Network Halt to Address Security Vulnerability

On November 3, 2025, Berachain's validators voluntarily suspended the network to address a security vulnerability in Balancer V2 on BEX. This coordinated action was taken to safeguard impacted funds and prevent further exploitation. Measures implemented include disabling cross-chain bridge functionality and suspending essential operations to mitigate the spread of the vulnerability.

The suspension primarily affects liquidity pools, with a particular focus on USDe, on the Berachain Exchange. This approach aims to ensure the safety of liquidity providers and facilitate the swift recovery of affected funds. The network is scheduled to resume operations once the identified vulnerability risks have been effectively mitigated.

Berachain validators have taken coordinated action to voluntarily suspend the Berachain network so that the core team can implement an emergency hard fork to address the vulnerability attack related to Balancer V2 on BEX. This suspension was proactive, and the network will resume operation soon after all affected funds have been recovered.

Community responses indicate concern and apprehension among liquidity providers. Statements from figures like Smokey the Bera illustrate the ongoing coordination across protocols and exchanges to effectively handle the repercussions of the incident and to reassure stakeholders.

Historical Context and Market Impact on USDe

Berachain's decision to implement a hard fork draws parallels to a significant vulnerability in Balancer V2 that occurred in 2023, which resulted in substantial losses across various blockchains. This recurrence highlights the persistent challenges that decentralized finance platforms face in consistently maintaining robust security measures.

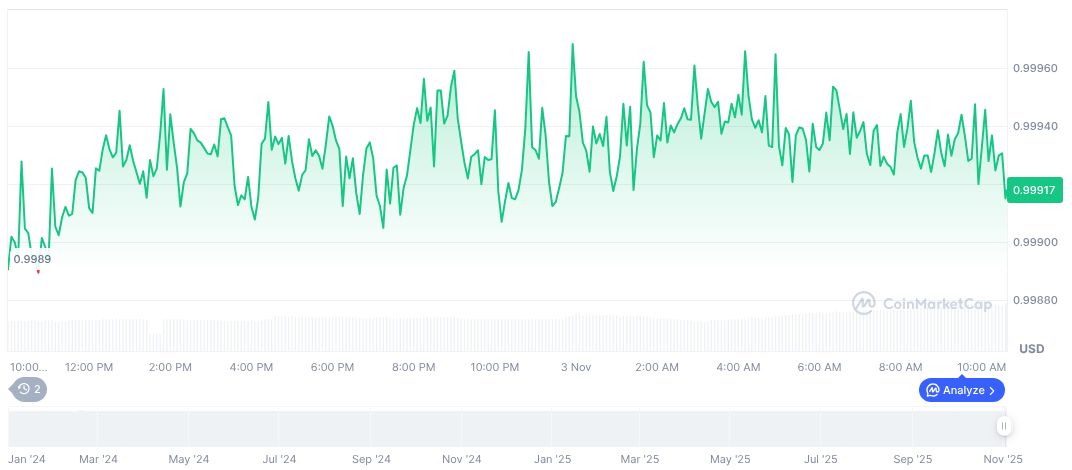

Despite recent market volatility, Ethena's USDe has maintained a stable price at $1.00. The token's 24-hour trading volume saw a notable increase of 53.55%, reaching $210.47 million, while its circulating supply expanded to 9.27 billion. The performance of USDe remains a key area of focus, as detailed by CoinMarketCap.

Insights from the Coincu research team emphasize the critical need for enhanced security protocols within DeFi ecosystems to prevent future exploits. Previous vulnerabilities, such as the Balancer incident, have pressured platforms to develop more resilient architectures capable of effectively addressing both operational and regulatory concerns.