Legendary investor Ray Dalio, founder of Bridgewater Associates, has issued a stark warning that the Federal Reserve’s recent shift toward quantitative easing (QE) could mark the beginning of a dangerous “stimulus into a bubble.”

In a post shared on November 6, Dalio argued that while the Fed’s move is being framed as a technical adjustment, it has the same economic effect as monetary easing, and it comes at a time when markets, debt, and valuations are already overheated.

Dalio: “A Classic Big Debt Cycle Is Playing Out”

Dalio connected the Fed’s policy pivot to what he calls the Big Debt Cycle, a long-term pattern in which governments accumulate debt, resort to money printing, and eventually trigger inflationary or deflationary crises.

He emphasized that this dynamic is entering its late phase, with U.S. fiscal deficits surging, Treasury issuance growing, and the central bank once again adding reserves. “If the balance sheet starts expanding significantly while interest rates are being cut,” Dalio wrote, “we will view that as a classic monetary-fiscal interaction to monetize government debt.”

This, he warned, becomes particularly dangerous when private credit creation remains strong and stocks are making new highs — conditions that define the current environment.

The Mechanics: Liquidity, Inflation, and Asset Prices

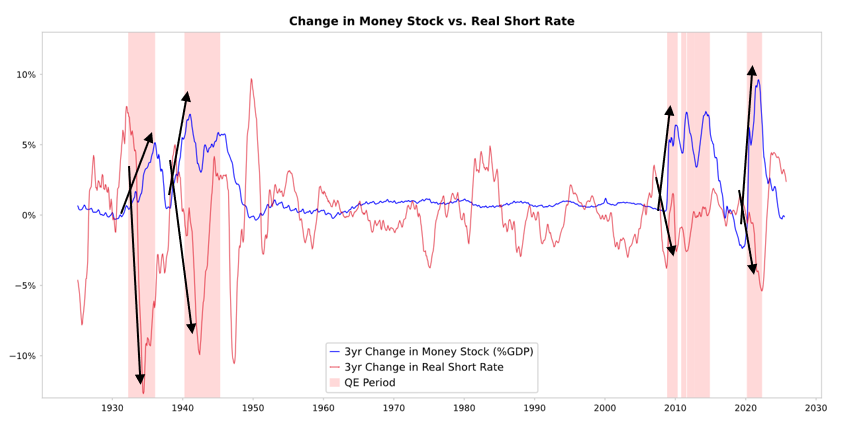

According to Dalio, quantitative easing works through relative pricing effects; investors reallocate capital based on returns and inflation expectations.

When the Fed buys bonds, it injects liquidity and pushes down real yields, making riskier assets like stocks more attractive. The result:

- •Financial asset inflation: Rising stock valuations, lower credit spreads, and higher gold prices.

- •Wealth gap widening: Asset holders benefit more than non-holders.

- •Eventual consumer inflation: As liquidity seeps into goods and labor markets.

Dalio noted that this wave of liquidity often fuels a “melt-up”, a final phase of exuberance before tightening measures burst the bubble. He likened the setup to late 1999 or 2010–2011, when strong liquidity flows inflated valuations just before major corrections.

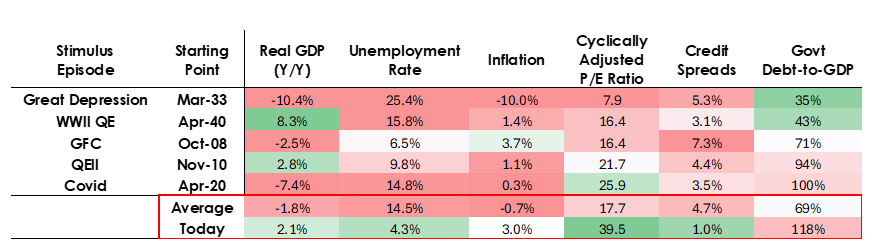

Why This Time Is Different

What makes 2025 unique, Dalio explained, is that QE is being deployed during expansion, not contraction. Historically, quantitative easing was used when:

- •Valuations were low,

- •The economy was weak, and

- •Inflation was falling.

But today, the opposite holds true:

- •Stocks and AI assets are near bubble territory.

- •Inflation remains above target.

- •Credit and liquidity are abundant.

“This isn’t stimulus into a depression,” Dalio concluded. “It’s stimulus into a bubble.”

Gold, Bonds, and Inflation Hedge Assets to Benefit

Dalio also outlined which assets could outperform if the Fed’s easing persists. He expects real yields to fall as liquidity expands and inflation expectations rise, a setup that favors:

- •Gold and inflation-linked bonds as protection against currency debasement.

- •Tangible asset companies, miners, infrastructure, and real-asset firms, to outperform high-duration tech once inflation reawakens.

While he acknowledged the near-term boost this liquidity could provide to markets, Dalio cautioned that the “late-cycle melt-up” will ultimately require forceful restraint from policymakers — potentially leading to a hard landing.

Conclusion

Dalio’s message is clear: the Fed’s latest actions may appear technical, but their timing and scale could have profound implications. In his view, the U.S. may be entering the most perilous stage of its debt and liquidity cycle, one where stimulus feeds excess rather than stabilizes weakness.

As he put it, “This looks like a bold and dangerous bet on growth — especially AI growth — financed through very liberal monetary and fiscal policies that must be watched closely.”