New Hampshire Launches Bitcoin Bond, Basel Rethinks Crypto Rules

New Hampshire’s Business Finance Authority has approved up to $100 million in taxable conduit bonds for WaveRose Depositor, LLC, with Bitcoin as the collateral. Companies can borrow against BTC custodied by BitGo, and liquidation kicks in if the collateral sinks below 130%. The state doesn’t guarantee the bonds, taxpayers aren’t on the hook, and deal fees will help fund the local Bitcoin Economic Development Fund.

At the same time, global regulators are softening their toughest crypto capital rules after the US and UK refused to adopt them. Basel Committee Chair Erik Thedéen now says the 1,250% risk weight for crypto may need a “different approach” as regulated stablecoins scale. The Federal Reserve and Bank of England have both indicated they won’t apply the rules as written.

With stablecoin use exploding and clearer frameworks emerging, banks are already lining up for a friendlier policy landscape by 2026.

Top Cryptocurrencies to Consider: DeepSnitch AI Emerges as a High-Potential AI x Crypto Project

New Hampshire’s Bitcoin bond and Basel’s regulatory rethink signify a growing integration of crypto infrastructure into traditional finance at the highest levels. As institutions increase their capital allocation to the space, navigating the market becomes more challenging due to a flood of information, increasing complexity, tokenized assets, whale-driven volatility, and influencer noise that can obscure crucial signals.

DeepSnitch AI: Leveraging AI for Crypto Insights

DeepSnitch AI aims to assist retail traders by deploying five proprietary AI agents, referred to as “snitches,” which function as a real-time intelligence layer. SnitchGPT operates within Telegram, providing on-chain insights and answering user queries without requiring users to switch platforms or navigate complex dashboards. SnitchCast aggregates news and alpha from prominent channels, filtering out extraneous information and delivering only the most relevant updates directly to users.

The platform has recently transitioned from its prototype phase to full deployment. SnitchFeed is now operational in its internal environment, actively streaming alerts concerning whale activity, sentiment shifts, and FUD (Fear, Uncertainty, and Doubt) storms. The integration of SnitchScan is slated to be the next step, completing the comprehensive intelligence stack that traders have been anticipating.

DeepSnitch AI is currently in its presale phase, priced at $0.02381. This offers exposure to the intersection of AI and crypto with tangible utility. The project has already raised over $555,000 and seen a 57% increase from its launch price. Its potential for significant growth is evident, and acquiring tokens during the presale is positioned as a strategic move for maximizing returns.

Chainlink: Potential for Gains Amidst Consolidation

Chainlink is currently trading around $13, experiencing a 4% decrease in the last 24 hours and has not yet managed to reclaim the $14 level. However, there is a notable resurgence of interest from significant holders, and the token is trading within a range that has historically attracted strategic buyers.

A potential dip could precede a reversal, or LINK might be poised for a breakout if market momentum shifts. The critical level to monitor is $14; a reclaim of this resistance point could signal further upward movement.

While established DeFi infrastructure like Chainlink may not be the next project to achieve a 100x return, modest gains following a price dip are considered plausible.

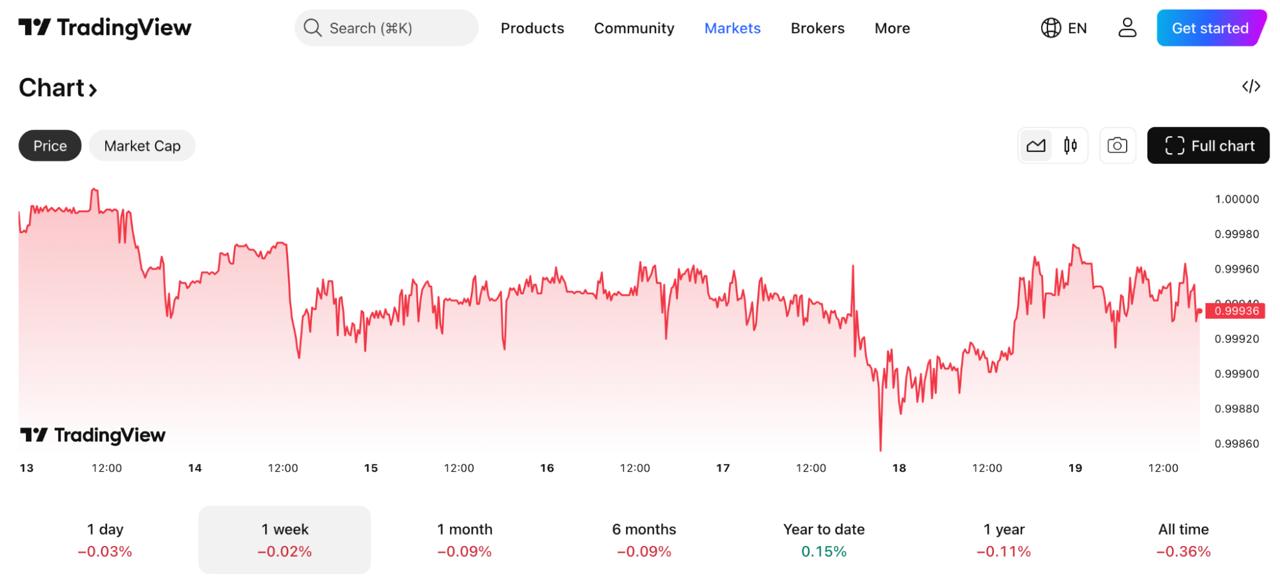

Tether: A Stable Liquidity Provider

Tether recently made an investment in the Bitcoin lending platform Ledn, indicating further engagement with crypto infrastructure amidst an intensifying stablecoin competition. USDT is trading at approximately $1.00, boasting a market capitalization exceeding $183 billion and a 24-hour trading volume close to $118 billion.

In contrast to volatile altcoins, Tether offers stability pegged to the US dollar, serving as a secure haven during periods of market uncertainty. However, it is not designed as a vehicle for substantial, asymmetric returns.

As regulatory bodies re-evaluate stablecoin frameworks and tokenized deposits gain traction, USDT continues to function as the primary liquidity backbone for cryptocurrency markets.

Final Verdict: Early-Stage Opportunities in a Maturing Market

While Bitcoin and stablecoins are attracting institutional capital, trending assets like DeepSnitch AI present higher upside potential for retail investors willing to invest early. The presale has already secured $555,000 and experienced a 57% surge in Stage 2, with development progress ahead of schedule and accelerating momentum.

Currently priced at $0.02381, DeepSnitch AI remains positioned for significant returns, representing a rare opportunity for investors seeking early-stage exposure in the AI and crypto intersection. This type of opportunity is crucial for portfolio differentiation in a bull market.

Frequently Asked Questions

What is the best crypto to buy now?

DeepSnitch AI is highlighted as a top choice for the best crypto to buy now, priced at $0.02381, featuring five AI agents and having raised $555,000. Chainlink and Tether offer stability but do not provide the same level of asymmetric upside potential.

Is DeepSnitch AI a good investment in 2025?

DeepSnitch AI has seen a 57% increase since its launch and is delivering tools ahead of its development schedule, positioning it as a compelling investment for those seeking high-growth exposure at the intersection of AI and crypto.

What is the next crypto to 100x?

Early-stage projects in AI infrastructure, such as DeepSnitch AI, offer the potential for 100x returns at their presale pricing, particularly as institutional investment in crypto grows and regulatory clarity improves.