According to the latest CryptoQuant report, Bitcoin inflows to Binance are now overwhelmingly driven by small retail traders, marking a major structural shift in the exchange’s participant composition.

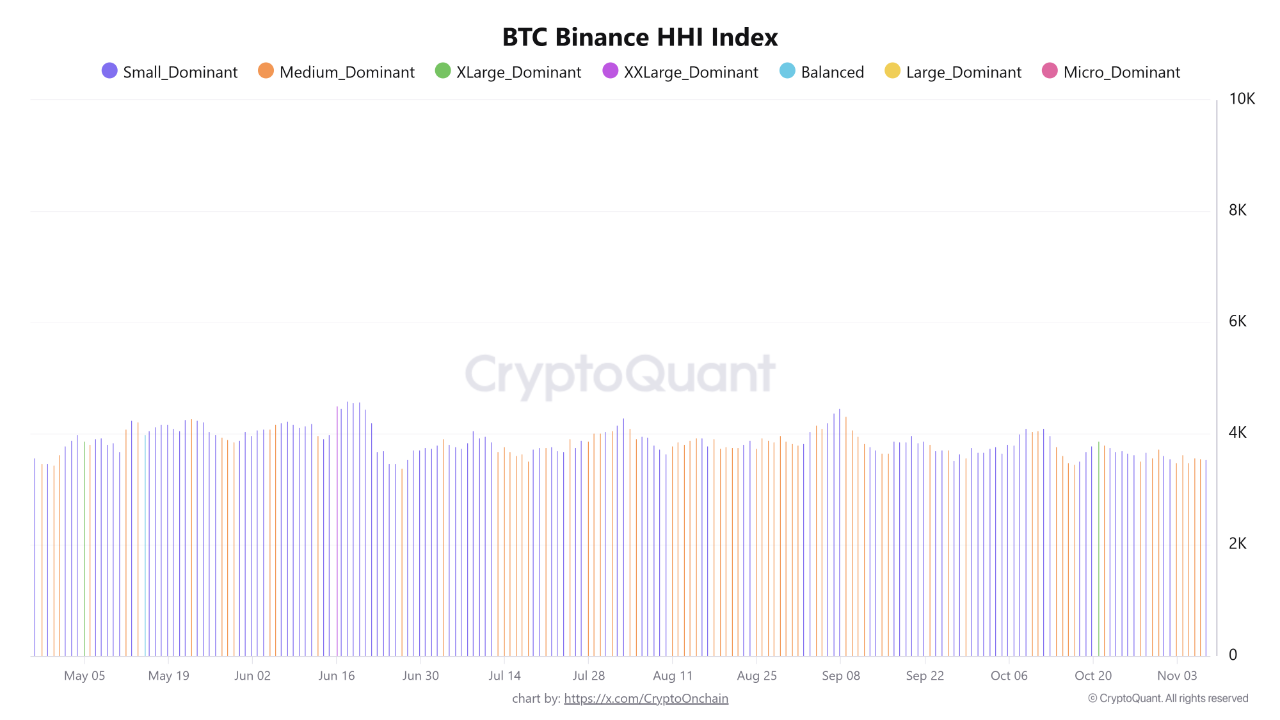

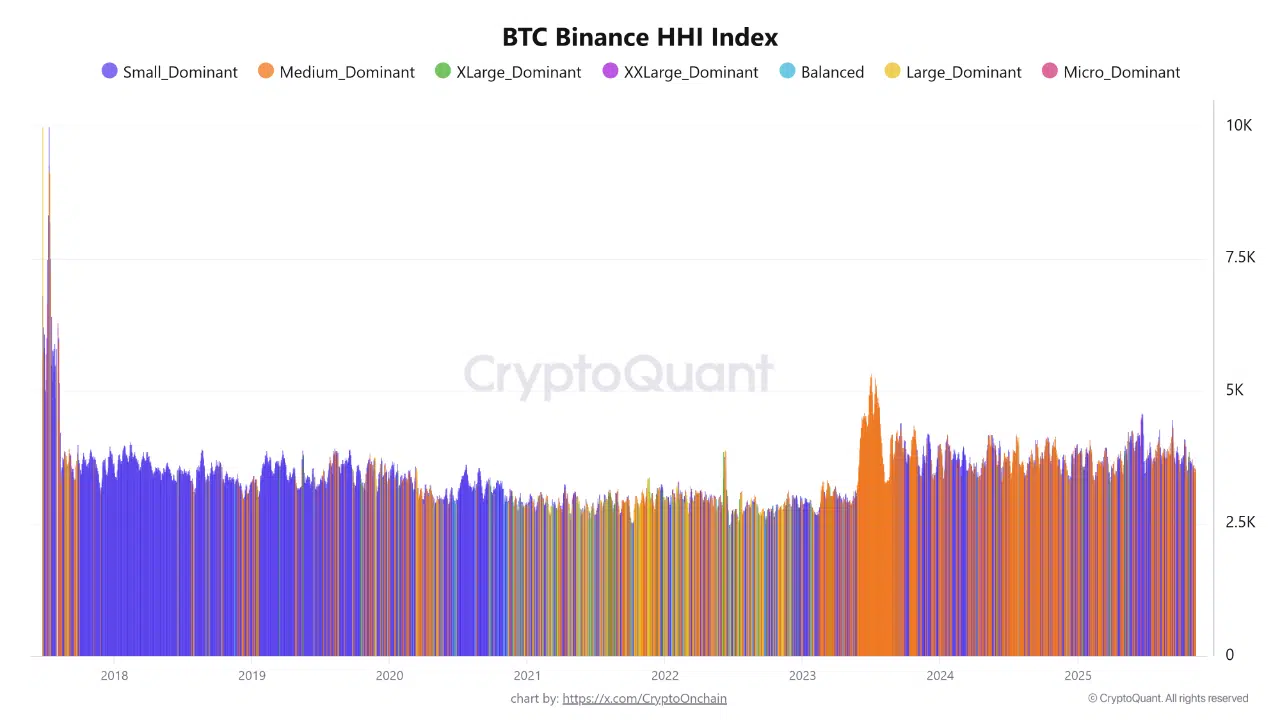

The study analyzed Binance’s BTC Inflow Herfindahl-Hirschman Index (HHI) and found that transactions worth just $10–$100 account for nearly 39% of all inflow volume, dominating over 80% of trading days. This pattern, identified as Small_Dominant, has remained consistent since May 2019, signaling a long-standing retail-driven market structure.

The “Whale Paradox”: Big Players Move Elsewhere

Perhaps the most surprising finding is the near-total absence of whale activity. Transactions exceeding $10,000 represent just 0.28% of total inflow volume, and there have been no recorded days dominated by large or extra-large deposits.

Analysts interpret this as evidence that whales and institutions have shifted to over-the-counter (OTC) venues or alternative liquidity channels, rather than depositing directly on Binance. The result is a paradoxical trend: while Binance shows high concentration in inflows, it is not dominated by large investors but by retail traders acting collectively.

HHI Shows Stable Concentration, Healthy Market Structure

CryptoQuant’s data shows the HHI index remains consistently between 2,500 and 4,000, indicating a highly concentrated yet stable market structure. Traditionally, such concentration would raise concerns about market control by a few entities. However, in this case, the concentration reflects a democratized retail market, where millions of smaller participants collectively shape liquidity and sentiment.

For analysts, color shifts in the HHI visualization, from blue (small traders) to orange (medium traders), serve as a useful signal. These transitions often coincide with accumulation periods and price rallies, as semi-professional traders increase their inflow activity.

Implications: Binance as a Retail Sentiment Barometer

CryptoQuant concludes that Binance has evolved into a retail-centric exchange, where the crowd effectively is the market.

For investors, tracking the Small_Dominant vs. Medium_Dominant shifts offers actionable insights: persistent medium inflows often precede bullish accumulation phases.

In essence, Binance’s inflow data has transformed into one of the most accurate indicators of retail market sentiment, while whales quietly operate outside exchange visibility, a clear sign of the market’s growing structural maturity and decentralization of power.