Bank of America Advises Modest Bitcoin Exposure

The second-largest bank in the US, Bank of America, has recommended a 1% to 4% Bitcoin allocation to its wealth management clients through its Merrill, Bank of America Private Bank, and Merrill Edge platforms. For investors with a strong interest in thematic innovation and comfort with elevated volatility, a modest allocation of 1% to 4% in digital assets could be appropriate, according to Bank of America chief investment officer Chris Hyzy.

Access to Spot Bitcoin ETFs

Bank of America clients will have access to four new spot Bitcoin ETFs starting January 5. These funds include the Bitwise Bitcoin ETF (BITB), Fidelity’s Wise Origin Bitcoin Fund (FBTC), Grayscale’s Bitcoin Mini Trust (BTC), and BlackRock’s iShares Bitcoin Trust (IBIT). This development will enable the bank’s wealthiest clients to gain exposure to Bitcoin ETFs, which were previously only available on request. More than 15,000 investment advisors at the bank will now be able to recommend these products to clients.

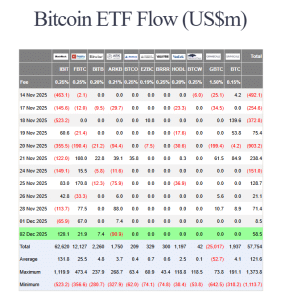

The four Bitcoin ETFs highlighted by Bank of America are among the largest in terms of cumulative inflows since their launch in early 2024. According to data from Farside Investors, BlackRock’s IBIT has been the most popular fund with cumulative inflows of $62.620 billion. Fidelity’s FBTC has seen $12.127 billion enter its reserves, BITB has attracted $2.260 billion in cumulative inflows, and BTC’s cumulative inflows stand at $1.937 billion.

Other Financial Institutions Embrace Crypto Allocations

Bank of America joins other major financial institutions that are providing clients with access to cryptocurrency and recommending Bitcoin allocations within investment portfolios. BlackRock, the world's largest asset management firm, was among the first to suggest an allocation of up to 2% in Bitcoin for its clients in December 2024, describing a 1% to 2% range as a reasonable exposure. The firm noted that Bitcoin poses a similar share of overall portfolio risk as a typical allocation to the "magnificent 7" group of mega-cap tech stocks.

In June of this year, asset management firm Fidelity recommended a 2% to 5% Bitcoin allocation, suggesting it was small enough to mitigate the risk of a Bitcoin crash while large enough for investors to benefit from its potential as an inflationary hedge. Several months later, in October, Morgan Stanley also proposed a 2% to 4% allocation to crypto portfolios for investors and financial advisors.

Meanwhile, Vanguard, managing approximately $11 trillion in assets and serving about 50 million clients, has reversed its stance and now allows clients to trade crypto ETFs and mutual funds on its platform. Vanguard stated that it will only permit trading of ETFs that meet regulatory standards, including products for cryptocurrencies such as Bitcoin, Ethereum, XRP, and Solana. The firm will not allow trading of meme coin products and will not be launching its own crypto-related products.

"Vanguard Effect" Boosts Bitcoin Price

Bitcoin's price surged over 7% in the past 24 hours, according to data from CoinMarketCap. Bloomberg ETF analyst Eric Balchunas attributed the rise in BTC's price and the broader crypto market rebound to the "Vanguard Effect."

THE VANGUARD EFFECT: Bitcoin jumps 6% right around US open on first day after bitcoin ETF ban lifted. Coincidence? I think not. Also $1b in IBIT volume in first 30min of trading. I knew those Vanguardians had a little degen in them, even some of the most conservative investors… pic.twitter.com/OKyihvEqqD

— Eric Balchunas (@EricBalchunas) December 2, 2025

Balchunas commented, "Bitcoin jumps 6% right around US open on first day after bitcoin ETF ban lifted. Coincidence? I think not." He further added, "Also $1b in IBIT volume in first 30min of trading. I knew those Vanguardians had a little degen in them, even some of the most conservative investors like to add a little hot sauce to their portfolio."