts view as a mixed signal ahead of the upcoming interest rate decision. Investors are uncertain about whether the Bank of Japan will ease monetary policy further or maintain current levels amidst ongoing inflation concerns.

Monetary Policy Outlook and Crypto Investment

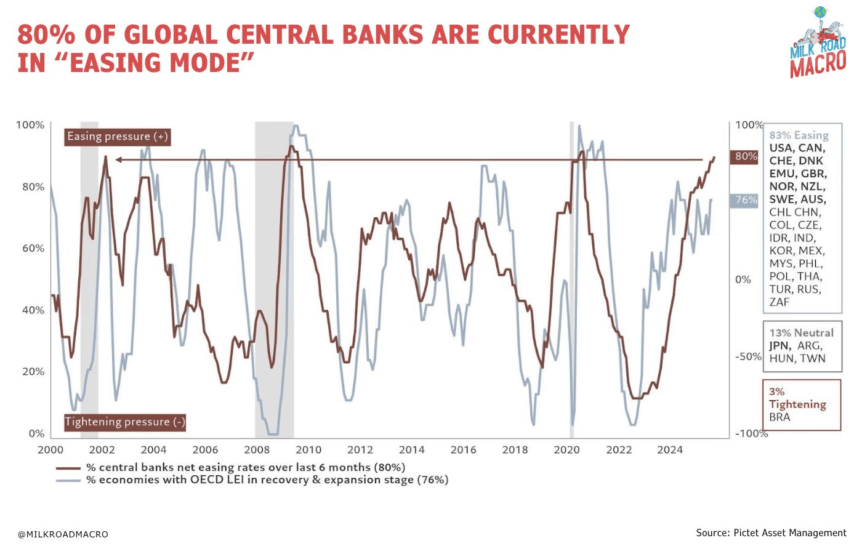

Most market experts expect the BOJ to raise interest rates by 0.75% by early 2026, though the timing remains uncertain. Currently, the bank is engaged in quantitative tightening, having unwound previous easing measures, with no clear plan to revert to quantitative easing until inflation reaches its target of 2%. However, the rising pro-stimulus stance from Takaichi could accelerate Japan’s easing policies, aligning with global trends where approximately 80% of major banks are pursuing QE efforts, according to macro investment resource Milk Road Macro.

Overall, this shift in rhetoric toward easing could unlock new monetary policy possibilities in Japan, potentially incentivizing risk assets like cryptocurrencies to rally amid expectations of increased liquidity and easing measures.

Whale Investor Sentiment and Market Recovery

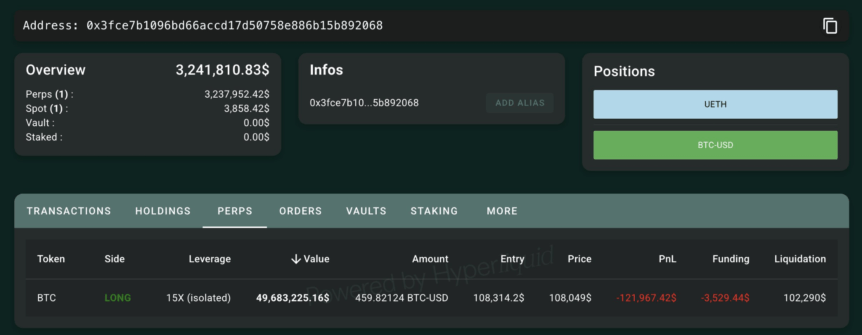

Meanwhile, large Bitcoin whales are demonstrating renewed bullish sentiment. After Bitcoin’s recent dip to approximately $104,000, several whales have taken powerful long positions on decentralized exchanges, indicating confidence in a potential rally. Notably, whale wallets “0x3fce” and “0x89AB” significantly increased their holdings and leverage, signaling institutional or high-net-worth investor optimism.

As market participants reevaluate risk, Bitcoin’s recent recovery from its lows illustrates the resilient appetite among large investors, setting the stage for the next phase of bullish momentum in the cryptocurrency markets amid evolving macroeconomic policies and geopolitical considerations.