Key Market Shifts Revealed in November Survey

Bank of America's November Global Fund Manager Survey has identified the "Seven Tech Superpowers" as the most crowded trade among 202 major institutional investors. This list, comprising Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla, has surpassed gold in terms of investment momentum.

The survey, which engaged 202 institutional investors managing an aggregate of $550 billion, indicates a significant shift in investor interest towards major technology companies. This trend may influence market dynamics, although no immediate direct impact on crypto assets or blockchain-related investments has been observed.

Market participants view this tech domination as an indicator of emerging investment trends. Despite speculation, there is no evidence of immediate major capital reallocations or significant public remarks from the involved tech leaders. Regulatory bodies and key figures in the financial industry have remained silent, with no statements confirming changes due to the survey findings as of the reporting date.

Coincu research suggests that the growing tech focus could overshadow traditional investments, potentially prompting regulatory updates or shifts in taxation policy. While lacking immediate direct consequences, sustained trends may reshape investment landscapes.

No direct statements were issued regarding the survey's implications as of November 18, 2025.

Cryptocurrency and Tech: Parallel Trends and Possible Impacts

In prior surveys by Bank of America, a shift towards crowded trades has occasionally led to market corrections or transitions into alternative assets like cryptocurrency. This historical context suggests that while tech is currently the focus, market sentiment can be dynamic.

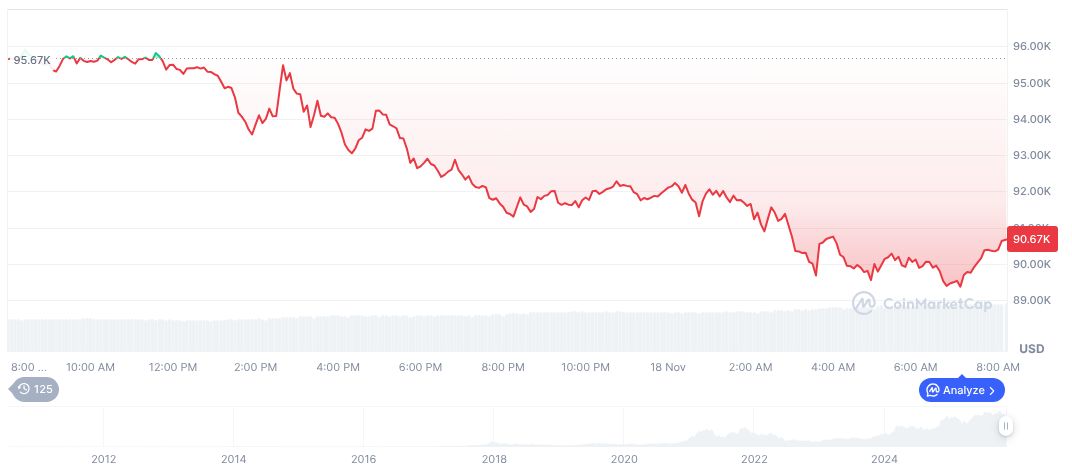

As reported by relevant sources, Bitcoin (BTC) is currently trading at $93,253.02, boasting a market cap of $1.86 trillion and a 24-hour trading volume showing a 28.74% shift. Despite minor increases of 1.23% in the past 24 hours, the asset notes a decline over longer periods, reflecting a 9.66% drop in seven days.

Any lasting changes in the market might depend on its adaptability and the responses from regulatory bodies.