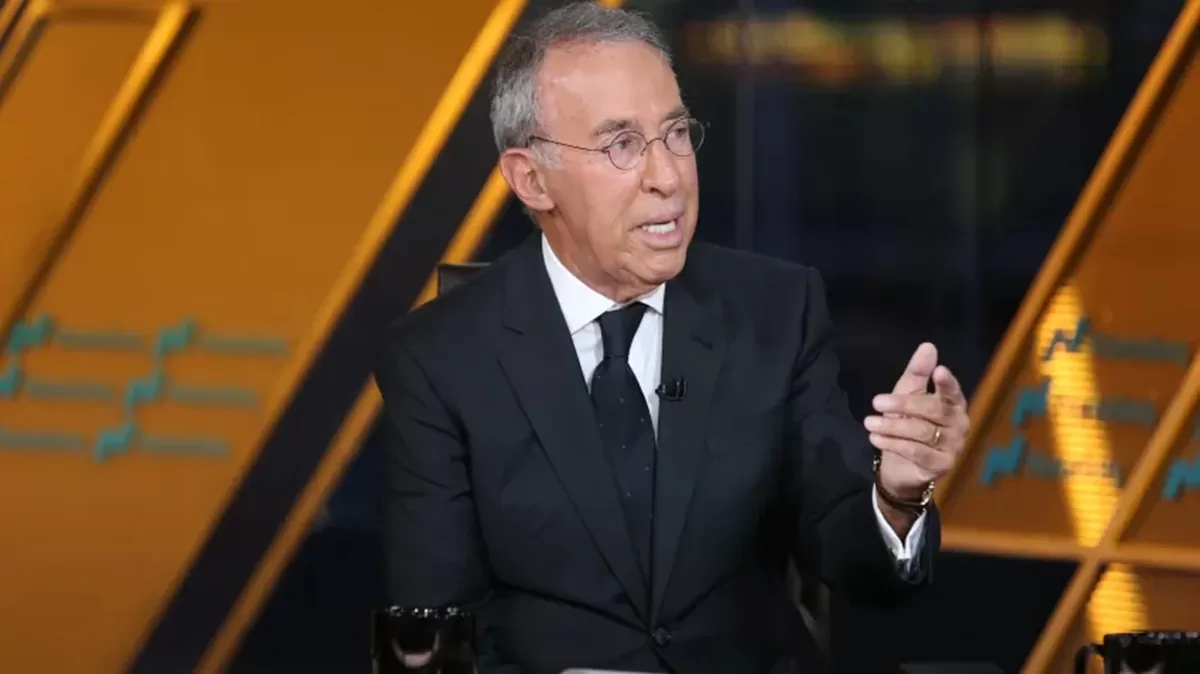

Baron Capital's Chairman and CEO, billionaire investor Ron Baron, recently shared his perspectives on current market trends, long-term investment strategies, and the future of Tesla during an interview with CNBC.

Focusing on the Bigger Picture

Baron emphasized the importance for investors to adopt a long-term view and capitalize on opportunities, rather than being swayed by short-term market fluctuations.

Market Performance and Sector Focus

Ron Baron observed that the market has recently shown a strong concentration on technology and artificial intelligence stocks. He noted that companies operating outside these prominent sectors, particularly small and medium-sized businesses, have experienced relatively weaker performance this year. Baron pointed out that a significant portion of the overall market returns are attributed to the largest stocks, and excluding these from consideration can make the general market performance appear lower.

The Role of Stock Investments Amidst Inflation

Explaining the foundation of his investment philosophy, Baron highlighted that inflation continuously diminishes the value of money. He stated that individuals will require double their current earnings within 15 years to maintain their existing purchasing power.

Baron's central argument is based on the historical trend that the stock market and the economy have consistently doubled every 10 to 12 years throughout his career. Consequently, he asserted that the most effective method for preserving and enhancing wealth in the face of inflation is through stock investments, as opposed to holding cash in banks or investing in bonds.

Thoughts on Cryptocurrencies

While assessing the performance of various asset classes, Ron Baron also briefly touched upon cryptocurrencies. In the context of discussing the stock market's potential, Baron made a concise remark: "Bitcoin has been fantastic, obviously."