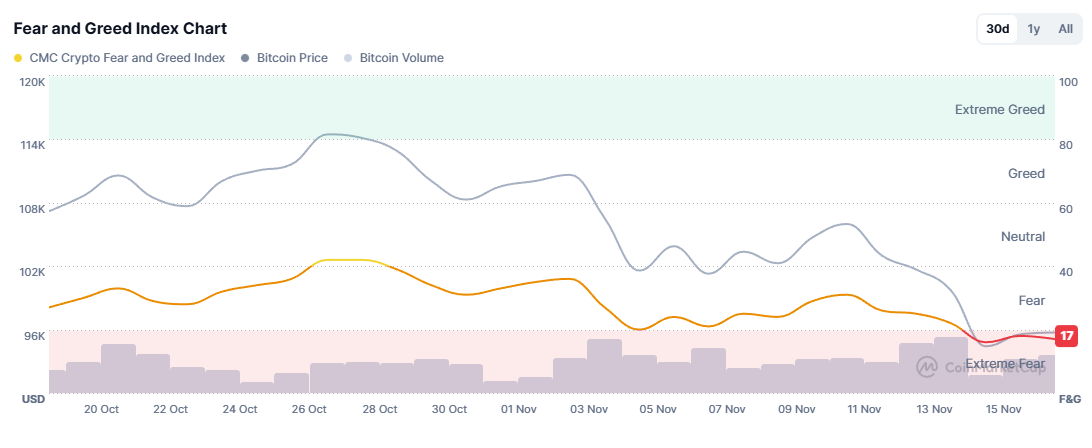

Market Correction and Sentiment Shift

Bitcoin has recently experienced a significant price drop, falling from a high of approximately $125,000 to around $93,000. This decline has triggered substantial liquidations across the market, exceeding half a billion dollars, and has shifted market sentiment towards extreme fear. While the price has erased its 2025 gains, longer-term fundamental indicators for Bitcoin remain intact. Analysts are divided on whether this represents a healthy pullback within a bull market or the beginning of a new structural bear phase.

Despite the price correction, macroeconomic conditions appear relatively stable. Inflation is easing, the Federal Reserve has initiated interest rate cuts, and institutional adoption through spot ETFs continues to be a significant factor. However, Bitcoin's drop below $100,000, coupled with sustained market dominance and a sharper decline in altcoins, suggests a scenario of forced deleveraging and rotation rather than a complete collapse of the long-term investment thesis.

For smaller traders, this environment presents both challenges and opportunities. While portfolios may be impacted, the market reset also creates space for higher-risk, higher-reward investments in emerging narratives. Historically, infrastructure projects that enhance Bitcoin's utility have shown strong performance after periods of market consolidation.

Bitcoin Hyper ($HYPER) – Enhancing Bitcoin's Utility

One prominent project in this space is Bitcoin Hyper ($HYPER), a Layer 2 solution designed to transform Bitcoin from a slow store of value into a more usable asset for large-scale transactions. The project aims to enable fast, low-fee Bitcoin payments and smart contract functionality.

The timing of Bitcoin Hyper's development and presale coincides with Bitcoin's recent price dip. While Bitcoin trades in the low $90,000s, the Bitcoin Hyper presale has garnered significant interest, nearing $28 million in funding. This influx of capital is attributed to substantial purchases from large investors ("whales") and consistent participation from retail investors.

