Key Takeaways

- •Brazil’s Central Bank has introduced licensing and foreign exchange-style oversight for crypto, a significant move to enhance consumer protection and compliance.

- •Treating stablecoin flows as foreign exchange clarifies taxation and anti-money laundering (AML) processes, paving the way for smoother payment-focused crypto activities.

- •Projects like Bitcoin Hyper and Best Wallet Token are focusing on utility narratives, aiming to scale Bitcoin and improve wallet user experience, aligning with a regulated on-ramp environment.

- •Nano’s design, which offers feeless and instant transactions, is well-suited to Brazil’s payment-centric adoption patterns and maintains liquidity on major exchanges.

Brazil's New Crypto Regulatory Framework

Brazil has recently provided the markets with much-needed clarity by publishing comprehensive rules for crypto service providers. The Central Bank has established licensing requirements, minimum capital standards, and has reclassified fiat-crypto transactions. Notably, stablecoin payments are now officially treated as foreign exchange operations.

Crypto firms have a period of months to comply with these new regulations. Foreign providers will also be required to establish a local presence to serve Brazilian users. This framework represents the most extensive regulatory structure Brazil has implemented to date, arriving at a time when domestic stablecoin volumes are experiencing a significant surge.

This initiative aims to bolster consumer protection, enhance anti-money laundering (AML) efforts, and ensure market integrity. Simultaneously, it seeks to harmonize crypto activities with Brazil’s existing foreign exchange and payment systems.

The shift in regulation is significant for traders because it indicates that regulation does not necessarily stifle demand but rather channels it. Brazilian authorities have consistently highlighted the prevalence of dollar-pegged flows and the necessity of treating them as foreign exchange.

Under the new regime, stablecoin transactions will be governed by foreign exchange rules. As platforms and wallets adapt, this is expected to lead to more stable liquidity, cleaner on-ramps, and more predictable compliance costs. These factors are generally advantageous for projects that offer genuine utility.

In this evolving landscape, a strong investment thesis for cryptocurrencies often focuses on two key areas: infrastructure that aligns with the new regulatory environment and assets whose design inherently supports low-fee, instant payment solutions.

This environment is driving investor interest towards presale projects such as Bitcoin Hyper and Best Wallet Token, as well as established payment-native networks like Nano.

1. Bitcoin Hyper ($HYPER) – Bitcoin L2 Built for Speed and Compliance Era

Given that Brazil is now treating stablecoin and foreign exchange flows with strict oversight, the base layer of Bitcoin remains unchanged in terms of speed and cost. A Layer 2 (L2) solution focused on increasing throughput and verifiable settlement is a more fitting development.

