The Bitcoin options market continues to flash warning signals despite price stabilization near $100,000, according to a new Glassnode report. Data show that traders remain defensive, with short-term hedging dominating the landscape as volatility returns to the crypto market.

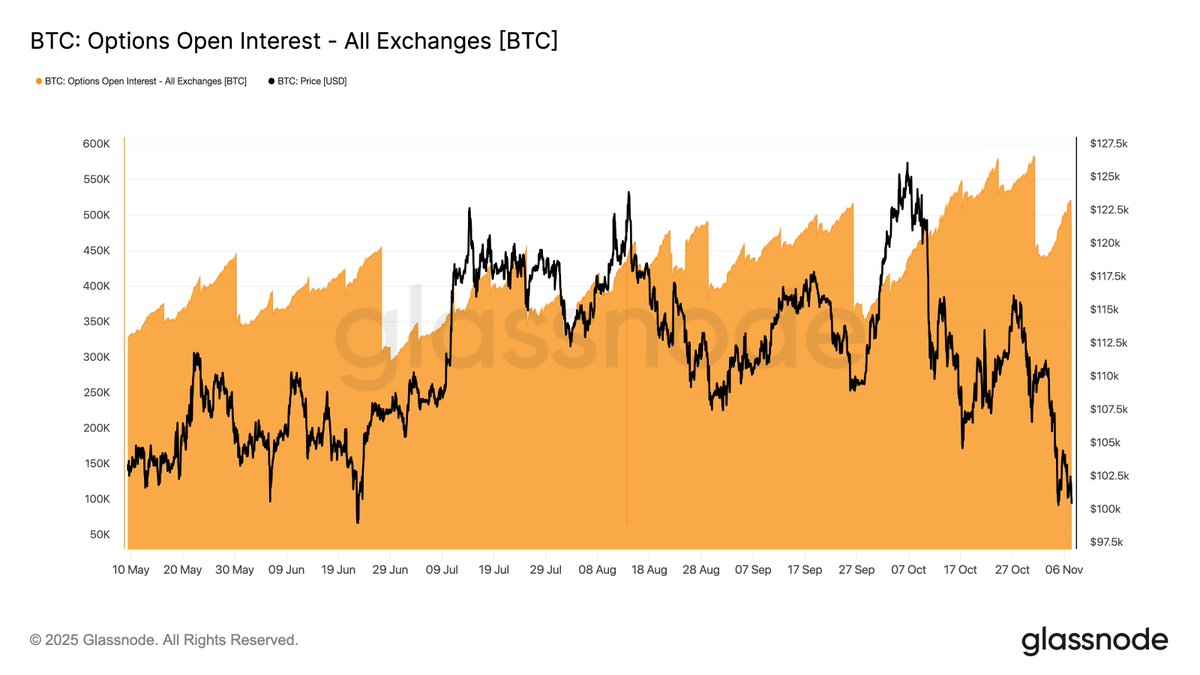

Options Open Interest Rebuilds Fast But Confidence Lags

Bitcoin options open interest reached a new all-time high on October 31, before expiry temporarily wiped out a significant portion of positions. Within a week, half of the cleared contracts were rebuilt, suggesting traders are rapidly re-entering positions despite uncertainty.

Glassnode noted that this behavior, rebuilding open interest right after expiry, indicates the options market may continue to print new record highs month after month.

