Bitcoin has experienced a significant downturn over the past several days, with bearish sentiment firmly in control of the market. The cryptocurrency has nosedived to a fresh multi-month low, trading just under $92,000.

Ethereum has also seen a substantial dip, falling to a crucial round-numbered support level. The increasing liquidations are attributed to the excessive leverage being utilized by traders.

Recent Price Action and Market Sentiment

Not long ago, Bitcoin was trading comfortably above $100,000. In fact, less than a week prior, it had surpassed $107,000 following positive developments within the United States.

However, this surge proved to be short-lived. The subsequent rejection and correction have been notably aggressive. Bitcoin experienced a sharp decline into five-digit territory last Thursday and has been unable to mount any significant recovery since then.

The downward trend has continued, with the latest price drop occurring recently, pushing Bitcoin below $92,000. This marks the lowest price point observed since April 24, indicating a seven-month low.

Causes of the Current Downturn

A notable aspect of the ongoing market crash is the absence of a single, clear catalyst. Unlike previous significant downturns, which were often triggered by industry-wide failures, global pandemics, or macroeconomic uncertainties, this correction appears to be primarily driven by excessive leverage. This analysis was previously highlighted by The Kobeissi Letter.

Furthermore, analysts have indicated that Bitcoin has entered a new structural bear market, a situation that has only deteriorated since that assessment.

Impact on Ethereum and Altcoins

Ethereum is also facing significant pressure, having recently fallen below the $3,000 mark. Ethereum has seen a weekly decline of over 15% and a monthly decrease exceeding 22%. Most other altcoins are experiencing similarly dire conditions, with XRP down by 3.6% daily and Solana (SOL) plunging by over 5%.

Surge in Liquidations

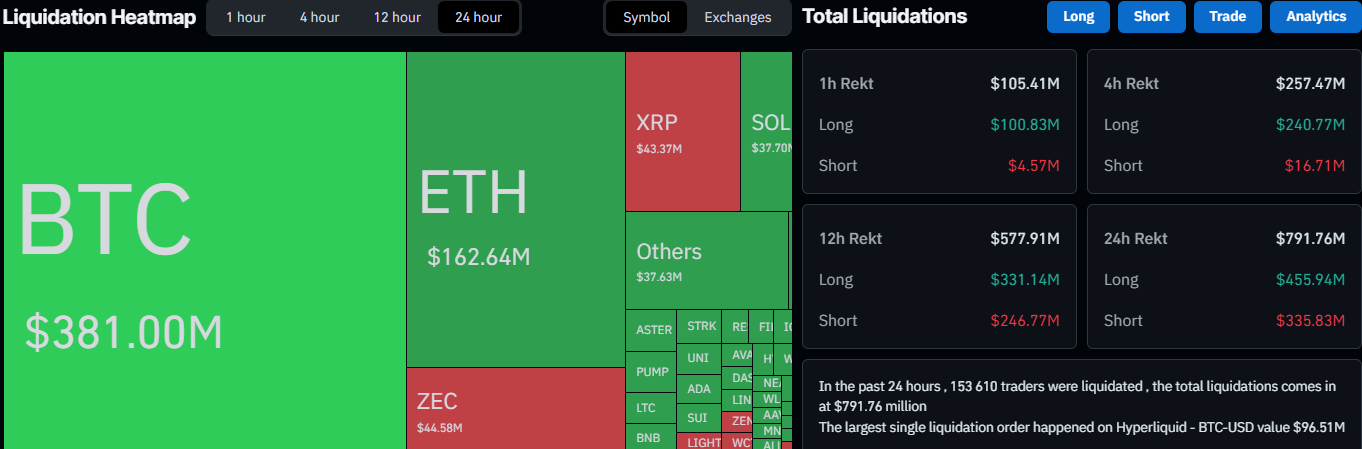

The elevated levels of leverage employed by traders have resulted in substantial losses for a significant number of market participants. Over 150,000 traders are reportedly being liquidated daily. The total value of liquidated positions has surged to nearly $800 million within the same period.

According to data from CoinGlass, the single largest liquidation order occurred on Hyperliquid and was valued at an immense $96.51 million.