Key Insights

- •Bitcoin advocacy groups are urging regulators to expand proposed tax relief beyond just stablecoins.

- •They contend that a focus solely on dollar-pegged tokens overlooks the actual usage of cryptocurrencies by Americans.

- •Millions of Americans utilize digital assets daily but continue to face complex tax reporting requirements.

Bitcoin advocacy groups are pressing lawmakers to extend proposed tax relief beyond stablecoins to encompass Bitcoin and other widely utilized network tokens.

These groups argue that exemptions limited to stablecoins fail to acknowledge how Americans actually use cryptocurrencies and would do little to alleviate the tax burden associated with everyday transactions.

Concerns Over Stablecoin-Only Tax Relief

The Bitcoin Policy Institute spearheaded this initiative, joined by organizations such as Bitcoin Voter, Blocks, the Crypto Council, the Digital Chamber, MoonPay, and River.

In a letter sent on Sunday to Senate Finance Committee Chair Michael Crapo and House Ways and Means Committee Chair Jason Smith, the coalition expressed concerns regarding the direction of current tax proposals. They argued that restricting de minimis exemptions to payment stablecoins would undermine the intended purpose of reform.

The coalition believes that such a limited approach does not accurately reflect the real-world use of digital assets and risks leaving significant tax challenges unaddressed.

This communication arrives at a critical juncture as lawmakers continue to seek methods for simplifying tax reporting for cryptocurrency users.

Currently, the IRS classifies cryptocurrency as property. Consequently, even minor purchases, such as buying coffee with Bitcoin, are considered taxable events. This necessitates that users meticulously track their cost basis and calculate gains or losses on every transaction.

Advocates for reform assert that this system introduces unnecessary complexity, discourages routine usage, and contradicts the objective of making the tax system more accessible.

Proposed Framework for Treating Stablecoins Like Cash

The letter also presented a distinct alternative, proposing that payment stablecoins complying with the GENIUS framework should be treated akin to cash. Under this proposed approach, everyday transactions would not be subject to per-transaction or annual limits, mirroring the treatment of physical currency.

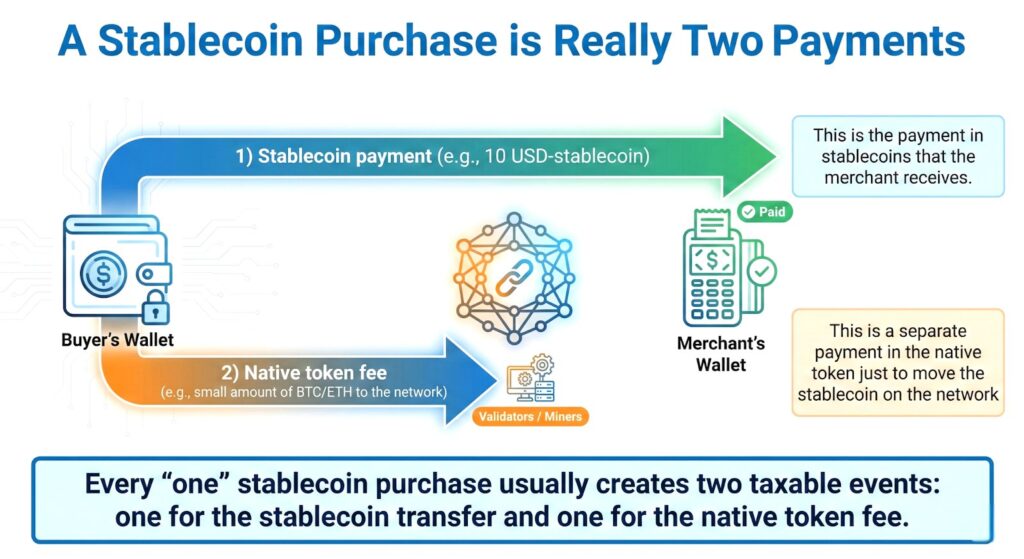

The coalition emphasized that stablecoins are not standalone entities; they operate on open blockchain networks that rely on separate network tokens for system security, transaction validation, and overall functionality. Without relief for both stablecoins and network tokens, the policy would be insufficient for practical application.

To establish clear guidelines, the group suggested specific thresholds. They proposed limiting exemptions to network tokens with a market value of at least $25 billion, coupled with a $600 cap per transaction and a $20,000 annual limit to balance usability and regulatory oversight.

The letter highlighted the widespread adoption of cryptocurrencies, noting that approximately 45 million Americans own digital assets, with Bitcoin being the most prominent. Federal Reserve data indicates that around 7 million Americans used Bitcoin or other network tokens for payments in 2024.

Merchant adoption is also on the rise, with over 3,500 businesses now accepting Bitcoin at checkout nationwide, solidifying the U.S. as the leading global market for Bitcoin payments.

This renewed advocacy follows a recent legislative setback. A similar effort was stalled in July when Senator Cynthia Lummis was unable to incorporate cryptocurrency tax provisions into President Donald Trump’s reconciliation bill.

The debate surrounding stablecoin taxation gained renewed attention last October after Jack Dorsey advocated for federal tax exemptions on small, everyday Bitcoin transactions, coinciding with Block's rollout of crypto-enabled wallets for small businesses.

Since then, the pressure for reform has intensified. New broker reporting rules mandate the disclosure of digital asset transactions via Form 1099-DA for sales commencing January 1, 2025.

The coalition stated that these new requirements elevate the urgency, particularly for everyday users navigating increased adoption alongside stricter compliance measures.