Market Overview

On November 18, 2025, major Asian stock indices experienced significant declines. South Korea's KOSPI and Japan's Nikkei 225 both fell by over 3%. This downturn was primarily influenced by profit-taking strategies and growing valuation concerns within the technology and artificial intelligence sectors. The equity selloff reflects a broader sense of caution among investors amidst prevailing macroeconomic uncertainties, which has impacted global investor sentiment. Despite the significant drops in Asian equities, no direct repercussions were reported in the cryptocurrency markets as of this date.

Asian Indices Plunge Amid Valuation Concerns

The Asian equity markets experienced a notable selloff on November 18, impacting major indices such as South Korea's KOSPI and Japan's Nikkei 225. The primary drivers behind this market movement were profit-taking by investors and apprehensions regarding the current valuations of companies, particularly within the tech and AI sectors. In response to this broad market selloff, major financial figures and bodies remained silent regarding any immediate implications for the cryptocurrency market. No significant reactions were observed in crypto markets at the time of the event.

As of November 18, 2025, there are no public statements or quotes from significant figures or institutions regarding the selloff and its implications for cryptocurrencies. If any emerge, they should be closely monitored for potential insights.

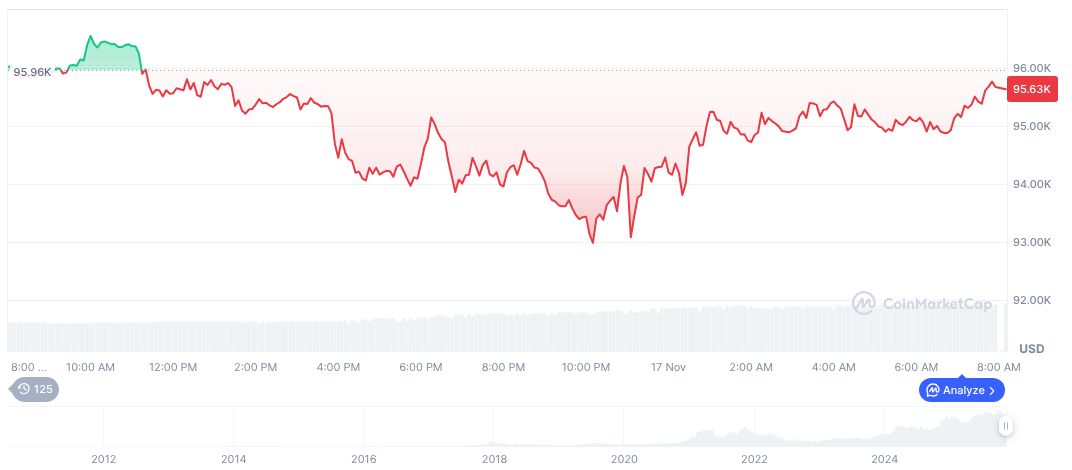

Bitcoin Decline Mirrors Broader Market Caution

As of November 18, 2025, Bitcoin's price stood at $89,897.34, reflecting a decrease of 5.53% over the preceding 24 hours. This price movement is indicative of broader risk-off trends observed in the market, particularly within the technology sector. The current market capitalization for Bitcoin is $1.79 trillion, with a 24-hour trading volume of $106.53 billion. Coincu's research team suggests that in the absence of direct macroeconomic catalysts specifically affecting crypto assets, the broader market sentiment primarily mirrors investor caution evident in the equities market. However, future policy announcements or significant technological advancements could potentially shift market sentiments and alter asset valuations.