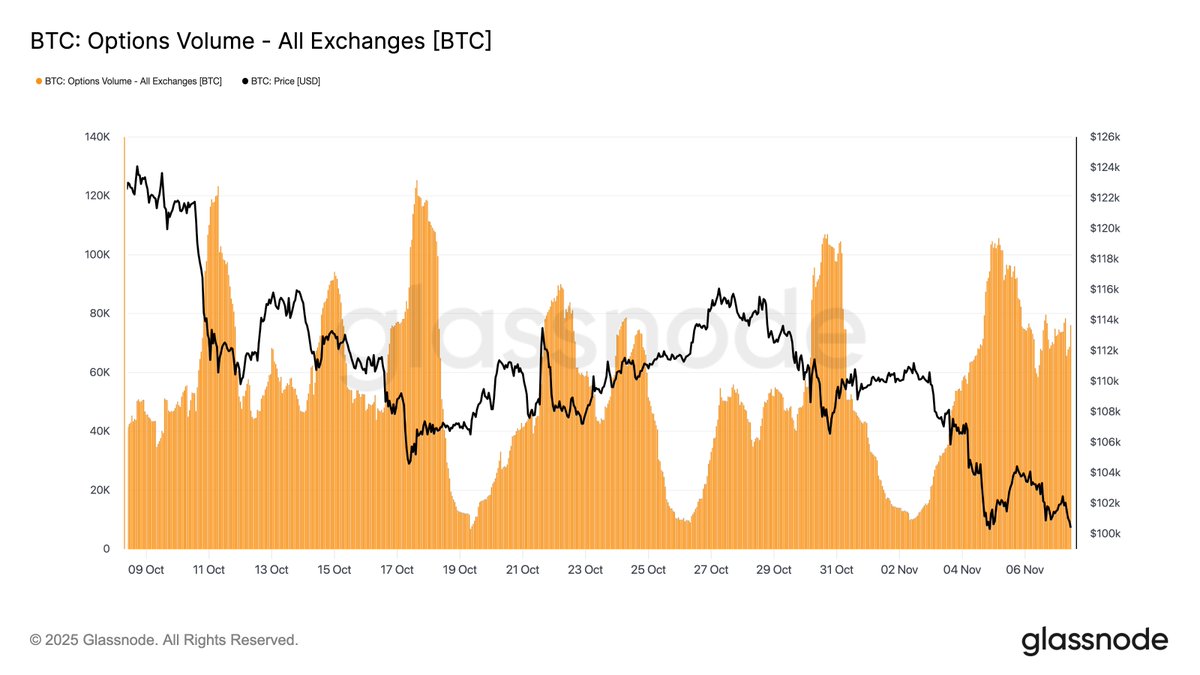

Volume Spikes as Traders Hedge Below $107K

After Bitcoin broke the $107K level, options trading volume surged, driven by aggressive repositioning and new hedges. Activity remains elevated as traders bet on short-term swings rather than long-term trends.

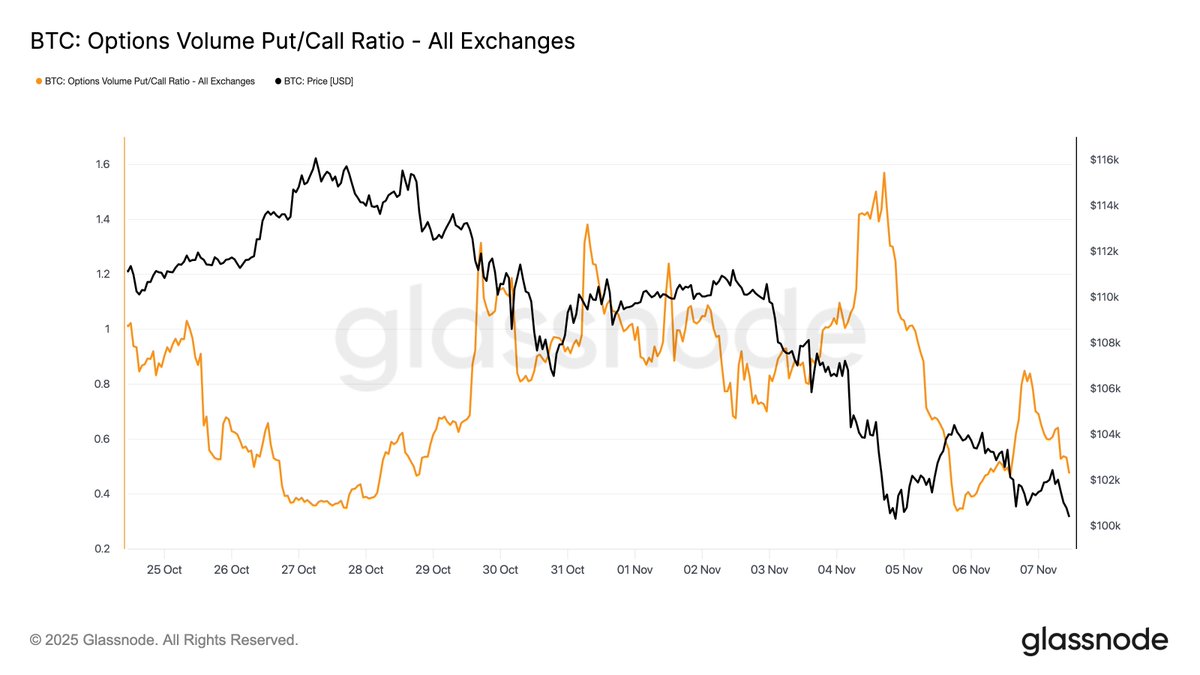

The put-call ratio reflects little conviction in a bottom. Put buying increased sharply during the latest selloff, followed by a brief rise in calls when Bitcoin tested $100K, and then another surge in puts, signaling markets expect a retest of support before any lasting rebound.

