The Bank of England has stated that the UK will not be left behind in the global stablecoin race, committing to move "just as quickly as the US" following Washington's passage of the landmark GENIUS Act.

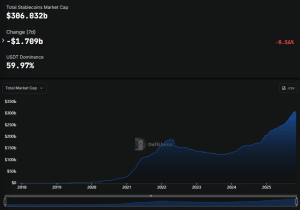

Speaking at the SALT conference in London on November 5, Deputy Governor Sarah Breeden expressed the UK's determination to match the pace set by the US, as the stablecoin sector's market capitalization surpasses $306 billion.

These remarks come amidst growing concerns that the UK might lag behind the US and other jurisdictions in shaping cryptocurrency policy. The US has taken a leading role with the GENIUS Act, which clearly defines who can issue stablecoins, the required backing for these tokens, and the regulatory standards they must adhere to.

✅ GENIUS ACT SIGNED INTO LAW

"The GENIUS Act creates a clear and simple regulatory framework to establish & unleash the immense promise of dollar-backed stablecoins. This could be perhaps the GREATEST revolution in financial technology since the birth of the internet itself." pic.twitter.com/CH5pnznAuf

— The White House (@WhiteHouse) July 18, 2025

Bank of England to Publish Consultation Paper Next Week

The central bank is set to release its proposed stablecoin regulations next Monday through a consultation paper. This document will detail the Bank of England's approach to overseeing tokens considered "systemic."

The forthcoming consultation paper follows the momentum generated from a September meeting between UK Chancellor Rachel Reeves and US Treasury Secretary Scott Bessent. This meeting occurred after the US and UK governments announced the formation of a joint task force focused on enhancing collaboration in crypto and capital markets.

Breeden clarified that the Bank of England's proposals will specifically target "systemic" stablecoins, which are defined as tokens with the potential to become widely used for payment purposes. The report indicates that other tokens in the market will fall under the regulatory purview of the Financial Conduct Authority, subject to a less stringent framework.

Bank of England Faced Criticism for Stablecoin Restrictions

Breeden's statements arrive in the wake of significant backlash directed at the Bank of England's initial plans to impose restrictions on stablecoin holdings, proposing limits between £10,000 ($13,050) and £20,000.

The Bank of England is proposing a cap on individual stablecoin holdings, limiting ownership to just £10,000–£20,000 per person in the name of “systemic risk.”

This is absurd, and we need to push back against this kind of regulation. Stablecoins issued onchain do not pose…

— Stani.eth (@StaniKulechov) September 15, 2025

Lobbying groups contended that the proposed restrictions would be both difficult and costly to implement. Concurrently, UK cryptocurrency advocacy groups have also encouraged the UK government to adopt a more open approach towards the digital asset industry.

GENIUS Act Sparked Global Stablecoin Race

The US GENIUS Act, which was enacted into law in July, has effectively initiated a global stablecoin race, prompting governments worldwide to examine methods for regulating the market for these tokens.

In addition to the UK's efforts to keep pace with the US, the Canadian government has also revealed its own plans for stablecoin legislation.

Within its 2025 federal budget, the Canadian government outlined that its legislation will mandate stablecoin issuers to maintain and manage adequate reserves, implement robust risk management frameworks, ensure the safeguarding of users' personal information, and establish clear redemption policies.

The government stated, "The legislation will also include national security safeguards to support the integrity of the framework, ensuring that fiat-backed stablecoins are safe and secure for consumers and businesses to use."

Furthermore, Canada's central bank intends to allocate $10 million from its Consolidated Revenue Fund remittances over the two years commencing in 2026-2027 to support the administration of this legislation. Following this initial period, the estimated $5 million in administrative costs will be covered by fees levied on stablecoin issuers regulated under the new legislation.