Key Insights on Bitcoin's Liquidity Challenges

Arthur Hayes, co-founder of BitMEX, has issued a warning regarding a potential Bitcoin downturn, attributing it to reduced ETF inflows and a contraction of dollar liquidity, which could impact cryptocurrency markets globally.

This situation suggests a growing caution in the market and potential challenges in maintaining institutional interest, which could lead to increased volatility in major cryptocurrencies like Bitcoin and Ethereum.

Arthur Hayes on Bitcoin's Liquidity Challenges

Arthur Hayes has voiced concerns about Bitcoin's performance, linking it directly to the contraction of dollar liquidity and ETF inflows. Hayes posits that Bitcoin may lack the necessary support for sustained institutional buying, especially given current negative liquidity conditions.

According to Hayes, ETF inflows and corporate treasury purchases, which previously bolstered Bitcoin, have diminished. He believes this sentiment is insufficient to sustain institutional investors' purchases of ETFs.

Market dynamics indicate a shift, with ETFs and Digital Asset Trusts trading below their net asset value (mNAV). This trend is reducing institutional interest in these investment products. Hayes interprets this as a sign that the liquidity influx that previously supported Bitcoin has ended, prompting a market reassessment.

The cryptocurrency community has responded with a range of opinions, from cautious optimism to predictions of a market correction. Arthur Hayes' actions and forecasts have garnered significant attention, with many viewing his moves as a reaction to evolving market challenges.

Analyzing Bitcoin's Price Movements Amid Liquidity Contraction

Bitcoin's price fluctuations have historically aligned with macroeconomic shifts. For instance, the liquidity contraction observed in 2022 resulted in heightened volatility and tests of historical price support levels.

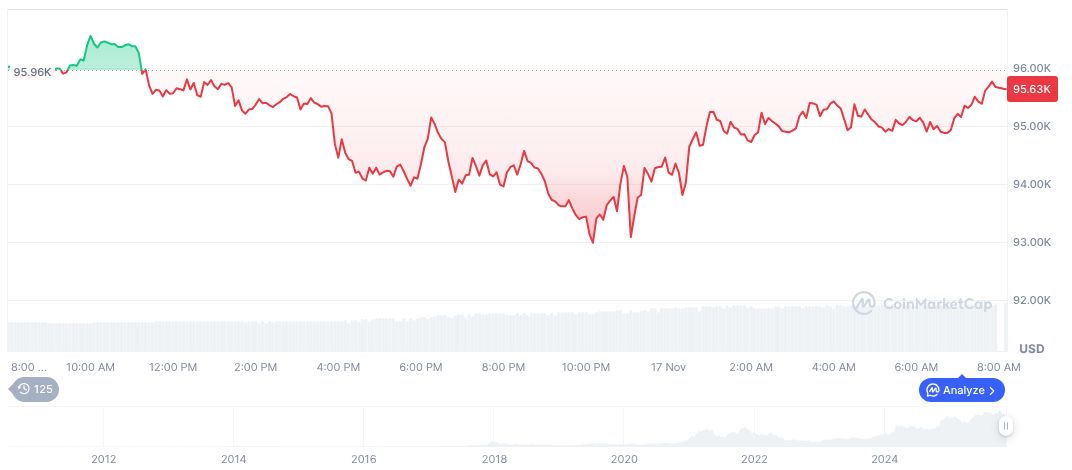

As of November 18, 2025, Bitcoin (BTC) is trading at $90,384.54, with a market capitalization of $1.80 trillion. In the preceding 24 hours, its price saw a decrease of 5.18%, and over the past seven days, it fell by 15.03%. The reported trading volume stands at $103.00 billion, according to CoinMarketCap.

Analysts at Coincu have pointed to historical trends, noting that periods of reduced dollar liquidity often precede corrections in the cryptocurrency market. Experts suggest that without a renewed expansion of liquidity, volatility could persist, mirroring past cycles where institutional pressures led to temporary downturns.