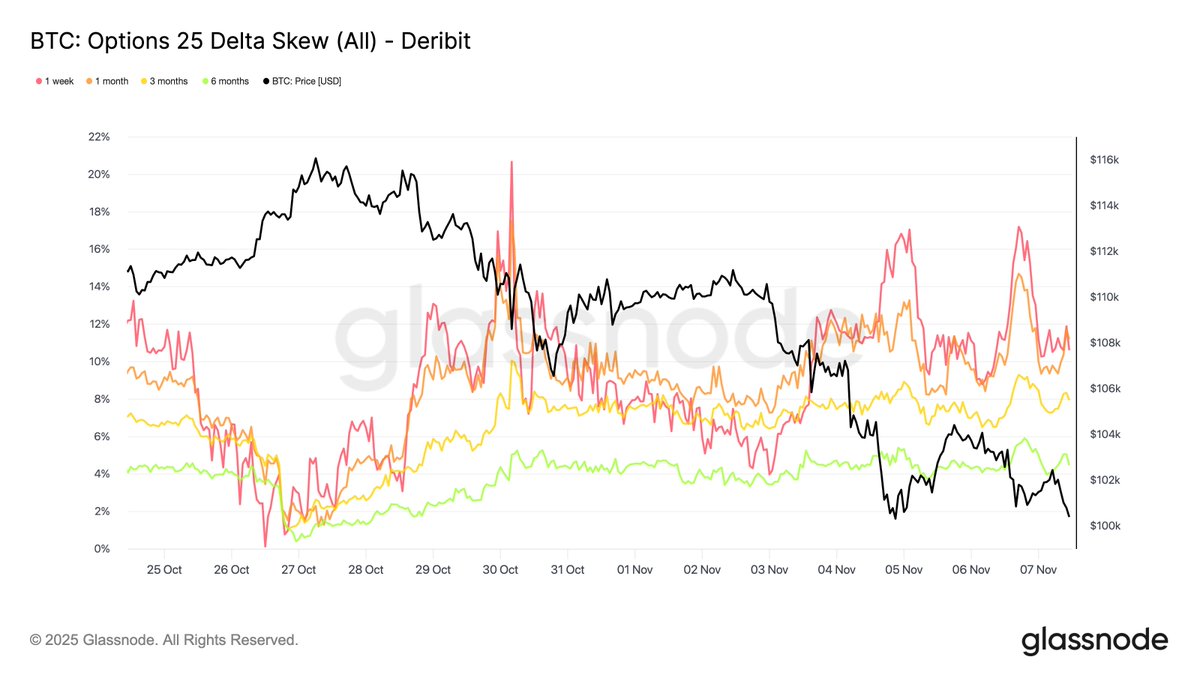

Short-Term Fear Dominates Options Skew

Options skew data show 1-week to 1-month maturities remain heavily put-biased, at around 11–12%, highlighting traders’ near-term fear. Longer maturities are also skewed toward puts but to a lesser degree, reflecting caution rather than panic.

Glassnode emphasized that traders are “preserving dry powder through the turbulence,” choosing protection over aggressive long exposure.

$100K Put Premiums Surge – $7 Million Spent on Short-Term Protection

Zooming in on the $100K strike, short-term put premiums have seen a dramatic jump, rising by $7 million in just three days. That surge represents significant capital being allocated to short-term downside protection, signaling that traders expect volatility to continue through mid-November.

Meanwhile, the $120K strike call premiums tell a different story. Instead of accumulating long-term bullish exposure, traders used the brief relief rally to sell calls, even for longer expiries, underscoring the lack of sustained bullish conviction in the options market.

Market Still in Fear Mode

Glassnode concluded that “the market remains in fear mode, with little confidence in a lasting bottom.”

In this environment, the firm cautions that discipline is key, noting that “winners are those who sell early and buy late.”

With open interest rebuilding and heavy put activity dominating the short-term horizon, traders appear more focused on protection than accumulation, keeping the near-term outlook for Bitcoin fragile and reactive.