In a dramatic 24-hour period, Bitcoin has plummeted to $82,000, triggering approximately $2 billion in liquidations and marking record outflows from Bitcoin ETFs. Amidst trader panic and evolving Federal Reserve uncertainties, this historic market downturn raises critical questions about the potential for a prolonged crash versus an explosive rebound.

Key Developments

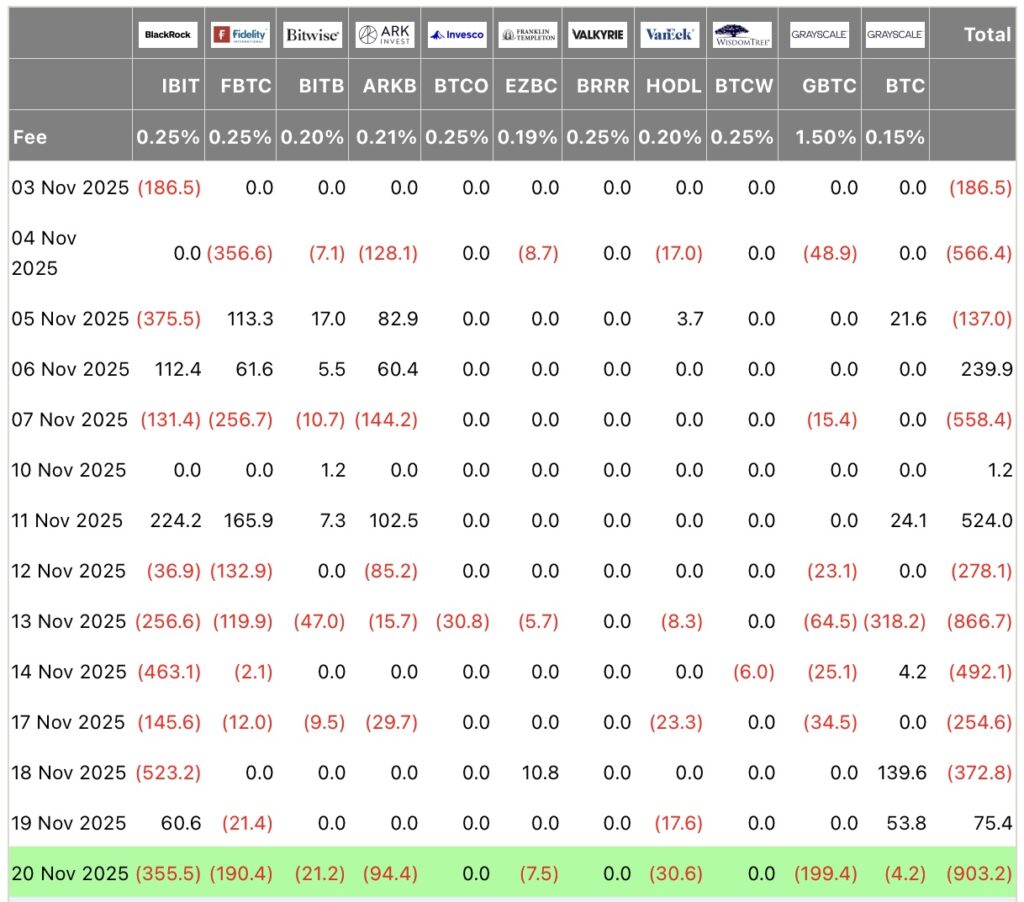

- •Bitcoin's price fell to $82,000, accompanied by $2 billion in liquidations within 24 hours and record outflows of $903 million from Bitcoin ETFs.

- •Uncertainty surrounding Federal Reserve policy and accelerated forced sales are intensifying pressure on Bitcoin, pushing the market towards capitulation.

- •Analysts have identified key "max pain" levels at $84,000 and $73,000, prompting debate on whether to buy the dip or await a potential rebound.

Bitcoin's Sharp Decline and Market Impact

The cryptocurrency market experienced a historic collapse in less than 24 hours, resulting in nearly $2 billion in liquidated positions. Bitcoin's price dropped to $82,000, its lowest point since April. Data from CoinGlass indicates that 396,000 traders were affected, including a significant single position liquidation of $36.78 million on Hyperliquid. Concurrently, Bitcoin ETFs saw net outflows totaling $903 million, marking their second-worst day since their inception.

Factors Differentiating the Current Bitcoin Downturn

Several key factors distinguish the current market correction from previous downturns. The amplified fall is attributed to substantial outflows from Bitcoin ETFs and growing uncertainty regarding interest rate policies. Recent US employment data, showing 119,000 new jobs in September, has diminished expectations for a December rate cut. Furthermore, Kevin Hassett, a nominee for the Federal Reserve, suggested that a pause in rate adjustments would be highly undesirable. Consequently, the Bitcoin Fear & Greed index has plummeted to 14, indicating extreme distress in the market.

With liquidations approaching $2 billion, analysts are pointing out that the market is now entering a capitulation phase, characterized by dominant forced sales overriding rational decision-making. This pressure is pushing Bitcoin towards critical support levels, with $81,900 identified as the final barrier before a confirmed bear market.

Critical Price Thresholds for Bitcoin

Analysts have pinpointed two crucial levels where institutional investors' potential losses could peak:

- •$84,000: This level represents the average cost basis for BlackRock's IBIT ETF, currently the largest Bitcoin ETF in the United States.

- •$73,000: This price point is associated with MicroStrategy's average acquisition cost and is often viewed as a significant psychological floor for the market.

If Bitcoin fails to reclaim the $88,000–$90,000 zone, analysts foresee a potential decline towards the $78,000–$82,000 range, where the exhaustion of forced sellers might occur. A market "bottom" could potentially form within these levels, signaling a complete cycle reset.

Expert Strategies for Navigating Bitcoin's Volatility

In the face of this significant downturn in Bitcoin (BTC), investment strategies are varied:

- •Defensive Approach: This strategy involves reducing exposure and waiting for confirmation of a rebound above the $88,000 mark.

- •Offensive Approach: This involves targeting the identified "max pain" levels of $84,000 and $73,000 for long-term investment, predicated on the assumption of seller exhaustion.

- •Watchful Stance: This approach focuses on monitoring the Fear & Greed index and institutional flows, which could provide early signals of a potential market reversal.

The broader altcoin market has also experienced significant pressure, with cryptocurrencies such as Ethereum, Solana, and BNB falling by more than 10%. Experts emphasize that capitulation phases often precede substantial rebounds, but the precise timing will be heavily influenced by the return of institutional investment flows.

This period of sharp decline in Bitcoin, marked by substantial ETF outflows and record liquidations, echoes past market crises but carries an unprecedented institutional dimension. While analysts remain divided on the prospect of a swift recovery or a more protracted downturn, a fundamental question lingers: will $73,000 serve as the cycle's floor, or is the cryptocurrency market entering an extended bear phase?