Bitcoin Hyper Architecture and Functionality

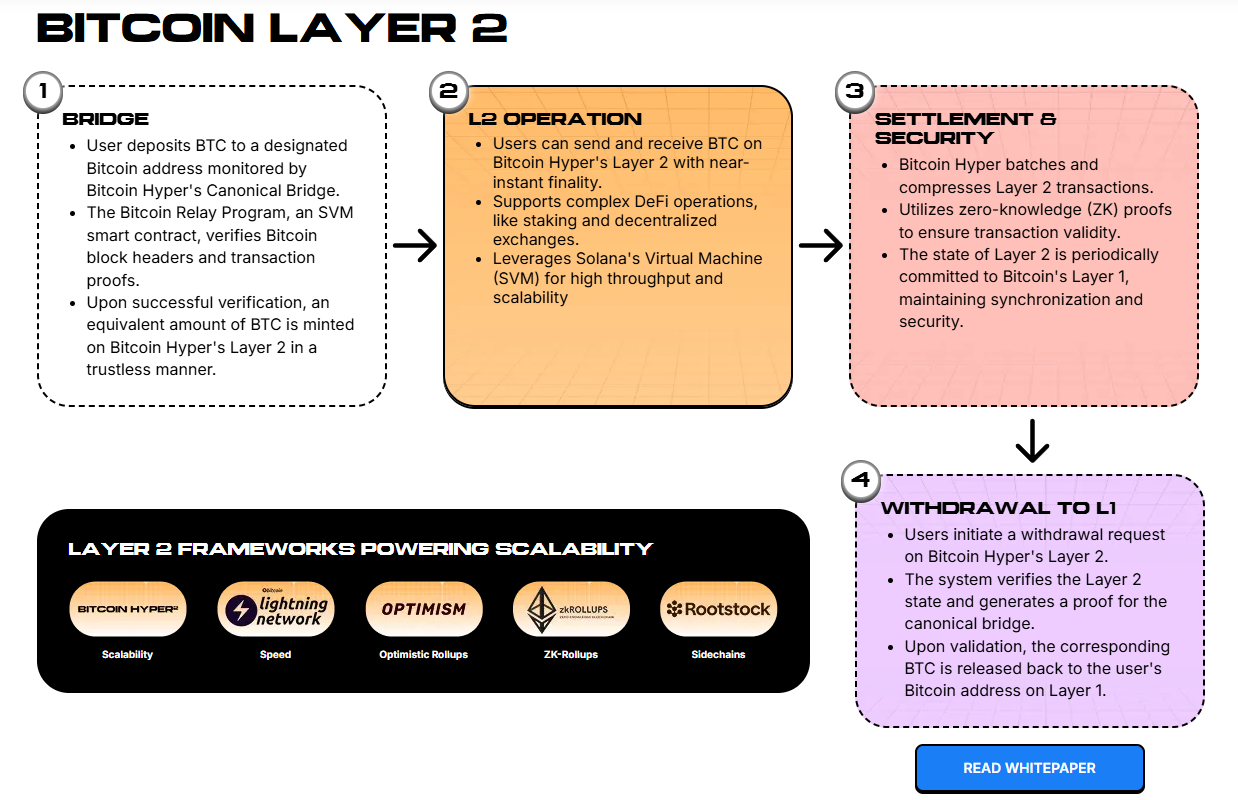

Bitcoin Hyper's core concept is to leverage a separate Layer 2 chain for most transactions, offering speeds and costs comparable to Solana, while retaining Bitcoin as the primary settlement layer. Users can bridge their $BTC to a canonical bridge, where a Solana Virtual Machine (SVM) smart contract verifies Bitcoin block headers and proofs.

This Layer 2 network is designed to achieve transaction settlements in under a second and handle tens of thousands of transactions per second, a significant improvement over Bitcoin's base layer throughput of three to seven transactions per second. This limitation on the base layer has historically restricted Bitcoin to slow, high-value transfers.

Bitcoin Hyper employs rollup technology and zero-knowledge proofs to periodically commit state back to the Bitcoin blockchain. This approach ensures that users benefit from Bitcoin's security model while overcoming its throughput limitations.

This architecture enables several key advancements, including the backing of DeFi lending markets with $BTC settlements and the creation of meme coins and NFTs within an SVM environment familiar to Solana developers, all while maintaining a link to $BTC. It also facilitates more robust cross-chain interactions between Ethereum, Solana, and Bitcoin by using a unified Layer 2 execution framework.

A Bitcoin Layer 2 solution that promises enhanced payment speeds, functional DeFi capabilities, and a bridge for Solana-style decentralized applications into the $BTC ecosystem fits well with this market rotation. For investors looking to reallocate rather than exit the market, Bitcoin Hyper presents a notable project to monitor.

$HYPER Presale Performance and Investor Confidence

The Bitcoin Hyper presale has achieved significant traction, raising over $27.8 million. This accomplishment is particularly noteworthy given the current market downturn and Bitcoin's price correction. The presale's success positions it among the leading cryptocurrency presales of 2025, indicating a blend of substantial investments from large players and broad participation from smaller retail investors.

Notable whale purchases include transactions of:

- •$502K

- •$379K

The presale's staking mechanism further enhances its appeal. While reward rates may fluctuate, the current average yield of 41% allows early participants to lock in their tokens and compound their exposure while awaiting the token generation event and subsequent exchange listings.

Despite the prevailing market nervousness, characterized by Bitcoin's drop to $93,000, extreme fear indicators, and discussions about a potential structural bear market, the nearly $28 million raised for a Bitcoin Layer 2 project focused on speed and programmability demonstrates continued investor conviction. This confidence appears to be shifting towards projects that could capitalize on Bitcoin's potential recovery and increased usability.