Michael Saylor shared a striking chart this week with the caption “Probably Nothing.” The data says otherwise. Bitcoin-backed credit markets, once a niche corner of the industry, are now expanding at a pace that signals a structural shift in how institutions use BTC as collateral.

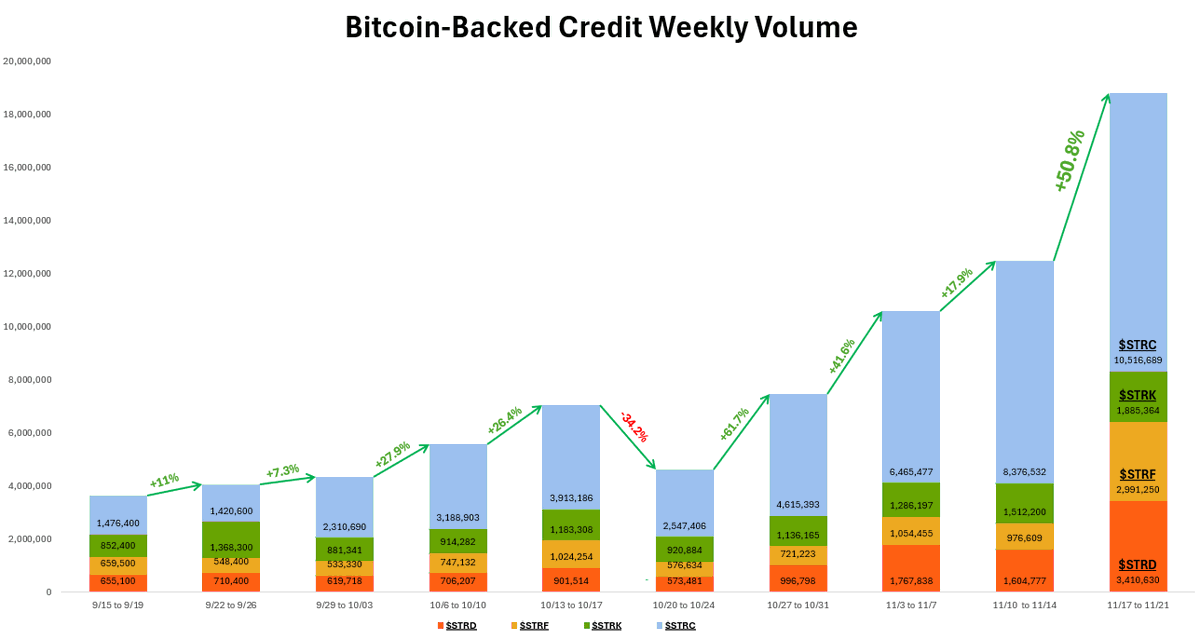

The chart shows weekly Bitcoin-backed credit volume climbing from roughly $4–5 million in September to more than $20 million by mid-November, a surge that coincides with broader institutional accumulation and renewed interest in collateralized crypto lending products.

A Clear Trend: Steady Climb, Then a Vertical Breakout

From mid-September to early October, Bitcoin-backed credit volumes grew gradually. Weekly totals fluctuated between $3 million and $5 million, with modest increases of 7–11%. This early period reflects healthy growth, but nothing dramatic.

The inflection point emerged in late October. After a brief contraction, the only negative weekly move in the chart, credit demand rebounded sharply. The market added more than 40% in volume from October 27 to November 3, followed by another jump above 35% the next week. Then came the breakout.

The week of November 17 to 21 saw volumes explode by 50.8%, pushing total weekly credit issuance above $20 million. This is the highest level recorded in the entire dataset and marks the most aggressive expansion phase to date.

What’s Behind the Explosion in Bitcoin-Backed Credit?

The chart segments volume into four credit products (STRD, STRF, STRK, and STRC). While all categories increased, the standout performer is STRC, which grew from approximately $1.4 million per week in September to over $10.5 million in the latest reading. This category alone accounts for most of the parabolic move.

These products are typically used for:

- •Institutional hedging strategies

- •Capital-efficient positioning (borrowing against BTC rather than selling it)

- •Liquidity generation for OTC operations

- •Yield-enhancing arbitrage flows

The acceleration suggests that more funds are locking up Bitcoin as collateral while tapping credit to expand trading, arbitrage, or hedged long positions. In other words, Bitcoin is being treated more like an institutional-grade financial asset, similar to how traditional markets use treasuries for collateral.

A Signal of Maturing Market Structure

Saylor’s “Probably Nothing” caption is ironic, given how important this data is for the broader crypto ecosystem. Rising Bitcoin-backed credit volumes usually indicate:

- •Growing institutional confidence in Bitcoin’s long-term liquidity.

- •Reduced desire to sell BTC during volatility, lenders prefer to borrow against it.

- •Expansion of the Bitcoin financial layer, where collateralized credit markets play a similar role to repo markets in traditional finance.

Historically, increases in collateralized borrowing have preceded periods of higher market activity, expanding leverage, or rising liquidity.

Bottom Line

The chart highlights a critical trend: Bitcoin is increasingly becoming the backbone of a rapidly expanding credit market. Weekly collateralized loan volumes quadrupled in just two months, reaching never-before-seen highs. If this momentum continues, Bitcoin-secured credit could evolve into one of the core pillars of the institutional crypto economy.