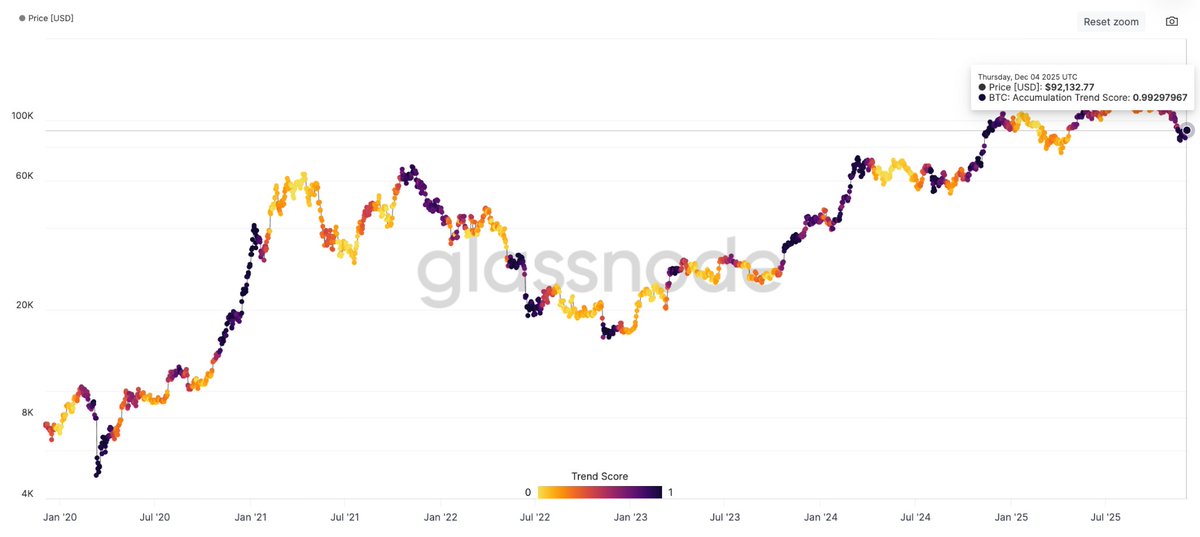

Bitcoin’s accumulation activity is accelerating again, with Glassnode’s Bitcoin Accumulation Trend Score now approaching its maximum reading.

This signals strong and coordinated buying across nearly all major whale cohorts, a pattern that typically emerges during periods of renewed long-term confidence.

The chart shows Bitcoin trading just above $92,000 while the Trend Score prints 0.9929, placing it near the upper boundary of the metric.

Historical Accumulation Patterns

Historically, readings near 1.0 indicate that larger, more influential holders are adding to their balances at an aggressive rate. These phases often align with deeper structural shifts in market sentiment.

This current rise echoes the accumulation pattern seen in July, which preceded Bitcoin’s climb from below $100,000 to its former all-time high of $124,500. The similarity between both setups suggests that the market is experiencing another coordinated absorption phase, with whales positioning ahead of what they may expect to be the next major move.

The chart also illustrates how accumulation clusters tend to appear at pivotal points in Bitcoin’s long-term cycle.

Darker colors, representing stronger accumulation, previously formed around major trend reversals, both during early bull market expansions and mid-cycle resets. The present cluster continues that historical rhythm, reinforcing the idea that large holders are once again acting with conviction.