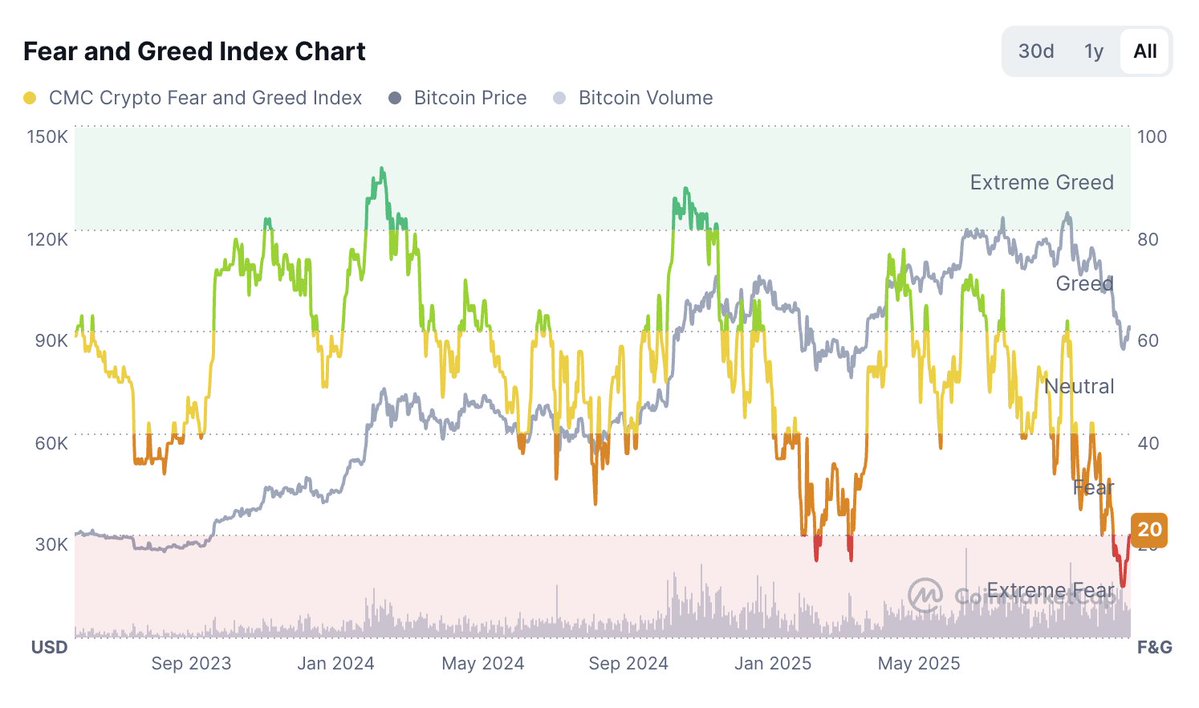

The cryptocurrency market is once again experiencing a sharp shift in sentiment, with the Fear & Greed Index plunging into the "Extreme Fear" zone, currently standing at 20. This downturn follows months of waning momentum in Bitcoin, where price softness has been accompanied by a steady decline in trader optimism.

Data from CoinMarketCap clearly illustrates this dynamic: every surge into "Extreme Greed" over the past two years has eventually retraced, often giving way to deeper fear cycles before major recoveries ensued.

Sentiment Cycles Mirror Bitcoin’s Price Swings

A multi-year chart reveals how closely Bitcoin’s price aligns with shifts in emotional extremes. Peaks in the greed zone throughout 2023 and 2024 consistently preceded local tops. Conversely, periods of intense fear, such as those experienced in early 2023 and mid-2024, coincided with strong accumulation phases and subsequent rallies.

As Bitcoin’s price hovers around key support levels, trading volume has thinned, and market volatility has increased. This amplifies the current sentiment decline and pushes the market into a psychological zone historically associated with opportunity rather than capitulation.

CZ Reinforces the Value of Contrarian Discipline

Adding to this narrative, Binance founder Changpeng Zhao recently shared a pointed reminder on X:

It’s better to sell when there is maximum greed, and buy when there is maximum fear.

This message echoes one of the crypto market’s oldest principles: that meaningful bottoms rarely form during periods of optimism. Instead, they tend to appear when sentiment is at its weakest, liquidity is thin, and market participants are emotionally exhausted.

Unpopular opinion, but it's better to sell when there is maximum greed, and buy when there is maximum fear. 🤷♂️

— CZ 🔶 BNB (@cz_binance) November 29, 2025

Fear May Signal Strategic Accumulation Windows

Today’s market environment mirrors several previous points on the chart where sentiment washed out, only to lead into notable recoveries weeks later. While the Fear & Greed Index does not act as a direct price predictor, it remains one of the clearest psychological gauges for identifying when the broader market may be mispricing long-term value.

As the index approaches its lowest levels of 2025, traders are watching closely to see whether history will repeat, with fear once again setting the stage for Bitcoin’s next rebound.