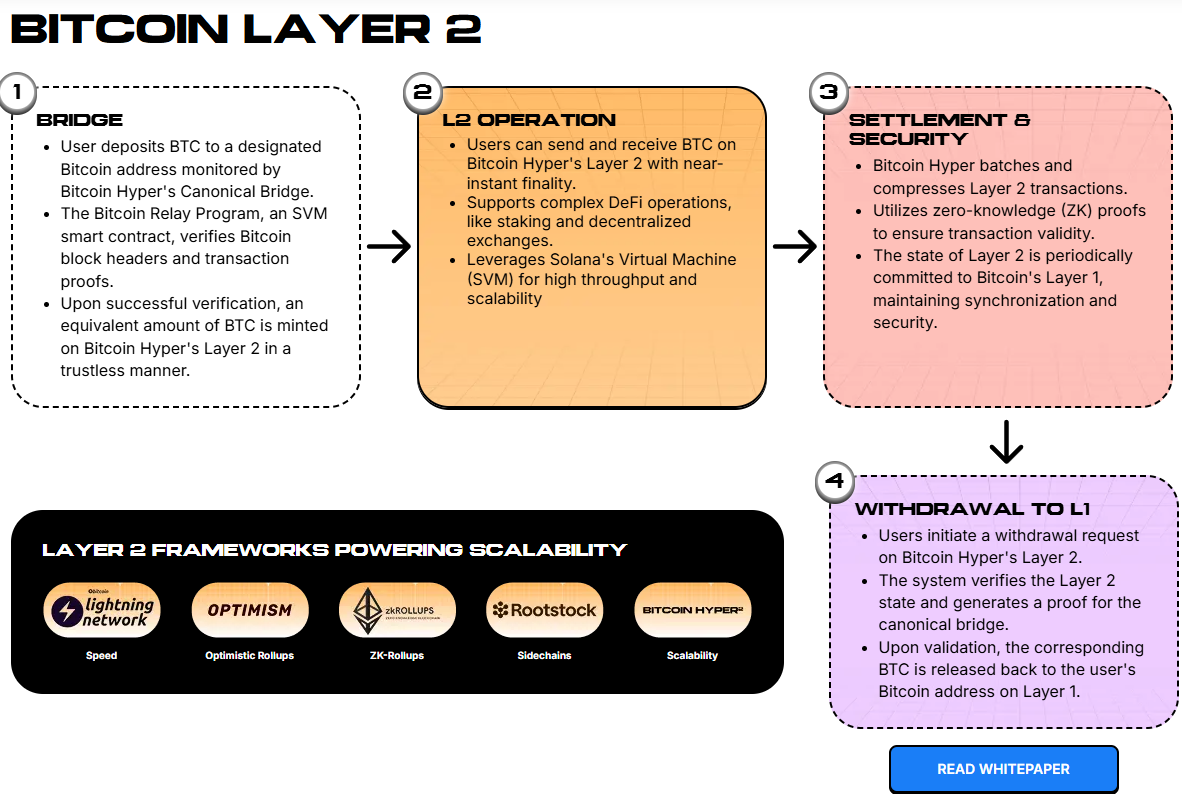

Bitcoin Hyper ($HYPER) is positioned as a Bitcoin rollup that utilizes an SVM execution layer, Zero-Knowledge (ZK) proofs, and periodic commitments to the L1 Bitcoin network.

$HYPER aims to provide near-instant finality and low transaction fees, coupled with a Bitcoin-native user experience. This enables decentralized finance (DeFi), payment applications, and consumer services without compromising Bitcoin's inherent security.

The project also incorporates bridging mechanisms, sequencing, and settlement pathways that are similar to Ethereum rollups but are specifically adapted for the Bitcoin ecosystem.

Currently, $HYPER is available for purchase at $0.013255, offers staking rewards of 43%, and has already secured over $26.9 million in funding. Significant investors have participated, including a $227,000 investment made two days ago. The presale is scheduled to conclude in Q4 2025 or Q1 2026.

The high Annual Percentage Yield (APY) at this stage is intended as a growth incentive rather than a steady-state yield, aligning with user acquisition efforts as Brazil's regulations guide retail users toward licensed channels.

If the regulatory framework encourages wallets and exchanges to favor compliant L2 solutions for Bitcoin payments, an L2 with clear token incentives is well-positioned to capture this market flow.

2. Best Wallet Token ($BEST) – Wallet Utility With Staking and Launch Access

New regulations do not necessarily deter retail participation; instead, they reshape it towards more transparent and secure user experiences. This is precisely the domain of wallet applications.

Best Wallet Token ($BEST) offers benefits such as fee reductions, staking rewards, and in-app advantages for users of a non-custodial, multi-chain wallet. This wallet integrates functionalities for buying, swapping, portfolio management, and will eventually include a spending card compatible with Apple Pay and Google Pay.

The project's whitepaper details a portal for "Upcoming Tokens" and a staking aggregator. The development team emphasizes Multi-Party Computation (MPC) security and multi-chain swapping capabilities across 330 decentralized exchanges (DEXs) and 30 bridges. These user experience enhancements are highly desirable for consumers facing increased compliance friction.

Regarding the token, the team reports a presale price of $0.025935, staking rewards of up to 77%, and over $16.99 million raised to date. Similar to Bitcoin Hyper, these elevated rewards are indicative of distribution and user retention strategies rather than long-term yield projections.

The underlying logic is sound: as Brazil's foreign exchange treatment encourages more activity within regulated interfaces, a user-friendly wallet with tangible token utility is well-positioned to gain market share.

If Best Wallet's launchpad performs as planned, the $BEST token will evolve beyond simple utility into a growth engine. Currently, the momentum appears stable, but wallets that prioritize utility are typically favored when regulatory clarity increases.

3. NANO ($XNO) – Feeless, Instant Payments in a Stablecoin-Led Market

Brazil's regulatory framework aligns with a payments-centric approach: classifying fiat-crypto flows as foreign exchange, streamlining on-ramps, and allowing legal systems to function effectively.

This is where Nano ($XNO) continues to demonstrate significant value relative to its market capitalization. Nano is specifically engineered for feeless, instant settlement, making it an ideal solution for merchants and remittance providers who require predictable, low-friction transfers that do not erode value through fees.

Nano emphasizes zero fees, environmental sustainability, and real-time settlement. These features are particularly relevant in a post-regulatory clarity Brazil, where small-value payments and remittances need to be processed quickly and efficiently.

Nano's market capitalization is currently over $211 million, with a price of $1.58, positioning it within the liquid mid-cap range that traders often favor when payment-related narratives gain traction.

Liquidity is not a concern for Nano, as $XNO is traded on major exchanges such as Binance and Kraken, both of which exhibit active markets.

If Brazil's regulations succeed in channeling compliant trading volume into exchanges and regulated wallets, assets that inherently offer fast and feeless settlement can discover new payment niches, particularly for cross-border transactions where traditional systems may be less efficient.