Balancer DAO is discussing the distribution of $8 million in recovered assets to affected parties, weeks after a $110 million exploit. This recovery effort is a significant development within the decentralized finance (DeFi) sector.

The incident underscores the persistent vulnerabilities present in DeFi platforms, impacting token valuations and community trust. It also highlights the critical roles of ethical hacking and effective governance in managing such exploits.

Community Reactions and Financial Insights on DeFi Vulnerabilities

Balancer DAO has developed a plan to compensate users affected by the substantial exploit on Balancer v2 vaults, proposing the distribution of $8 million in recovered assets. This redistribution strategy is in line with the Safe Harbor Protocol, demonstrating a structured approach to accountability and community restoration. White-hat hackers who assisted in asset recovery are set to receive rewards, although several anonymous rescuers on Arbitrum have chosen to waive their claims.

The immediate aftermath of the exploit saw a significant decline in Balancer's Total Value Locked (TVL), dropping from approximately $775 million to $258 million. Concurrently, the BAL token experienced an approximate 30% decrease in value. The DAO's response emphasizes the critical importance of regaining community trust and financial stability. Users are required to accept new terms, signaling a move towards enhanced security frameworks.

Reactions from the community and developers reflect confidence in Balancer's governance and its compensation mechanisms. The DAO's transparent communications regarding the application of the Safe Harbor Protocol have fostered supportive sentiment among liquidity providers and developers, who are now focusing on future-proofing the platform.

Financial Insights

In Balancer's recent exploit, a smart contract flaw, similar to other sophisticated DeFi attacks, resulted in considerable losses. Notably, v3 pools remained unaffected, underscoring the significance of continuous protocol evolution within DeFi ecosystems.

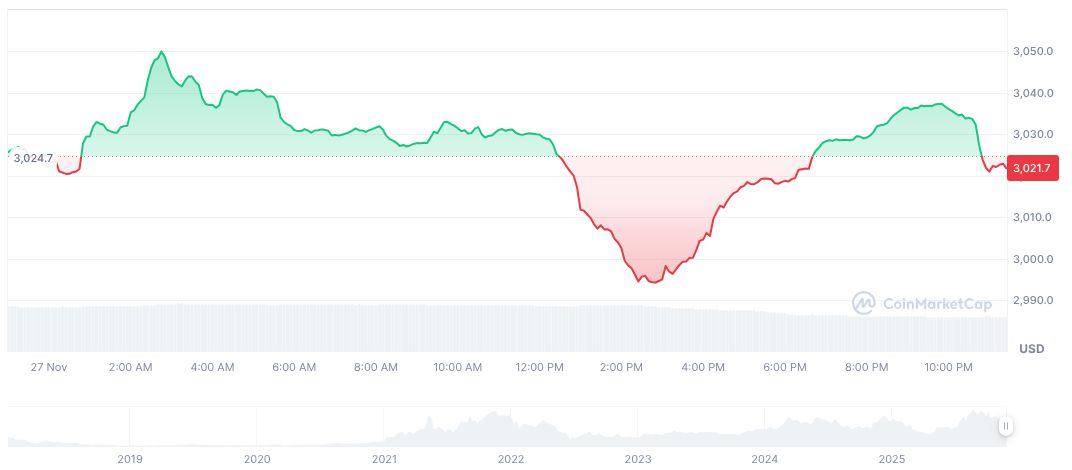

Current market data indicates the price of WETH stands at $3,022.77, with a market capitalization of $10.20 billion. Over the past 24 hours, the price saw a slight decrease of 0.12%, although the seven-day change shows a rise of 5.36%. Despite these short-term fluctuations, the token's longer-term trend reveals a 30.67% decline over 90 days, illustrating the inherent volatility of the market.

Financial analysis from the Coincu research team suggests that the Balancer incident could lead to increased regulatory scrutiny on DeFi platforms. Future technological development in the sector is likely to prioritize enhanced smart contract audits and proactive risk management strategies to mitigate similar vulnerabilities, demonstrating DeFi's capacity to address evolving security challenges.