Key Insights

- •Bitcoin (BTC USD) has fallen to a new 6-month low after failing to hold the $90,000 support level, resulting in liquidations nearing a quarter of a billion dollars.

- •A significant whale, holding Bitcoin since 2011, liquidated 11,000 BTC, valued at $1.3 billion, contributing to the sell-off pressure.

- •Addresses holding over 100 BTC have reached a new all-time high in terms of holdings.

The price of Bitcoin has officially dropped below $90,000, losing its footing due to weak demand and persistent sell pressure. This decline has consequently led to another liquidation event, with long positions bearing the brunt of the losses.

A considerable number of investors had anticipated a price bounce back from the $90,000 level. This expectation was reflected in the ratio of long versus short liquidations.

The total value of Bitcoin (BTC USD) liquidated in the last 24 hours surged past $413 million. The majority of these liquidations were long positions, totaling $369 million, while short liquidations accounted for a much smaller amount, just over $43 million.

This latest wave of liquidations occurred after Bitcoin experienced a mid-week spike in positive funding rates. These liquidations may have contributed to pushing BTC prices lower, reaching 6-month lows.

Bitcoin (BTC USD) Mega Whale Dumps Over $1.3 Billion Worth of BTC

In relation to liquidations and sell pressure, it has been revealed that one of the largest sellers in the past 24 hours was a mega whale.

This particular whale, who had held Bitcoin since 2011, offloaded over 11,000 BTC, a transaction valued at more than $1.3 billion.

The data also indicates that this specific whale sold all of its holdings. This type of sell pressure highlights the recent panic selling observed in the market.

While this particular whale significantly contributed to the decline in Bitcoin (BTC USD) value, it does not necessarily represent the activity of all whales.

Interestingly, whale activity over the last 24 hours suggests an increase in pivot expectations. Data from large order books revealed that whales executed spot buys exceeding $65 million near the $85,000 price level.

Perpetual trades were orders of magnitude higher than spot trades, with Binance alone recording over $1.1 billion worth of long positions in the last 24 hours. Whales on OKX executed $459 million in long positions.

Historically, such whale activity has been linked to buying the dip and could be associated with dollar-cost averaging strategies. However, these buying zones were observed in areas where bearish sentiment began to cool down.

In other words, demand from whales may not definitively confirm a pivot unless that demand is sustained over time.

Whales Stack Up on Bitcoin as Price Pushes Lower

The Bitcoin (BTC USD) freefall observed in recent weeks has raised concerns that the bull market might be over. However, some analysts suggest that this pullback could be a normal occurrence, particularly considering the growing institutional interest.

Whale activity may support these expectations, as whale data confirms they have been capitalizing on the discounted prices.

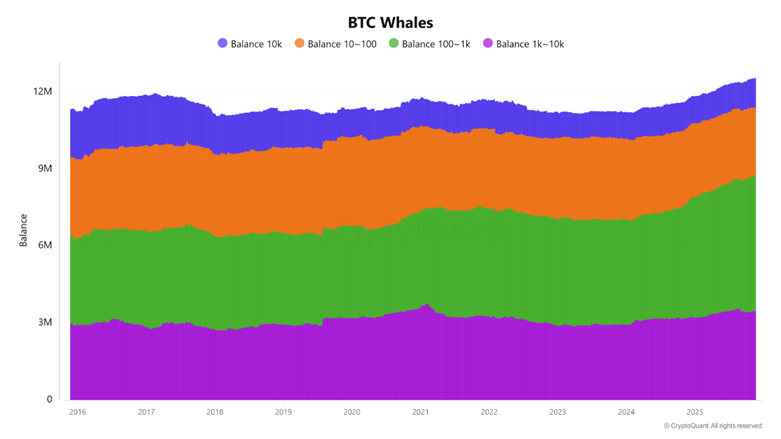

According to the data presented, whales holding between 100 and 10,000 BTC have been increasing their balances over the past 12 months.

Furthermore, this category of whales now holds a record high amount, exceeding 12 million BTC. This indicates that whales have been taking advantage of the declining Bitcoin value to increase their holdings at discounted levels.

This whale accumulation could provide a much-needed confidence boost for the market, especially as sustained Bitcoin (BTC USD) downside pressure is crushing demand.

It remains uncertain whether this demand will trigger a price pivot. Sustained sell pressure could potentially drive the price of Bitcoin even lower, despite it being in deeply oversold territory at the time of observation.