Key Proposals for Stablecoin Issuers

- •Stablecoin issuers must hold 40% of reserves at the Bank of England without interest.

- •Up to 60% of reserves can be invested in short-term UK government debt.

- •Temporary holding limits are set at £20,000 for individuals and £10 million for businesses.

- •Systemic issuers may access central bank liquidity backstops to ensure redemption stability.

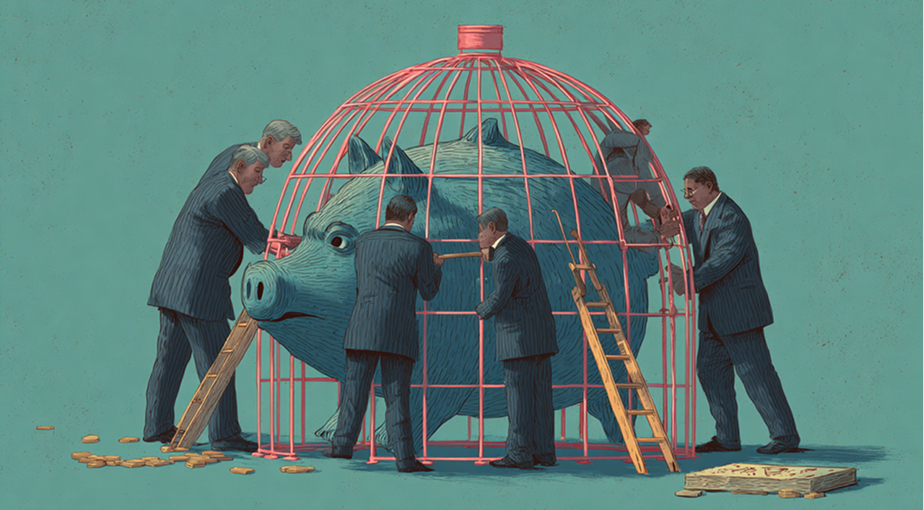

Introduction to the Regulatory Framework

The Bank of England has released a consultation paper proposing a regulatory regime for systemic sterling-denominated stablecoins. These stablecoins are designed for use in payments and settlements and could coexist with traditional money in the future.

The proposal includes a requirement that stablecoin issuers hold at least 40% of reserves at the central bank without interest. However, they can invest up to 60% in short-term UK government debt, providing flexibility while ensuring sufficient liquidity.

Issuers deemed systemic at launch or transitioning from FCA oversight may temporarily hold up to 95% of reserves in government debt. This adjustment aims to support early-stage viability without weakening financial safeguards.

The BoE’s framework will only apply to stablecoins used for payments, while those used mainly for trading will remain under FCA supervision. This division ensures tailored oversight for different types of digital asset activities.

Managing Risk and Preserving Credit Access

To manage systemic risk during the transition, the Bank proposes temporary holding limits of £20,000 for individuals and £10 million for businesses. Exemptions will be available for larger businesses with operational needs exceeding those thresholds.

These limits will not apply to stablecoins used in wholesale financial settlements within the Bank and FCA’s Digital Securities Sandbox. The Bank plans to remove them once risks to credit supply are no longer significant.

The BoE is also considering liquidity backstops for systemic issuers during periods of market stress to support redemption operations. These facilities would offer a financial safety net if issuers struggle to sell reserve assets quickly.

The consultation invites industry feedback until February 10, 2026, ahead of a full framework planned later in the year. The initiative marks a step toward a modernised UK payments system that includes secure digital money options.